Doom spending reflects a consumer behavior where individuals engage in excessive, often impulsive purchases driven by anxiety about economic uncertainty, contrasting sharply with the principles of minimalism that emphasize intentional buying and mindful resource management. Economic studies reveal a rise in doom spending during recessions, affecting overall market stability and household debt levels. Explore the impact of these opposing financial habits on personal wealth and the broader economy.

Why it is important

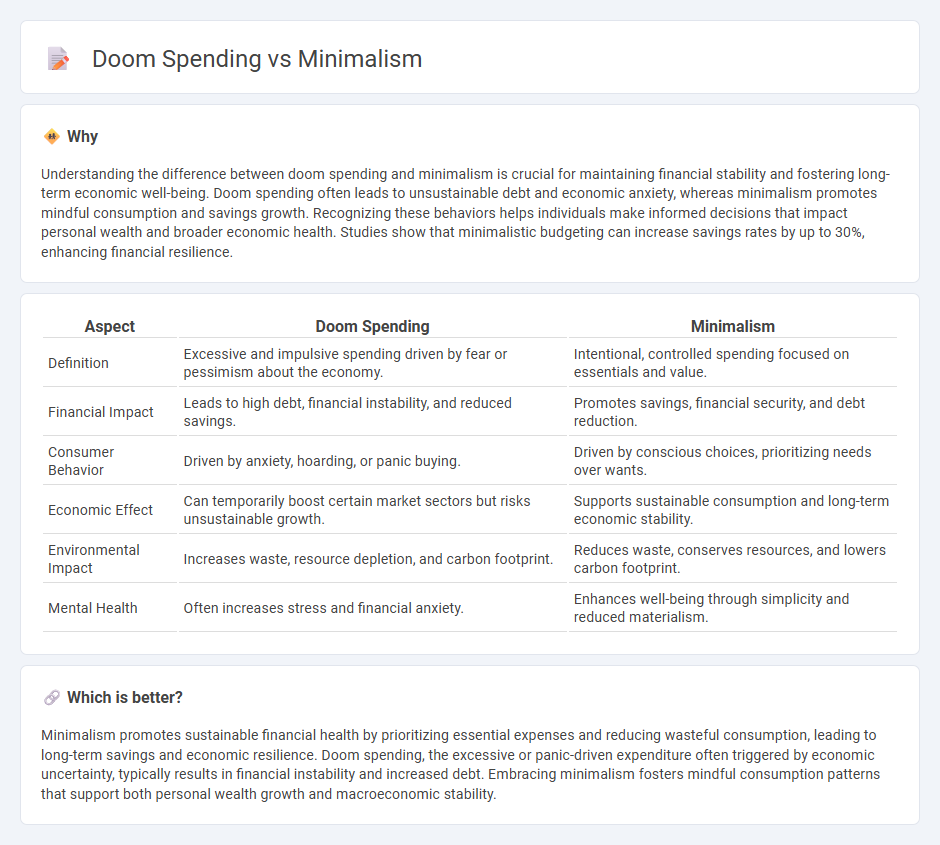

Understanding the difference between doom spending and minimalism is crucial for maintaining financial stability and fostering long-term economic well-being. Doom spending often leads to unsustainable debt and economic anxiety, whereas minimalism promotes mindful consumption and savings growth. Recognizing these behaviors helps individuals make informed decisions that impact personal wealth and broader economic health. Studies show that minimalistic budgeting can increase savings rates by up to 30%, enhancing financial resilience.

Comparison Table

| Aspect | Doom Spending | Minimalism |

|---|---|---|

| Definition | Excessive and impulsive spending driven by fear or pessimism about the economy. | Intentional, controlled spending focused on essentials and value. |

| Financial Impact | Leads to high debt, financial instability, and reduced savings. | Promotes savings, financial security, and debt reduction. |

| Consumer Behavior | Driven by anxiety, hoarding, or panic buying. | Driven by conscious choices, prioritizing needs over wants. |

| Economic Effect | Can temporarily boost certain market sectors but risks unsustainable growth. | Supports sustainable consumption and long-term economic stability. |

| Environmental Impact | Increases waste, resource depletion, and carbon footprint. | Reduces waste, conserves resources, and lowers carbon footprint. |

| Mental Health | Often increases stress and financial anxiety. | Enhances well-being through simplicity and reduced materialism. |

Which is better?

Minimalism promotes sustainable financial health by prioritizing essential expenses and reducing wasteful consumption, leading to long-term savings and economic resilience. Doom spending, the excessive or panic-driven expenditure often triggered by economic uncertainty, typically results in financial instability and increased debt. Embracing minimalism fosters mindful consumption patterns that support both personal wealth growth and macroeconomic stability.

Connection

Doom spending, characterized by impulsive purchases during economic uncertainty, contrasts with minimalism's focus on intentional consumption and resource conservation. Both behaviors respond to financial stress but result in opposite spending patterns: doom spending increases short-term economic activity while minimalism promotes long-term savings and reduced demand. Understanding this dynamic helps economists analyze consumer confidence and market fluctuations during recessions.

Key Terms

Consumer Behavior

Minimalism emphasizes intentional purchasing habits, reducing consumption to essentials, which fosters financial discipline and long-term satisfaction. Doom spending, triggered by anxiety or uncertainty, drives impulsive buying as a coping mechanism, often resulting in financial instability. Explore further to understand how these contrasting consumer behaviors impact economic trends and personal finance.

Disposable Income

Minimalism encourages mindful spending by prioritizing essential purchases and reducing clutter, which leads to increased disposable income for savings or investments. Doom spending, driven by anxiety about economic instability, results in impulsive buying that diminishes disposable income and financial security. Explore how managing disposable income through these contrasting behaviors can impact your long-term financial health.

Financial Sustainability

Minimalism emphasizes reducing expenses and prioritizing essential spending to enhance long-term financial sustainability by avoiding unnecessary purchases. Doom spending, often triggered by anxiety or uncertainty, leads to impulsive buying that undermines budget stability and delays wealth accumulation. Explore strategies to balance mindful spending with financial security and break free from detrimental spending habits.

Source and External Links

Minimalism - Wikipedia - Minimalism is an art movement originating in the post-war era, but also a lifestyle philosophy centered on using only essential materials and items, helping to reduce clutter, waste, and focus on what truly matters.

What Is Minimalism? - Becoming Minimalist - Minimalism is about freedom from the obsession to possess; it involves intentionally promoting what we value most and removing distractions, leading to a slower, more focused, and grateful life.

What Is Minimalism? - The Minimalists - Minimalism is a tool to remove life's excess to focus on what is important, enabling happiness, fulfillment, and freedom, with each minimalist adapting it uniquely to their life purpose.

dowidth.com

dowidth.com