Rising doom spending reflects growing consumer anxiety amid economic uncertainty, leading to reduced discretionary purchases and increased saving behavior. Consumer confidence indexes often dip as fears of recession or job losses amplify, directly impacting retail sales and economic growth forecasts. Explore how shifts in consumer sentiment influence market trends and fiscal policy decisions.

Why it is important

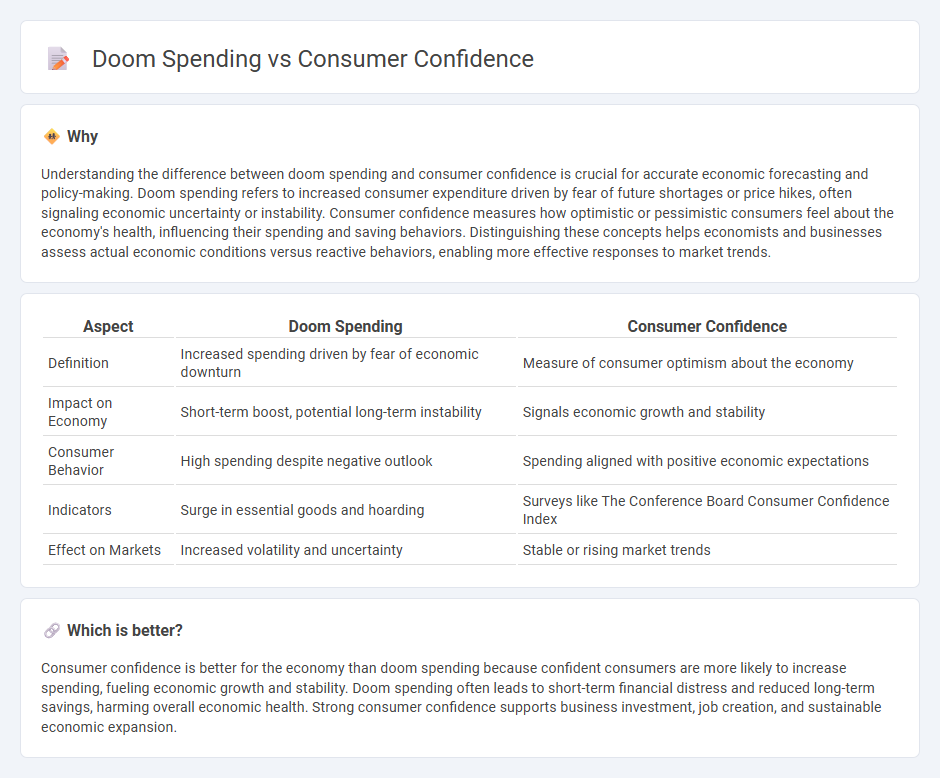

Understanding the difference between doom spending and consumer confidence is crucial for accurate economic forecasting and policy-making. Doom spending refers to increased consumer expenditure driven by fear of future shortages or price hikes, often signaling economic uncertainty or instability. Consumer confidence measures how optimistic or pessimistic consumers feel about the economy's health, influencing their spending and saving behaviors. Distinguishing these concepts helps economists and businesses assess actual economic conditions versus reactive behaviors, enabling more effective responses to market trends.

Comparison Table

| Aspect | Doom Spending | Consumer Confidence |

|---|---|---|

| Definition | Increased spending driven by fear of economic downturn | Measure of consumer optimism about the economy |

| Impact on Economy | Short-term boost, potential long-term instability | Signals economic growth and stability |

| Consumer Behavior | High spending despite negative outlook | Spending aligned with positive economic expectations |

| Indicators | Surge in essential goods and hoarding | Surveys like The Conference Board Consumer Confidence Index |

| Effect on Markets | Increased volatility and uncertainty | Stable or rising market trends |

Which is better?

Consumer confidence is better for the economy than doom spending because confident consumers are more likely to increase spending, fueling economic growth and stability. Doom spending often leads to short-term financial distress and reduced long-term savings, harming overall economic health. Strong consumer confidence supports business investment, job creation, and sustainable economic expansion.

Connection

Doom spending, characterized by consumers increasing purchases during economic uncertainty, directly influences consumer confidence by revealing underlying fears about future financial stability. Elevated doom spending often signals reduced trust in economic recovery, prompting households to prioritize necessities and stockpile goods. This behavior creates a feedback loop where declining consumer confidence further drives precautionary spending, impacting overall economic growth.

Key Terms

Economic Sentiment

Economic Sentiment Index reflects overall consumer confidence levels, revealing optimism or pessimism about the economy's future performance. High consumer confidence typically drives increased spending, whereas heightened economic uncertainty can trigger doom spending, characterized by panic buying and stockpiling. Explore in-depth how shifts in economic sentiment influence consumer behaviors and market dynamics.

Disposable Income

Consumer confidence levels significantly influence disposable income allocation, where higher confidence encourages increased spending, while lower confidence often triggers doom spending behavior--characterized by hoarding essential goods. Disposable income acts as a critical economic indicator, reflecting the capacity for discretionary purchases that stimulate market growth or contraction. Explore deeper insights on how consumer sentiment directly affects disposable income trends and economic health.

Behavioral Economics

Consumer confidence significantly influences spending behaviors, with high confidence encouraging increased purchases while low confidence often leads to doom spending, driven by fear and uncertainty. Behavioral economics explores these psychological factors, such as loss aversion and present bias, which prompt consumers to either save excessively or splurge impulsively during economic downturns. Discover how understanding these patterns can help predict market trends and improve financial decision-making strategies.

Source and External Links

Consumer Confidence Retreats in June - dshort - Advisor Perspectives - The Conference Board's Consumer Confidence Index fell 5.4 points to 93.0 in June 2025, marking its sixth decline in seven months, reflecting consumers' worsening views on current business and job conditions and slightly pessimistic future expectations.

United States Michigan Consumer Sentiment - Trading Economics - The University of Michigan consumer sentiment index rose to 61.8 in July 2025, the highest in five months, driven by improved short-run business conditions, though inflation expectations remain elevated.

Consumer confidence index (CCI) - OECD - The Consumer Confidence Index (CCI) measures households' expectations for financial and economic conditions, with values above 100 indicating optimism and below 100 signaling pessimism that affects consumption and saving behaviors.

dowidth.com

dowidth.com