A soft landing in the economy occurs when growth slows down just enough to prevent inflation without triggering a recession, maintaining stable employment and consumer confidence. In contrast, a growth slowdown indicates a more pronounced deceleration, often leading to higher unemployment and reduced business investment. Explore the key indicators and strategies behind these economic outcomes to deepen your understanding.

Why it is important

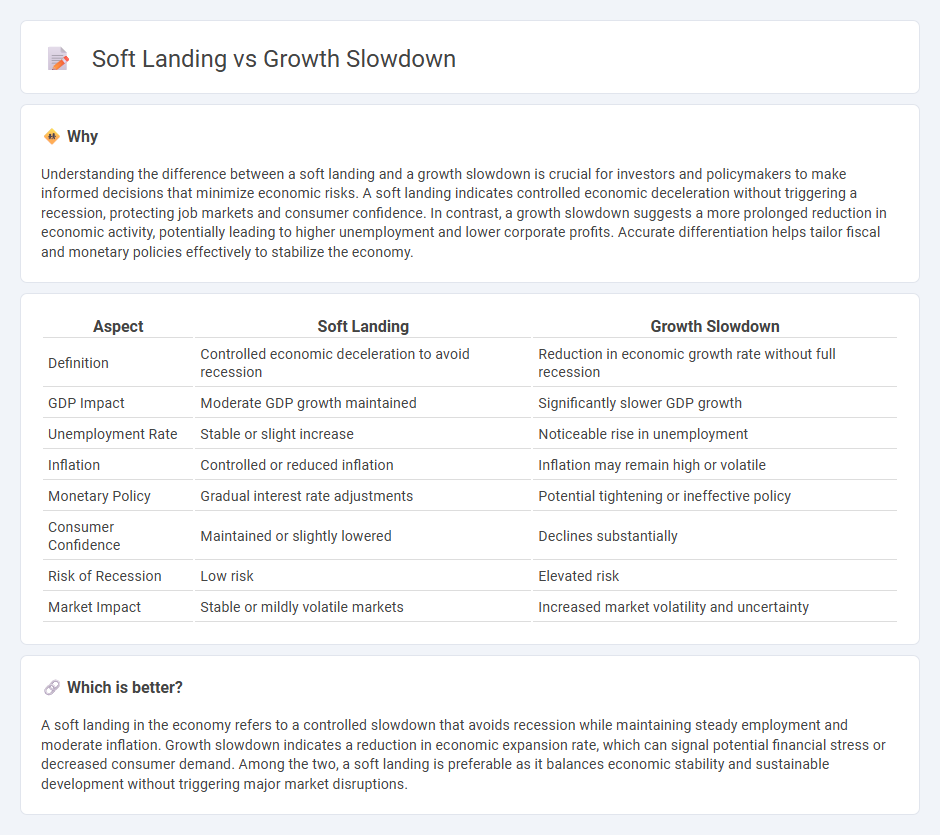

Understanding the difference between a soft landing and a growth slowdown is crucial for investors and policymakers to make informed decisions that minimize economic risks. A soft landing indicates controlled economic deceleration without triggering a recession, protecting job markets and consumer confidence. In contrast, a growth slowdown suggests a more prolonged reduction in economic activity, potentially leading to higher unemployment and lower corporate profits. Accurate differentiation helps tailor fiscal and monetary policies effectively to stabilize the economy.

Comparison Table

| Aspect | Soft Landing | Growth Slowdown |

|---|---|---|

| Definition | Controlled economic deceleration to avoid recession | Reduction in economic growth rate without full recession |

| GDP Impact | Moderate GDP growth maintained | Significantly slower GDP growth |

| Unemployment Rate | Stable or slight increase | Noticeable rise in unemployment |

| Inflation | Controlled or reduced inflation | Inflation may remain high or volatile |

| Monetary Policy | Gradual interest rate adjustments | Potential tightening or ineffective policy |

| Consumer Confidence | Maintained or slightly lowered | Declines substantially |

| Risk of Recession | Low risk | Elevated risk |

| Market Impact | Stable or mildly volatile markets | Increased market volatility and uncertainty |

Which is better?

A soft landing in the economy refers to a controlled slowdown that avoids recession while maintaining steady employment and moderate inflation. Growth slowdown indicates a reduction in economic expansion rate, which can signal potential financial stress or decreased consumer demand. Among the two, a soft landing is preferable as it balances economic stability and sustainable development without triggering major market disruptions.

Connection

A soft landing refers to an economy slowing down just enough to curb inflation without triggering a recession, maintaining steady employment and consumer confidence. A growth slowdown indicates reduced GDP expansion, which can signal easing economic overheating but risks tipping into contraction if overly severe. The interplay between a soft landing and growth slowdown hinges on calibrated monetary policies that temper growth rates to prevent economic turbulence.

Key Terms

GDP Growth Rate

A growth slowdown refers to a deceleration in the GDP growth rate without entering negative territory, indicating the economy is expanding but at a reduced pace. A soft landing occurs when policymakers successfully cool down an overheating economy, reducing inflation while maintaining positive GDP growth, thereby avoiding a recession. Explore detailed economic indicators and policy responses to understand the critical differences between these two economic scenarios.

Inflation

A growth slowdown refers to a deceleration in economic expansion, often accompanied by rising inflation due to persistent demand pressures or supply constraints. A soft landing occurs when the economy slows sufficiently to reduce inflation without triggering a recession, typically influenced by central bank policy adjustments targeting price stability. Explore how inflation dynamics differentiate growth slowdown scenarios from soft landing outcomes in today's economic environment.

Monetary Policy

Monetary policy plays a crucial role in distinguishing between a growth slowdown and a soft landing by adjusting interest rates to balance economic expansion and inflation control. Central banks often tighten monetary policy to prevent overheating, aiming for a soft landing where GDP growth moderates without triggering a recession. Explore how different monetary policy strategies impact economic outcomes and future market expectations.

Source and External Links

Falling Long-Term Growth Prospects - World Bank - Global economic potential growth is expected to decline to a three-decade low over the 2020s due to weakening productivity, aging labor forces, slower investment, and weaker trade, posing serious challenges to poverty reduction and development goals.

How can we get growth back on track? - The World Economic Forum - Global growth is forecast to average just 3.1% between 2024 and 2028, the slowest pace in decades, with emerging markets and developing economies experiencing particularly pronounced slowdowns.

Why is growth slowing down? | Growth Study Guide - Dietrich Vollrath - The growth slowdown is mainly due to a decline in demographic momentum and human capital growth, leading to a lower productivity growth rate and a substantial drop in overall GDP per capita growth since 2000.

dowidth.com

dowidth.com