The shift from a dollar-dominated global economy toward alternative monetary systems, such as the gold standard, reflects growing concerns over currency stability and national sovereignty. Countries pursuing de-dollarization aim to reduce dependence on the US dollar by adopting assets like gold to back their currencies, promoting long-term economic security and inflation control. Explore the implications of this transition and how it could reshape global financial dynamics.

Why it is important

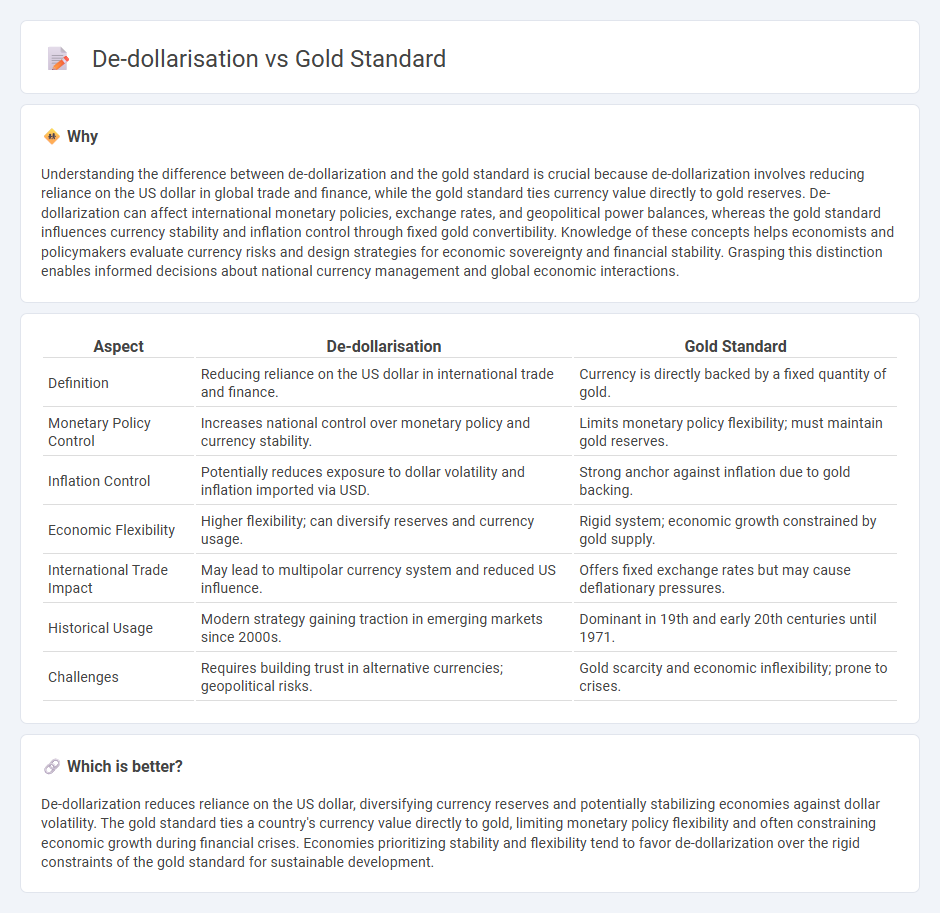

Understanding the difference between de-dollarization and the gold standard is crucial because de-dollarization involves reducing reliance on the US dollar in global trade and finance, while the gold standard ties currency value directly to gold reserves. De-dollarization can affect international monetary policies, exchange rates, and geopolitical power balances, whereas the gold standard influences currency stability and inflation control through fixed gold convertibility. Knowledge of these concepts helps economists and policymakers evaluate currency risks and design strategies for economic sovereignty and financial stability. Grasping this distinction enables informed decisions about national currency management and global economic interactions.

Comparison Table

| Aspect | De-dollarisation | Gold Standard |

|---|---|---|

| Definition | Reducing reliance on the US dollar in international trade and finance. | Currency is directly backed by a fixed quantity of gold. |

| Monetary Policy Control | Increases national control over monetary policy and currency stability. | Limits monetary policy flexibility; must maintain gold reserves. |

| Inflation Control | Potentially reduces exposure to dollar volatility and inflation imported via USD. | Strong anchor against inflation due to gold backing. |

| Economic Flexibility | Higher flexibility; can diversify reserves and currency usage. | Rigid system; economic growth constrained by gold supply. |

| International Trade Impact | May lead to multipolar currency system and reduced US influence. | Offers fixed exchange rates but may cause deflationary pressures. |

| Historical Usage | Modern strategy gaining traction in emerging markets since 2000s. | Dominant in 19th and early 20th centuries until 1971. |

| Challenges | Requires building trust in alternative currencies; geopolitical risks. | Gold scarcity and economic inflexibility; prone to crises. |

Which is better?

De-dollarization reduces reliance on the US dollar, diversifying currency reserves and potentially stabilizing economies against dollar volatility. The gold standard ties a country's currency value directly to gold, limiting monetary policy flexibility and often constraining economic growth during financial crises. Economies prioritizing stability and flexibility tend to favor de-dollarization over the rigid constraints of the gold standard for sustainable development.

Connection

De-dollarisation involves reducing reliance on the US dollar as the primary reserve currency, often by increasing gold reserves to back national currencies. The gold standard directly links currency value to a specific amount of gold, providing monetary stability and limiting inflation. Both strategies aim to strengthen economic sovereignty and limit exposure to foreign exchange volatility.

Key Terms

Reserve Currency

The gold standard historically ensured currency stability by pegging national currencies to a fixed quantity of gold, maintaining trust and limiting inflation, while de-dollarisation seeks to reduce dependency on the US dollar as the global reserve currency by promoting alternative currencies or assets. Central banks and international institutions are increasingly exploring diversification strategies and digital currencies to mitigate risks associated with dollar dominance. Explore the evolving dynamics of reserve currencies and their impact on international finance for a comprehensive understanding.

Fixed Exchange Rate

The gold standard anchors currency value directly to a specific amount of gold, ensuring a fixed exchange rate that limits currency fluctuation and promotes international trade stability. De-dollarisation involves countries reducing reliance on the US dollar in global transactions to gain monetary sovereignty, potentially leading to diversified reserve currencies but also challenging established fixed exchange rate frameworks. Explore detailed analyses on how fixed exchange rates are impacted by shifts from the gold standard to modern de-dollarisation strategies.

Monetary Sovereignty

The gold standard anchors currency value to a fixed quantity of gold, limiting central banks' monetary policy flexibility but ensuring price stability and inflation control. De-dollarisation promotes monetary sovereignty by reducing reliance on the US dollar in international trade and reserves, enabling countries to regain control over exchange rates and implement independent monetary policies. Explore how these monetary frameworks impact national economic autonomy and financial stability in greater detail.

Source and External Links

What is the Gold Standard System? - The gold standard is a monetary system where a country's currency has a value directly linked to gold, limiting fiat money issuance to gold reserves and allowing international settlements in gold to correct balance of payments automatically.

Gold Standard - Econlib - The gold standard commits countries to fix their currency value to a specified amount of gold, allowing free conversion between money and gold, leading to long periods of economic growth and fixed exchange rates.

Gold standard - A gold standard fixes the economic unit of account to gold and offers benefits such as price stability, reduced currency crises, automatic adjustment of international imbalances, and protection against hyperinflation.

dowidth.com

dowidth.com