De-dollarization involves reducing reliance on the US dollar for international trade and domestic transactions, enabling countries to regain control over their monetary policy and financial systems. Embracing monetary sovereignty allows nations to stabilize their economies by tailoring currency management to their specific needs, countering external dollar shocks. Explore how shifting from dollar dependence enhances economic resilience and autonomy in an increasingly multipolar global economy.

Why it is important

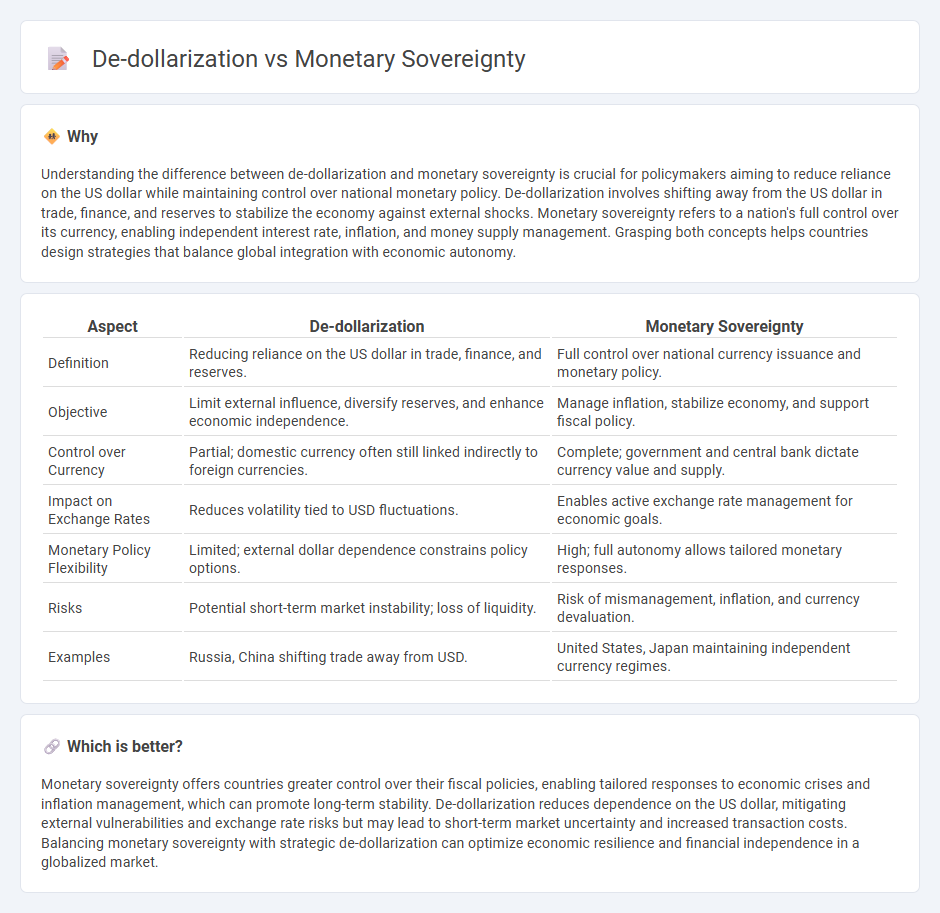

Understanding the difference between de-dollarization and monetary sovereignty is crucial for policymakers aiming to reduce reliance on the US dollar while maintaining control over national monetary policy. De-dollarization involves shifting away from the US dollar in trade, finance, and reserves to stabilize the economy against external shocks. Monetary sovereignty refers to a nation's full control over its currency, enabling independent interest rate, inflation, and money supply management. Grasping both concepts helps countries design strategies that balance global integration with economic autonomy.

Comparison Table

| Aspect | De-dollarization | Monetary Sovereignty |

|---|---|---|

| Definition | Reducing reliance on the US dollar in trade, finance, and reserves. | Full control over national currency issuance and monetary policy. |

| Objective | Limit external influence, diversify reserves, and enhance economic independence. | Manage inflation, stabilize economy, and support fiscal policy. |

| Control over Currency | Partial; domestic currency often still linked indirectly to foreign currencies. | Complete; government and central bank dictate currency value and supply. |

| Impact on Exchange Rates | Reduces volatility tied to USD fluctuations. | Enables active exchange rate management for economic goals. |

| Monetary Policy Flexibility | Limited; external dollar dependence constrains policy options. | High; full autonomy allows tailored monetary responses. |

| Risks | Potential short-term market instability; loss of liquidity. | Risk of mismanagement, inflation, and currency devaluation. |

| Examples | Russia, China shifting trade away from USD. | United States, Japan maintaining independent currency regimes. |

Which is better?

Monetary sovereignty offers countries greater control over their fiscal policies, enabling tailored responses to economic crises and inflation management, which can promote long-term stability. De-dollarization reduces dependence on the US dollar, mitigating external vulnerabilities and exchange rate risks but may lead to short-term market uncertainty and increased transaction costs. Balancing monetary sovereignty with strategic de-dollarization can optimize economic resilience and financial independence in a globalized market.

Connection

De-dollarization strengthens monetary sovereignty by reducing reliance on the US dollar in international trade and finance, allowing countries greater control over their monetary policy. This shift supports the stabilization of national currencies and mitigates exposure to external economic shocks linked to dollar fluctuations. Enhanced monetary sovereignty enables more autonomous economic decision-making, fostering sustainable growth and financial independence.

Key Terms

Currency control

Monetary sovereignty refers to a nation's exclusive control over its currency, enabling independent monetary policy decisions, while de-dollarization focuses on reducing reliance on the US dollar in international trade and finance to regain currency autonomy. Countries pursuing de-dollarization aim to strengthen their monetary sovereignty by increasing the use of local currencies in global transactions, which can enhance economic stability and mitigate external shocks. Explore how different nations implement currency control strategies to understand the impact on their financial independence and economic growth.

Exchange rate regime

Monetary sovereignty entails a nation's control over its currency and exchange rate regime, allowing for flexible adjustments to economic conditions. De-dollarization involves reducing dependence on the US dollar in international transactions and reserves, often prompting countries to shift from dollar-pegged or dollarized exchange rate regimes to more autonomous or diversified regimes. Explore how central banks manage exchange rate policies in the context of de-dollarization to better understand their impact on monetary sovereignty.

Reserve diversification

Monetary sovereignty empowers nations to control their currency and monetary policy, reducing reliance on foreign currencies like the U.S. dollar. De-dollarization strategies often emphasize reserve diversification by increasing holdings in alternative currencies such as the euro, yuan, or gold to mitigate risks associated with dollar dependency. Explore the dynamics and implications of reserve diversification in enhancing monetary sovereignty and advancing de-dollarization goals.

Source and External Links

Monetary sovereignty - Wikipedia - Monetary sovereignty is the state's exclusive legal control over its currency and monetary policy, including legal tender authority and currency issuance, exemplified by countries with autonomous central banks like the USA and Japan, while entities like Eurozone nations have ceded much of this control to the European Central Bank.

From Territorial to Monetary Sovereignty by Katharina Pistor - This article argues that monetary sovereignty, defined as control over a state's own money supply and financial system, has become more crucial than territorial sovereignty, with states surrendering it by adopting foreign currencies or issuing debt in foreign money, thereby limiting their ability to backstop domestic financial crises.

How to Rethink Monetary Sovereignty in an Era of Financial Globalization - The article proposes moving beyond the traditional Westphalian concept of monetary sovereignty as merely having one's own currency to a more nuanced "effective monetary sovereignty" idea, recognizing constraints global finance imposes on what states can do with their monetary policy today.

dowidth.com

dowidth.com