Carbon border adjustment mechanisms impose tariffs on imported goods based on their carbon emissions to level the playing field between domestic and foreign producers targeting carbon-intensive industries. Carbon taxes directly charge companies a fee per ton of emitted CO2 to incentivize emission reductions and generate governmental revenue. Explore the economic impacts and policy effectiveness of these climate strategies for sustainable growth.

Why it is important

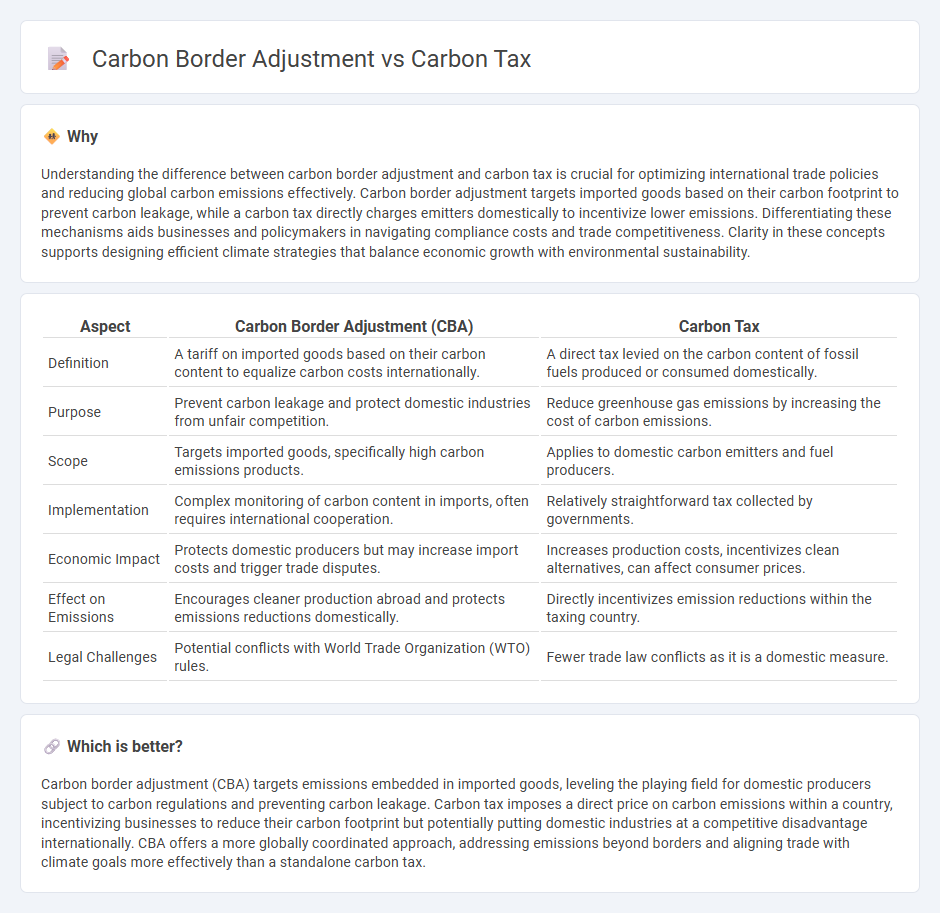

Understanding the difference between carbon border adjustment and carbon tax is crucial for optimizing international trade policies and reducing global carbon emissions effectively. Carbon border adjustment targets imported goods based on their carbon footprint to prevent carbon leakage, while a carbon tax directly charges emitters domestically to incentivize lower emissions. Differentiating these mechanisms aids businesses and policymakers in navigating compliance costs and trade competitiveness. Clarity in these concepts supports designing efficient climate strategies that balance economic growth with environmental sustainability.

