A polycrisis occurs when multiple, interconnected economic challenges like inflation, supply chain disruptions, and geopolitical tensions converge, amplifying financial instability. In contrast, a debt spiral emerges when rising borrowing costs and mounting debt lead to a vicious cycle of increased interest payments and reduced fiscal flexibility. Explore the dynamics of polycrisis and debt spirals to understand their impact on global economic resilience.

Why it is important

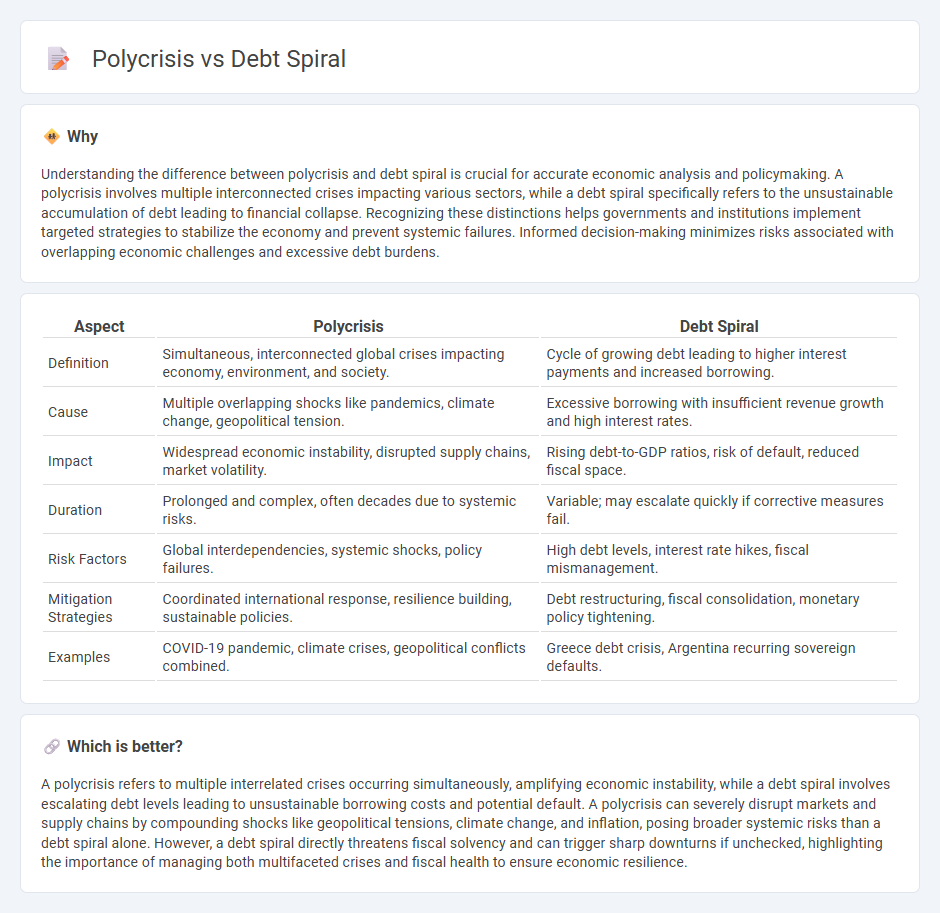

Understanding the difference between polycrisis and debt spiral is crucial for accurate economic analysis and policymaking. A polycrisis involves multiple interconnected crises impacting various sectors, while a debt spiral specifically refers to the unsustainable accumulation of debt leading to financial collapse. Recognizing these distinctions helps governments and institutions implement targeted strategies to stabilize the economy and prevent systemic failures. Informed decision-making minimizes risks associated with overlapping economic challenges and excessive debt burdens.

Comparison Table

| Aspect | Polycrisis | Debt Spiral |

|---|---|---|

| Definition | Simultaneous, interconnected global crises impacting economy, environment, and society. | Cycle of growing debt leading to higher interest payments and increased borrowing. |

| Cause | Multiple overlapping shocks like pandemics, climate change, geopolitical tension. | Excessive borrowing with insufficient revenue growth and high interest rates. |

| Impact | Widespread economic instability, disrupted supply chains, market volatility. | Rising debt-to-GDP ratios, risk of default, reduced fiscal space. |

| Duration | Prolonged and complex, often decades due to systemic risks. | Variable; may escalate quickly if corrective measures fail. |

| Risk Factors | Global interdependencies, systemic shocks, policy failures. | High debt levels, interest rate hikes, fiscal mismanagement. |

| Mitigation Strategies | Coordinated international response, resilience building, sustainable policies. | Debt restructuring, fiscal consolidation, monetary policy tightening. |

| Examples | COVID-19 pandemic, climate crises, geopolitical conflicts combined. | Greece debt crisis, Argentina recurring sovereign defaults. |

Which is better?

A polycrisis refers to multiple interrelated crises occurring simultaneously, amplifying economic instability, while a debt spiral involves escalating debt levels leading to unsustainable borrowing costs and potential default. A polycrisis can severely disrupt markets and supply chains by compounding shocks like geopolitical tensions, climate change, and inflation, posing broader systemic risks than a debt spiral alone. However, a debt spiral directly threatens fiscal solvency and can trigger sharp downturns if unchecked, highlighting the importance of managing both multifaceted crises and fiscal health to ensure economic resilience.

Connection

A polycrisis occurs when multiple global challenges, such as inflation, supply chain disruptions, and geopolitical tensions, simultaneously strain economies, exacerbating financial vulnerabilities. These compounded pressures can accelerate a debt spiral as governments and businesses increasingly borrow to manage deficits and maintain liquidity, leading to higher debt servicing costs. The resulting fiscal stress reduces economic growth potential and heightens the risk of default, creating a feedback loop that intensifies the polycrisis effects.

Key Terms

**Debt Spiral:**

A debt spiral occurs when a country or entity accumulates excessive debt, leading to rising interest payments that outpace economic growth and force further borrowing. This vicious cycle can trigger default risks, currency depreciation, and financial instability, severely impacting credit ratings and investor confidence. Explore deeper insights on debt spirals and their economic consequences to understand how they shape financial crises.

Interest Compounding

Debt spirals intensify as compounding interest exponentially increases debt obligations, making repayment increasingly unmanageable over time. Polycrisis scenarios amplify economic instability by intertwining multiple crises, where compounded interest aggravates fiscal pressures across sectors. Explore how interest compounding accelerates both debt spirals and polycrisis complexities for a deeper understanding.

Default Risk

A debt spiral intensifies default risk as rising interest payments consume more revenue, making it harder for borrowers to meet obligations and increasing the likelihood of default. In contrast, a polycrisis involves multiple simultaneous crises that compound financial instability, elevating default risk by disrupting economic and political stability across sectors. Explore deeper insights into how these phenomena influence default risk in global markets.

Source and External Links

What Is a Debt Spiral and How Do I Get Out? - This article explains how a debt spiral occurs when individuals continuously fall deeper into debt despite keeping up with payments, often due to unexpected expenses or income drops.

America's Debt "Death Spiral" Gives Us $1 Trillion Reasons to Act Now - This article discusses how the U.S. faces a debt crisis similar to a personal debt spiral, where high interest rates on rapidly increasing debt could lead to unsustainable financial situations.

The Debt Spiral: What it Is and How to Escape It - This article defines a debt spiral as a situation where an individual, company, or country accumulates debt over time, often due to poor credit management, and provides strategies for escaping it.

dowidth.com

dowidth.com