Revenge spending refers to the surge in consumer purchases as individuals seek to compensate for previous periods of restricted spending, often triggered by economic or social limitations. Impulse buying involves spontaneous, unplanned purchases driven by immediate desires rather than long-term needs or financial planning. Discover how these contrasting spending behaviors impact economic trends and consumer psychology.

Why it is important

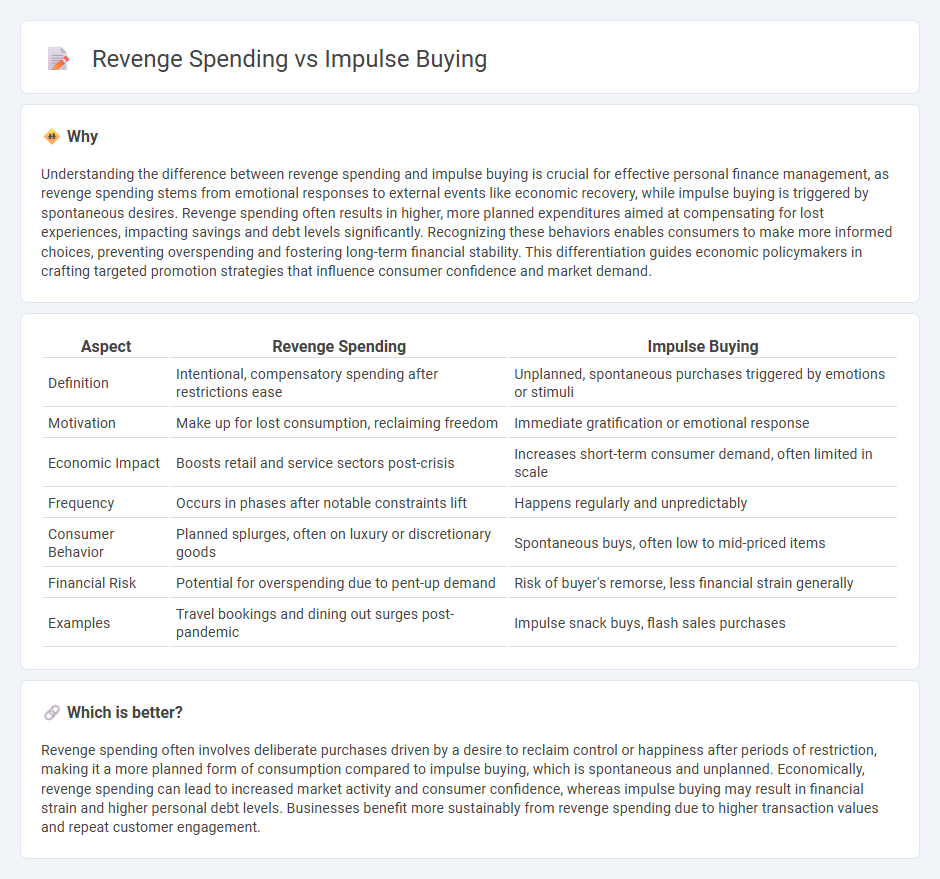

Understanding the difference between revenge spending and impulse buying is crucial for effective personal finance management, as revenge spending stems from emotional responses to external events like economic recovery, while impulse buying is triggered by spontaneous desires. Revenge spending often results in higher, more planned expenditures aimed at compensating for lost experiences, impacting savings and debt levels significantly. Recognizing these behaviors enables consumers to make more informed choices, preventing overspending and fostering long-term financial stability. This differentiation guides economic policymakers in crafting targeted promotion strategies that influence consumer confidence and market demand.

Comparison Table

| Aspect | Revenge Spending | Impulse Buying |

|---|---|---|

| Definition | Intentional, compensatory spending after restrictions ease | Unplanned, spontaneous purchases triggered by emotions or stimuli |

| Motivation | Make up for lost consumption, reclaiming freedom | Immediate gratification or emotional response |

| Economic Impact | Boosts retail and service sectors post-crisis | Increases short-term consumer demand, often limited in scale |

| Frequency | Occurs in phases after notable constraints lift | Happens regularly and unpredictably |

| Consumer Behavior | Planned splurges, often on luxury or discretionary goods | Spontaneous buys, often low to mid-priced items |

| Financial Risk | Potential for overspending due to pent-up demand | Risk of buyer's remorse, less financial strain generally |

| Examples | Travel bookings and dining out surges post-pandemic | Impulse snack buys, flash sales purchases |

Which is better?

Revenge spending often involves deliberate purchases driven by a desire to reclaim control or happiness after periods of restriction, making it a more planned form of consumption compared to impulse buying, which is spontaneous and unplanned. Economically, revenge spending can lead to increased market activity and consumer confidence, whereas impulse buying may result in financial strain and higher personal debt levels. Businesses benefit more sustainably from revenge spending due to higher transaction values and repeat customer engagement.

Connection

Revenge spending often triggers impulsive buying as consumers seek immediate gratification after periods of financial restraint or emotional stress. This surge in unplanned expenditures heavily influences retail sales, driving temporary economic boosts in sectors like fashion, dining, and electronics. Understanding the psychological motives behind these behaviors helps economists and marketers predict market trends and consumer confidence levels.

Key Terms

Consumer Behavior

Impulse buying involves spontaneous purchases driven by immediate desires without pre-planning, often triggered by emotional stimuli or in-store promotions. Revenge spending, a consumer behavior surge post-economic or personal hardship, reflects a compensatory response where individuals buy luxury or non-essential items to regain a sense of control or reward themselves. Explore more insights into how these distinct buying patterns influence market trends and consumer psychology.

Discretionary Income

Impulse buying often occurs when individuals make unplanned purchases using discretionary income, driven by spontaneous desires or emotional triggers. Revenge spending, on the other hand, involves intentional, often excessive spending as a response to stress or restrictions, typically resulting in higher discretionary income allocation. Explore how managing discretionary income can influence these spending behaviors and strategies to maintain financial health.

Post-Purchase Rationalization

Impulse buying involves spontaneous purchases driven by immediate desire without pre-planning, while revenge spending refers to purchases made as a reaction to emotional triggers, often to regain a sense of control or reward oneself. Post-purchase rationalization is a cognitive bias where consumers justify these impulsive or emotionally charged purchases to reduce buyer's remorse and affirm the decision as reasonable. Explore deeper insights into how psychological factors influence consumer behavior and spending patterns.

Source and External Links

Factors Affecting Impulse Buying Behavior of Consumers - Impulse buying is an unplanned and emotional purchase characterized by low cognitive control, influenced by personality traits, store environment, promotional campaigns, and emotional state, often providing immediate gratification but potentially leading to compulsive behaviors.

Impulse purchase - An impulse purchase is a consumer's unplanned decision to buy a product or service immediately, triggered by emotions, feelings, and marketing stimuli, with its definition evolving to focus on the consumer's intense urge to satisfy wants spontaneously.

What Is Impulse Buying? 5 Ways to Resist - Impulse buying is purchasing without prior planning often triggered by sales, social influences, or online deals and can be controlled by strategies such as pausing before buying and sticking to a budget to avoid overspending.

dowidth.com

dowidth.com