Carbon border adjustment mechanisms (CBAM) aim to level the playing field by imposing tariffs on imported goods based on their carbon emissions, reducing carbon leakage where production shifts to regions with lax climate policies. These adjustments protect domestic industries from unfair competition and incentivize global emission reductions by encouraging cleaner production worldwide. Explore how CBAM strategies compare with traditional carbon leakage prevention methods to enhance sustainable economic growth.

Why it is important

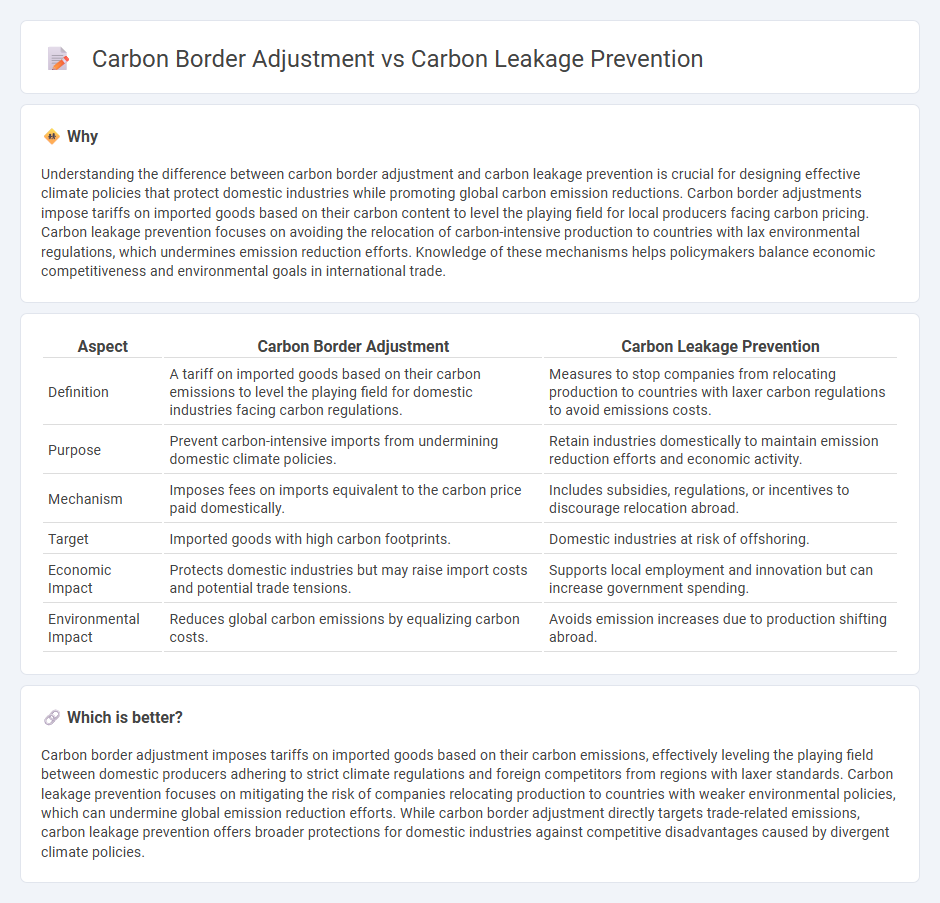

Understanding the difference between carbon border adjustment and carbon leakage prevention is crucial for designing effective climate policies that protect domestic industries while promoting global carbon emission reductions. Carbon border adjustments impose tariffs on imported goods based on their carbon content to level the playing field for local producers facing carbon pricing. Carbon leakage prevention focuses on avoiding the relocation of carbon-intensive production to countries with lax environmental regulations, which undermines emission reduction efforts. Knowledge of these mechanisms helps policymakers balance economic competitiveness and environmental goals in international trade.

