De-dollarization involves reducing reliance on the US dollar in international trade and finance to enhance economic sovereignty and mitigate exchange rate risks. Currency pegs stabilize a country's currency by fixing its exchange rate to a major currency, often the US dollar, to control inflation and promote trade predictability. Explore how different nations balance these strategies to navigate global economic challenges.

Why it is important

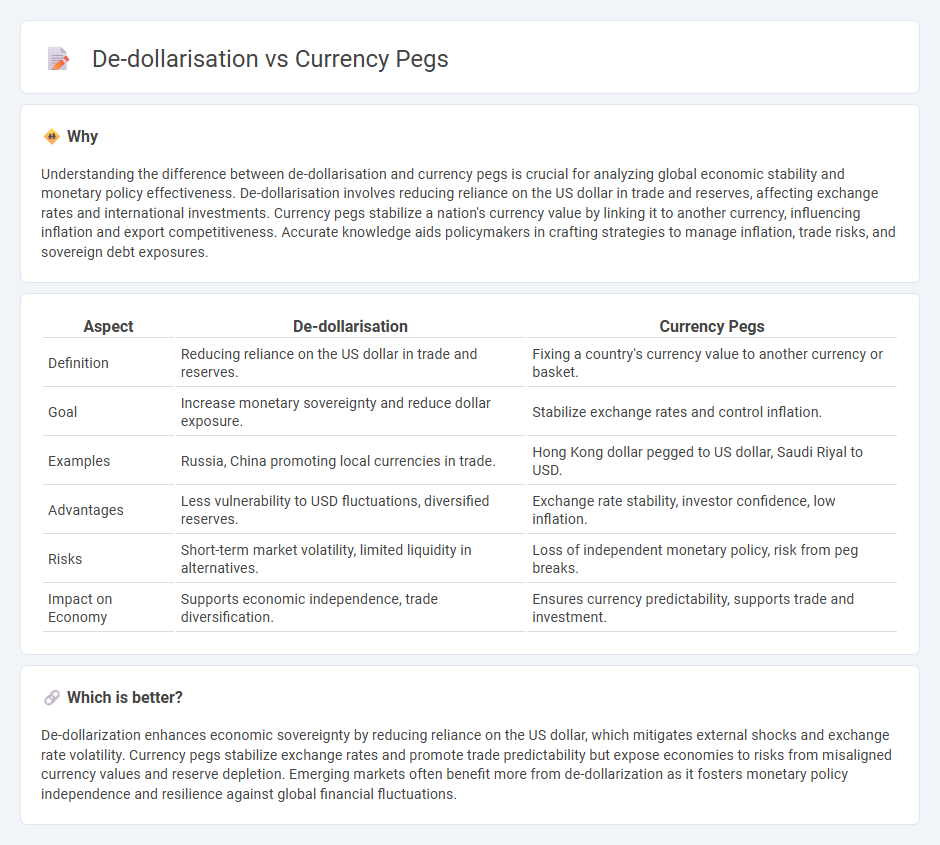

Understanding the difference between de-dollarisation and currency pegs is crucial for analyzing global economic stability and monetary policy effectiveness. De-dollarisation involves reducing reliance on the US dollar in trade and reserves, affecting exchange rates and international investments. Currency pegs stabilize a nation's currency value by linking it to another currency, influencing inflation and export competitiveness. Accurate knowledge aids policymakers in crafting strategies to manage inflation, trade risks, and sovereign debt exposures.

Comparison Table

| Aspect | De-dollarisation | Currency Pegs |

|---|---|---|

| Definition | Reducing reliance on the US dollar in trade and reserves. | Fixing a country's currency value to another currency or basket. |

| Goal | Increase monetary sovereignty and reduce dollar exposure. | Stabilize exchange rates and control inflation. |

| Examples | Russia, China promoting local currencies in trade. | Hong Kong dollar pegged to US dollar, Saudi Riyal to USD. |

| Advantages | Less vulnerability to USD fluctuations, diversified reserves. | Exchange rate stability, investor confidence, low inflation. |

| Risks | Short-term market volatility, limited liquidity in alternatives. | Loss of independent monetary policy, risk from peg breaks. |

| Impact on Economy | Supports economic independence, trade diversification. | Ensures currency predictability, supports trade and investment. |

Which is better?

De-dollarization enhances economic sovereignty by reducing reliance on the US dollar, which mitigates external shocks and exchange rate volatility. Currency pegs stabilize exchange rates and promote trade predictability but expose economies to risks from misaligned currency values and reserve depletion. Emerging markets often benefit more from de-dollarization as it fosters monetary policy independence and resilience against global financial fluctuations.

Connection

De-dollarisation reduces reliance on the U.S. dollar by encouraging use of local currencies, which often involves establishing currency pegs to stabilize exchange rates and build investor confidence. Currency pegs link a nation's currency value to a stable foreign currency, mitigating volatility and facilitating trade under de-dollarised regimes. This strategy supports economic sovereignty and helps countries manage inflation and balance of payments more effectively.

Key Terms

Exchange Rate Regime

Currency pegs maintain exchange rate stability by fixing a nation's currency value to a major currency, typically the US dollar, which helps control inflation and attract investment. De-dollarisation involves reducing reliance on the US dollar in domestic and international transactions, often through promoting local currency usage and diversifying foreign reserves. Explore how different exchange rate regimes influence economic sovereignty and global trade dynamics.

Reserve Currency

Currency pegs stabilize exchange rates by anchoring a nation's currency to a dominant reserve currency like the US dollar, thereby facilitating trade and investment. De-dollarisation involves reducing reliance on the US dollar in international reserves and transactions, aiming to enhance economic sovereignty and mitigate exchange rate risks. Explore the dynamics between currency pegs and de-dollarisation to understand their impact on global financial stability and reserve currency prominence.

Monetary Sovereignty

Currency pegs maintain monetary stability by fixing a nation's currency value to a major foreign currency, often the US dollar, but can limit a country's monetary sovereignty and flexibility in policy adjustments. De-dollarisation seeks to reduce dependence on the US dollar, enhancing monetary sovereignty by promoting the use of local currencies in international trade and reserves. Explore how shifting from currency pegs to de-dollarisation strategies impacts economic independence and global financial resilience.

Source and External Links

What is Currency Peg (Fixed Exchange Rate)? | AvaTrade - Currency pegging is when a country fixes its currency's exchange rate to another currency, like the US dollar, or a basket of currencies, to provide stability and reduce economic volatility, commonly used by over 66 countries for trade and inflation control.

Peggers can't be choosers: Currency pegs - A currency peg involves fixing a nation's exchange rate to a more stable foreign currency or basket, reducing foreign exchange risk and promoting trade, with around 60 countries pegging to the US dollar and 25 to the euro.

What is a pegged exchange rate and why do countries do it? - Privalgo - Pegged exchange rates link a country's currency value to another currency at a fixed rate, maintained by central banks; a well-known example is Hong Kong's dollar pegged to the US dollar since 1983 to ensure economic stability and low inflation.

dowidth.com

dowidth.com