Shadow inflation represents the hidden rise in prices not captured by official measures, reflecting increased costs in goods and services that consumers face daily. Core inflation excludes volatile items like food and energy, providing a clearer picture of underlying long-term price trends. Explore how understanding both indicators can enhance economic decision-making and policy development.

Why it is important

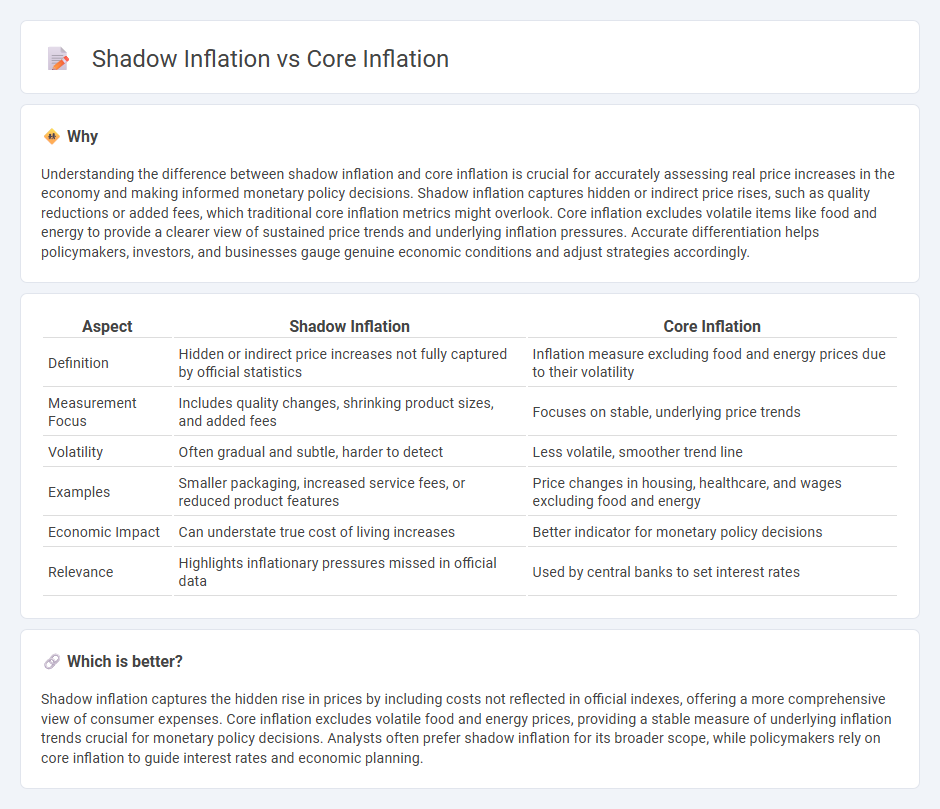

Understanding the difference between shadow inflation and core inflation is crucial for accurately assessing real price increases in the economy and making informed monetary policy decisions. Shadow inflation captures hidden or indirect price rises, such as quality reductions or added fees, which traditional core inflation metrics might overlook. Core inflation excludes volatile items like food and energy to provide a clearer view of sustained price trends and underlying inflation pressures. Accurate differentiation helps policymakers, investors, and businesses gauge genuine economic conditions and adjust strategies accordingly.

Comparison Table

| Aspect | Shadow Inflation | Core Inflation |

|---|---|---|

| Definition | Hidden or indirect price increases not fully captured by official statistics | Inflation measure excluding food and energy prices due to their volatility |

| Measurement Focus | Includes quality changes, shrinking product sizes, and added fees | Focuses on stable, underlying price trends |

| Volatility | Often gradual and subtle, harder to detect | Less volatile, smoother trend line |

| Examples | Smaller packaging, increased service fees, or reduced product features | Price changes in housing, healthcare, and wages excluding food and energy |

| Economic Impact | Can understate true cost of living increases | Better indicator for monetary policy decisions |

| Relevance | Highlights inflationary pressures missed in official data | Used by central banks to set interest rates |

Which is better?

Shadow inflation captures the hidden rise in prices by including costs not reflected in official indexes, offering a more comprehensive view of consumer expenses. Core inflation excludes volatile food and energy prices, providing a stable measure of underlying inflation trends crucial for monetary policy decisions. Analysts often prefer shadow inflation for its broader scope, while policymakers rely on core inflation to guide interest rates and economic planning.

Connection

Shadow inflation reflects the hidden rise in prices of goods and services excluded from official core inflation measures, capturing costs like housing and healthcare. Core inflation, which excludes volatile food and energy prices, often underestimates the true cost of living increases experienced by consumers. Understanding the interplay between shadow inflation and core inflation reveals the full extent of inflationary pressures in an economy.

Key Terms

Price Index

Core inflation measures the change in prices of goods and services excluding volatile items like food and energy, providing a clearer view of underlying inflation trends. Shadow inflation reflects hidden price increases, such as shrinking product sizes or reduced quality, which traditional Price Indexes may not fully capture. Discover more about how these inflation metrics impact economic analysis and consumer experience.

Hidden Costs

Core inflation measures the rise in prices of essential goods and services, excluding volatile items like food and energy, providing a clearer view of underlying inflation trends. Shadow inflation refers to hidden costs that do not immediately appear in official indices, such as smaller package sizes or reduced product quality, effectively increasing consumer expenses without being captured in traditional inflation data. Explore how these hidden costs impact real purchasing power and financial planning to better understand true inflation dynamics.

Consumer Basket

Core inflation measures price changes of essential goods and services in the consumer basket, excluding volatile items like food and energy to provide a clearer view of persistent inflation trends. Shadow inflation reflects the hidden rise in living costs caused by downsizing product sizes or reducing quality without lowering prices, impacting consumers' real purchasing power within the same basket. Explore the detailed impact of these inflation types on household budgets and economic policy by learning more about their measurement and implications.

Source and External Links

Core inflation - Wikipedia - Core inflation measures the long-run trend of price levels in the economy by excluding volatile items like food and energy to better indicate underlying inflation trends and assist policy decisions.

United States Core Inflation Rate - Trading Economics - The US core inflation rate, excluding food and energy prices, was 2.9% in June 2025, with projections of around 2.6% in 2026 and 2.3% in 2027.

Core inflation: a measure of inflation for policy purposes - BIS - Core inflation is used by monetary authorities as a better guide for current and future policy by filtering out short-term price shocks to focus on persistent inflation trends controllable by policy.

dowidth.com

dowidth.com