Economic scarring refers to the long-term damage to an economy caused by severe downturns, including persistent unemployment, reduced capital investment, and diminished productivity growth. In contrast, economic rebound captures the rapid recovery and growth following a recession, often driven by renewed consumer spending, fiscal stimulus, and technological innovation. Explore how these opposing forces shape national economic trajectories and policy responses.

Why it is important

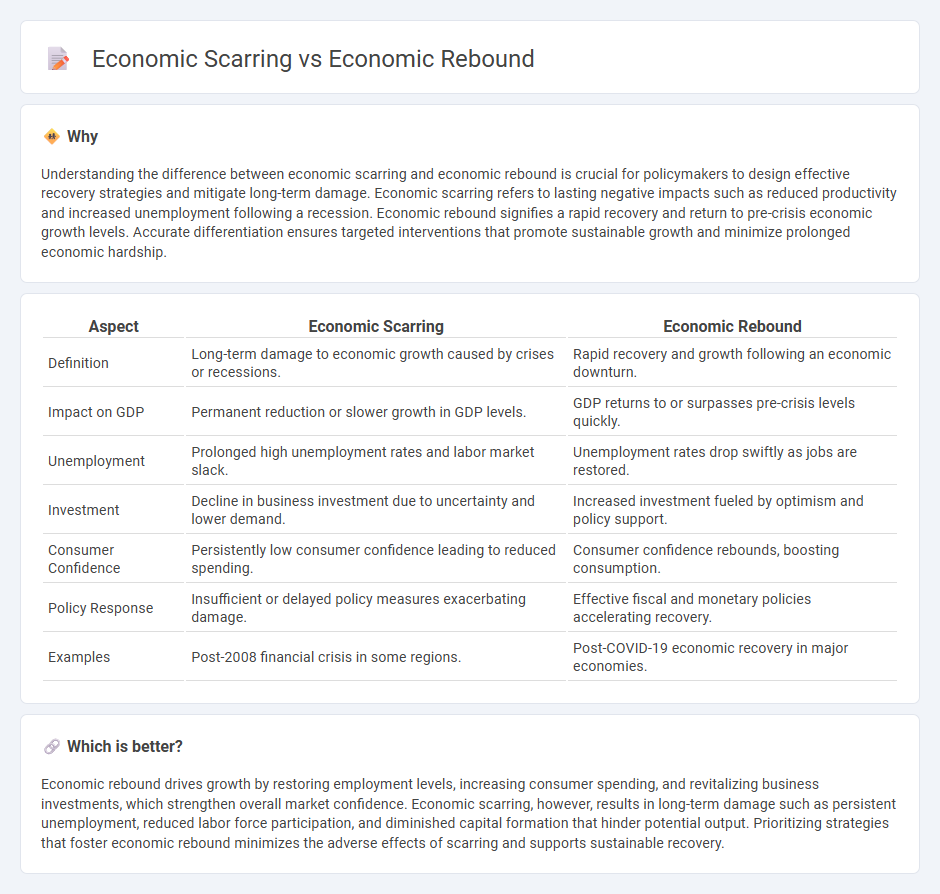

Understanding the difference between economic scarring and economic rebound is crucial for policymakers to design effective recovery strategies and mitigate long-term damage. Economic scarring refers to lasting negative impacts such as reduced productivity and increased unemployment following a recession. Economic rebound signifies a rapid recovery and return to pre-crisis economic growth levels. Accurate differentiation ensures targeted interventions that promote sustainable growth and minimize prolonged economic hardship.

Comparison Table

| Aspect | Economic Scarring | Economic Rebound |

|---|---|---|

| Definition | Long-term damage to economic growth caused by crises or recessions. | Rapid recovery and growth following an economic downturn. |

| Impact on GDP | Permanent reduction or slower growth in GDP levels. | GDP returns to or surpasses pre-crisis levels quickly. |

| Unemployment | Prolonged high unemployment rates and labor market slack. | Unemployment rates drop swiftly as jobs are restored. |

| Investment | Decline in business investment due to uncertainty and lower demand. | Increased investment fueled by optimism and policy support. |

| Consumer Confidence | Persistently low consumer confidence leading to reduced spending. | Consumer confidence rebounds, boosting consumption. |

| Policy Response | Insufficient or delayed policy measures exacerbating damage. | Effective fiscal and monetary policies accelerating recovery. |

| Examples | Post-2008 financial crisis in some regions. | Post-COVID-19 economic recovery in major economies. |

Which is better?

Economic rebound drives growth by restoring employment levels, increasing consumer spending, and revitalizing business investments, which strengthen overall market confidence. Economic scarring, however, results in long-term damage such as persistent unemployment, reduced labor force participation, and diminished capital formation that hinder potential output. Prioritizing strategies that foster economic rebound minimizes the adverse effects of scarring and supports sustainable recovery.

Connection

Economic scarring, characterized by long-term damage to labor markets, productivity, and capital investment, hampers the speed and strength of an economic rebound. The magnitude of scarring influences recovery trajectories, with severe scarring often leading to slower GDP growth and persistent unemployment rates. Policies targeting structural reforms and investment in human capital are essential to mitigate scarring effects and accelerate the economic rebound process.

Key Terms

Aggregate demand

The economic rebound often hinges on the rapid restoration of aggregate demand, which drives consumption, investment, and overall economic activity essential for growth recovery. Economic scarring manifests as persistent declines in aggregate demand due to increased unemployment, reduced consumer confidence, and structural shifts limiting spending capacity. Explore how targeted fiscal and monetary policies can mitigate economic scarring by revitalizing aggregate demand and supporting sustainable economic rebound.

Labor market recovery

Labor market recovery after economic downturns hinges on distinguishing between temporary economic rebound and long-term economic scarring, with the latter involving persistent unemployment and skill degradation. Key indicators such as labor force participation rates, job vacancy statistics, and wage growth reveal the extent of recovery and the potential for sustained employment opportunities. Explore deeper insights on how targeted policies and upskilling initiatives can mitigate labor market scarring and foster a robust economic revival.

Long-term productivity

Economic rebound reflects a recovery in GDP growth driven by short-term stimulus and pent-up demand, but long-term productivity gains hinge on innovation, workforce skills, and capital investment. Economic scarring, conversely, involves lasting damage such as labor market disruptions, reduced capital formation, and sectoral shifts that depress potential output and productivity over time. Explore the dynamics shaping sustainable growth and the policies necessary to enhance long-term productivity.

Source and External Links

Autumn 2024 Economic Forecast: A gradual rebound in an adverse environment - Economic activity is projected to expand by 1.8% in 2026, driven by growing demand, easing inflation, and improved credit conditions, with consumption and investment expected to accelerate over the forecast horizon.

Forecast 2025: A welcome economic rebound - Economists forecast a 6.2% increase in housing starts in 2025 following declines in 2023 and 2024, attributing the rebound to lower interest rates and easier credit, which are expected to revitalize both residential and commercial construction sectors.

United States Economic Forecast Q2 2025 - Lower interest rates, inflation, and deregulation are expected to boost business investment and productivity growth, though a downside scenario warns of potential recession due to rising tariffs and fiscal austerity in late 2025.

dowidth.com

dowidth.com