Comparison Table

| Aspect | Carbon Border Adjustment (CBA) | Carbon Tax |

|---|---|---|

| Definition | A tariff on imported goods based on their carbon content to equalize carbon costs internationally. | A direct tax levied on the carbon content of fossil fuels produced or consumed domestically. |

| Purpose | Prevent carbon leakage and protect domestic industries from unfair competition. | Reduce greenhouse gas emissions by increasing the cost of carbon emissions. |

| Scope | Targets imported goods, specifically high carbon emissions products. | Applies to domestic carbon emitters and fuel producers. |

| Implementation | Complex monitoring of carbon content in imports, often requires international cooperation. | Relatively straightforward tax collected by governments. |

| Economic Impact | Protects domestic producers but may increase import costs and trigger trade disputes. | Increases production costs, incentivizes clean alternatives, can affect consumer prices. |

| Effect on Emissions | Encourages cleaner production abroad and protects emissions reductions domestically. | Directly incentivizes emission reductions within the taxing country. |

| Legal Challenges | Potential conflicts with World Trade Organization (WTO) rules. | Fewer trade law conflicts as it is a domestic measure. |

Which is better?

Carbon border adjustment (CBA) targets emissions embedded in imported goods, leveling the playing field for domestic producers subject to carbon regulations and preventing carbon leakage. Carbon tax imposes a direct price on carbon emissions within a country, incentivizing businesses to reduce their carbon footprint but potentially putting domestic industries at a competitive disadvantage internationally. CBA offers a more globally coordinated approach, addressing emissions beyond borders and aligning trade with climate goals more effectively than a standalone carbon tax.

Connection

Carbon border adjustment and carbon tax are interconnected as mechanisms designed to reduce carbon emissions by incentivizing cleaner production methods. Carbon tax directly imposes a price on carbon emissions within a country to encourage reduced emissions, while carbon border adjustment extends this principle to imported goods, leveling the playing field and preventing carbon leakage. Together, they promote global decarbonization by ensuring carbon costs are internalized regardless of production location.

Key Terms

Emissions Pricing

Carbon tax directly imposes a fixed price per ton of CO2 emitted, incentivizing businesses to reduce emissions by making pollution more costly. Carbon border adjustment (CBA) ensures imported goods face equivalent carbon costs to domestic products, preventing carbon leakage and maintaining competitive fairness. Explore how emissions pricing strategies like carbon tax and CBA drive global climate action and economic balance.

Trade Competitiveness

Carbon tax imposes direct levies on greenhouse gas emissions within a country, potentially increasing production costs and affecting trade competitiveness by making domestic goods more expensive compared to imports. Carbon border adjustment mechanisms (CBAM) level the playing field by applying equivalent carbon costs on imported goods, preventing carbon leakage and protecting domestic industries from unfair competition. Explore how these policies can shape global trade dynamics and environmental goals.

Leakage Prevention

Carbon tax imposes a direct price on carbon emissions within a country's borders, encouraging domestic emission reductions but risking carbon leakage as production shifts to regions with laxer regulations. Carbon Border Adjustment Mechanisms (CBAM) address this leakage by levying fees on imported goods based on their carbon content, leveling the playing field for domestic industries and incentivizing global emission cuts. Explore how these policies interact to effectively prevent carbon leakage and promote sustainable trade.

Source and External Links

Carbon Tax: Definition, Pros and Cons, and Implementation - A carbon tax directly puts a price on carbon emissions from burning fossil fuels, incentivizing reduced greenhouse gas emissions by making polluting activities more costly, with revenues potentially used to fund green projects or returned to citizens.

What is a carbon tax? | Tax Policy Center - A carbon tax encourages lower emissions by pricing carbon dioxide and other greenhouse gases, and its revenues can be used to offset regressive impacts, reduce other taxes, or invest in clean energy solutions.

What You Need to Know About a Federal Carbon Tax in the United States - A carbon tax imposes a fee per ton of CO2 emitted, driving emissions reductions especially in the power sector, with tax rate design crucial for the scale of impact and encouraging development of low-carbon technologies.

dowidth.com

dowidth.com