Comparison Table

| Aspect | Carbon Border Adjustment | Carbon Leakage Prevention |

|---|---|---|

| Definition | A tariff on imported goods based on their carbon emissions to level the playing field for domestic industries facing carbon regulations. | Measures to stop companies from relocating production to countries with laxer carbon regulations to avoid emissions costs. |

| Purpose | Prevent carbon-intensive imports from undermining domestic climate policies. | Retain industries domestically to maintain emission reduction efforts and economic activity. |

| Mechanism | Imposes fees on imports equivalent to the carbon price paid domestically. | Includes subsidies, regulations, or incentives to discourage relocation abroad. |

| Target | Imported goods with high carbon footprints. | Domestic industries at risk of offshoring. |

| Economic Impact | Protects domestic industries but may raise import costs and potential trade tensions. | Supports local employment and innovation but can increase government spending. |

| Environmental Impact | Reduces global carbon emissions by equalizing carbon costs. | Avoids emission increases due to production shifting abroad. |

Which is better?

Carbon border adjustment imposes tariffs on imported goods based on their carbon emissions, effectively leveling the playing field between domestic producers adhering to strict climate regulations and foreign competitors from regions with laxer standards. Carbon leakage prevention focuses on mitigating the risk of companies relocating production to countries with weaker environmental policies, which can undermine global emission reduction efforts. While carbon border adjustment directly targets trade-related emissions, carbon leakage prevention offers broader protections for domestic industries against competitive disadvantages caused by divergent climate policies.

Connection

Carbon border adjustment mechanisms (CBAM) aim to level the playing field by imposing carbon costs on imports from countries with less stringent climate policies, directly addressing carbon leakage risks. Preventing carbon leakage ensures that domestic emissions reductions are not offset by increased emissions abroad due to shifting production. Together, CBAM and carbon leakage prevention promote global emissions accountability and support the transition to a low-carbon economy.

Key Terms

Emissions Trading System (ETS)

Carbon leakage prevention aims to avoid the relocation of emissions-intensive industries by implementing measures within the Emissions Trading System (ETS) like free allowance allocations and benchmarking. Carbon Border Adjustment Mechanisms (CBAM) impose costs on imported goods equivalent to the carbon price under the ETS, leveling the playing field and preventing competitive disadvantages for domestic industries. Explore how combining ETS strategies with CBAM enhances global carbon leakage mitigation efforts.

Carbon Tariff

Carbon leakage prevention aims to stop companies from relocating production to countries with lax emission regulations, while Carbon Border Adjustment (CBA) imposes tariffs on imported goods based on their carbon content to equalize costs between domestic and foreign producers. The Carbon Tariff under CBA serves as a financial mechanism to minimize carbon leakage by ensuring imports face equivalent carbon pricing as locally produced goods, thereby protecting domestic industries and promoting global emissions reduction. Explore how Carbon Tariffs are shaping international climate policy and trade frameworks for a deeper understanding.

Competitiveness

Carbon leakage prevention strategies aim to protect domestic industries from losing competitiveness due to stringent climate regulations by implementing measures such as free emission allowances and sectoral agreements. Carbon Border Adjustment Mechanisms (CBAM) impose tariffs on imported goods based on their carbon content, leveling the playing field and incentivizing cleaner production methods globally. Explore further to understand the economic impacts and policy effectiveness in maintaining industrial competitiveness.

Source and External Links

Carbon Leakage Prevention - Term - Border Carbon Adjustments (BCAs) level the playing field by applying a carbon price to imports from regions with weaker climate policies, while free allocation of emission allowances in emissions trading systems and international cooperation to harmonize policies across countries are also key strategies to prevent businesses from relocating polluting activities to avoid stricter regulations.

Addressing Carbon Leakage: A toolkit - Jurisdictions with Emissions Trading Systems (ETS) use cost-containment measures, such as higher emissions baselines for at-risk sectors and conditional tax exemptions, to reduce the risk of carbon leakage without undermining domestic competitiveness.

Carbon Leakage: What Is It and How Is It Shaping Climate - Targeted exemptions and free allocation of emission credits to vulnerable sectors--such as those on the EU ETS carbon leakage list--help firms remain competitive with foreign producers not subject to carbon costs, directly reducing incentives to relocate production.

dowidth.com

dowidth.com