Greenflation refers to rising prices driven by the increased costs of environmentally sustainable goods and energy, impacting inflation rates worldwide. Reflation involves government policies aimed at stimulating economic growth and increasing demand to counteract deflationary pressures. Explore these concepts further to understand their distinct effects on global markets and policy decisions.

Why it is important

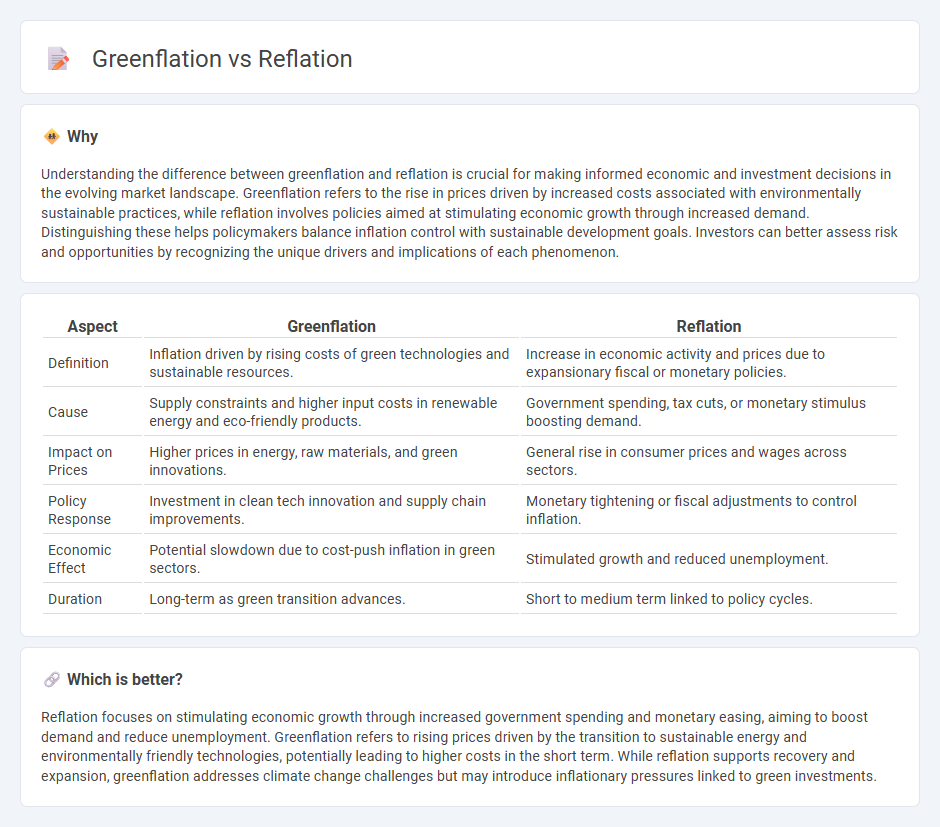

Understanding the difference between greenflation and reflation is crucial for making informed economic and investment decisions in the evolving market landscape. Greenflation refers to the rise in prices driven by increased costs associated with environmentally sustainable practices, while reflation involves policies aimed at stimulating economic growth through increased demand. Distinguishing these helps policymakers balance inflation control with sustainable development goals. Investors can better assess risk and opportunities by recognizing the unique drivers and implications of each phenomenon.

Comparison Table

| Aspect | Greenflation | Reflation |

|---|---|---|

| Definition | Inflation driven by rising costs of green technologies and sustainable resources. | Increase in economic activity and prices due to expansionary fiscal or monetary policies. |

| Cause | Supply constraints and higher input costs in renewable energy and eco-friendly products. | Government spending, tax cuts, or monetary stimulus boosting demand. |

| Impact on Prices | Higher prices in energy, raw materials, and green innovations. | General rise in consumer prices and wages across sectors. |

| Policy Response | Investment in clean tech innovation and supply chain improvements. | Monetary tightening or fiscal adjustments to control inflation. |

| Economic Effect | Potential slowdown due to cost-push inflation in green sectors. | Stimulated growth and reduced unemployment. |

| Duration | Long-term as green transition advances. | Short to medium term linked to policy cycles. |

Which is better?

Reflation focuses on stimulating economic growth through increased government spending and monetary easing, aiming to boost demand and reduce unemployment. Greenflation refers to rising prices driven by the transition to sustainable energy and environmentally friendly technologies, potentially leading to higher costs in the short term. While reflation supports recovery and expansion, greenflation addresses climate change challenges but may introduce inflationary pressures linked to green investments.

Connection

Greenflation, driven by rising costs of carbon-intensive goods and renewable energy investments, contributes to overall price increases in the economy. Reflation policies, aimed at stimulating economic growth and increasing inflation, can exacerbate greenflation by boosting demand for energy and raw materials. The interplay between greenflation and reflation shapes inflation dynamics and influences central bank monetary policy decisions.

Key Terms

Monetary Policy

Reflation involves monetary policy actions aimed at stimulating the economy by increasing money supply and lowering interest rates to counteract deflationary pressures, while greenflation refers to rising prices driven by the transition to sustainable energy and environmentally friendly technologies. Central banks face the challenge of balancing reflationary measures with the inflationary impacts of greenflation, as policies promoting green investments may lead to short-term cost increases in energy and raw materials. Explore how monetary authorities adapt strategies to manage the dual impact of reflation and greenflation in today's economic landscape.

Carbon Pricing

Reflation refers to policies aimed at boosting economic growth and increasing inflation, typically through monetary or fiscal stimulus, while greenflation arises from rising costs due to the transition to sustainable, low-carbon technologies and stricter environmental regulations. Carbon pricing, including carbon taxes and cap-and-trade systems, plays a crucial role in driving greenflation by internalizing the cost of carbon emissions and incentivizing cleaner energy sources, thereby influencing production costs and consumer prices. Explore how carbon pricing mechanisms impact economic strategies and inflation dynamics to better understand the balance between growth and sustainability.

Supply Chain Disruptions

Supply chain disruptions play a critical role in both reflation and greenflation dynamics by causing increased costs and shortages of essential raw materials and components. Reflation reflects a broader economic response to stimulate growth and inflation post-recession, while greenflation specifically arises from the rising costs linked to the transition towards sustainable energy and environmentally friendly technologies. Explore further to understand how these inflationary pressures impact global markets and supply chain strategies.

Source and External Links

Reflation - Wikipedia - Reflation refers to the act of stimulating the economy by increasing the money supply or reducing taxes to bring prices back up to a long-term trend after a dip, essentially a return of prices to a previous inflation rate following economic slowdown or deflation.

What's the Reflation Trade? - SoFi - Reflation is the recovery of prices and employment growth after an economic downturn, often driven by economic stimulus, and the reflation trade involves investing in sectors expected to perform well during early recovery phases.

Reflation is what's intended to happen when officials move to pull the economy out of a recession - Reflation occurs when government stimulus spending circulates in the economy, boosting spending and supporting economic recovery after a recession.

dowidth.com

dowidth.com