The carbon border tax imposes fees on imported goods based on their carbon emissions to prevent carbon leakage and protect domestic industries, while cap and trade establishes a market for carbon permits, allowing companies to buy and sell emission allowances under a government-imposed limit. Both policies aim to reduce greenhouse gas emissions but differ in approach, with the carbon border tax focusing on trade measures and cap and trade emphasizing market-based incentives. Explore detailed comparisons to understand their impacts on global economies and climate goals.

Why it is important

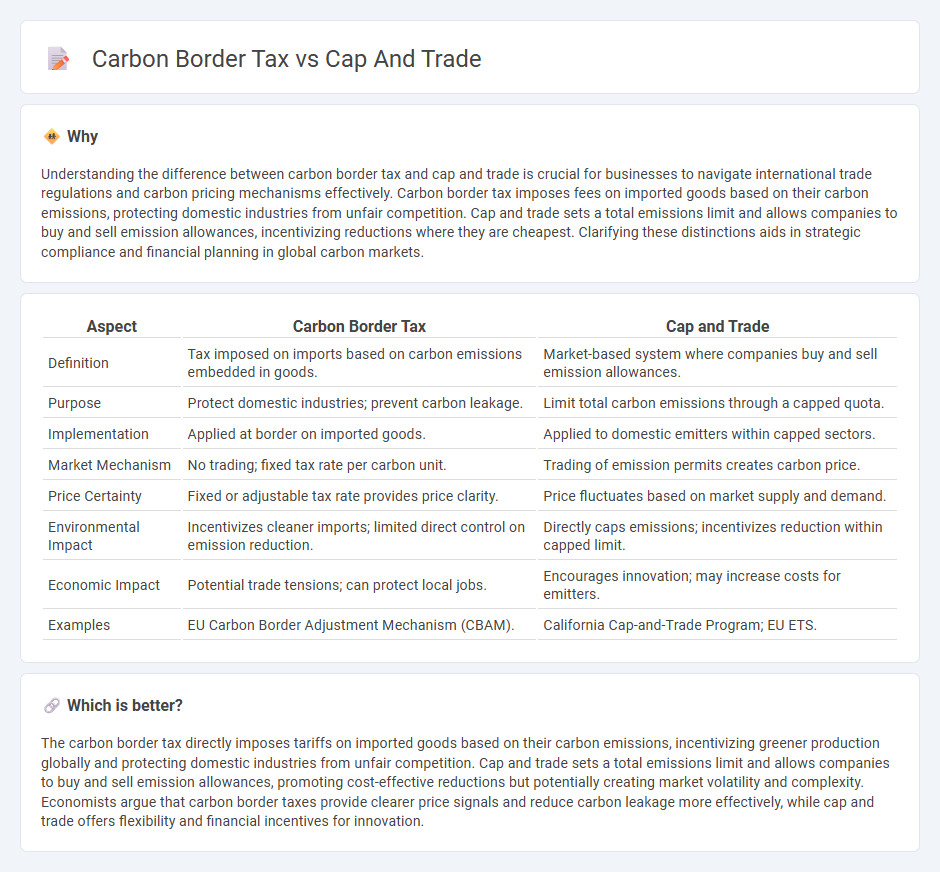

Understanding the difference between carbon border tax and cap and trade is crucial for businesses to navigate international trade regulations and carbon pricing mechanisms effectively. Carbon border tax imposes fees on imported goods based on their carbon emissions, protecting domestic industries from unfair competition. Cap and trade sets a total emissions limit and allows companies to buy and sell emission allowances, incentivizing reductions where they are cheapest. Clarifying these distinctions aids in strategic compliance and financial planning in global carbon markets.

Comparison Table

| Aspect | Carbon Border Tax | Cap and Trade |

|---|---|---|

| Definition | Tax imposed on imports based on carbon emissions embedded in goods. | Market-based system where companies buy and sell emission allowances. |

| Purpose | Protect domestic industries; prevent carbon leakage. | Limit total carbon emissions through a capped quota. |

| Implementation | Applied at border on imported goods. | Applied to domestic emitters within capped sectors. |

| Market Mechanism | No trading; fixed tax rate per carbon unit. | Trading of emission permits creates carbon price. |

| Price Certainty | Fixed or adjustable tax rate provides price clarity. | Price fluctuates based on market supply and demand. |

| Environmental Impact | Incentivizes cleaner imports; limited direct control on emission reduction. | Directly caps emissions; incentivizes reduction within capped limit. |

| Economic Impact | Potential trade tensions; can protect local jobs. | Encourages innovation; may increase costs for emitters. |

| Examples | EU Carbon Border Adjustment Mechanism (CBAM). | California Cap-and-Trade Program; EU ETS. |

Which is better?

The carbon border tax directly imposes tariffs on imported goods based on their carbon emissions, incentivizing greener production globally and protecting domestic industries from unfair competition. Cap and trade sets a total emissions limit and allows companies to buy and sell emission allowances, promoting cost-effective reductions but potentially creating market volatility and complexity. Economists argue that carbon border taxes provide clearer price signals and reduce carbon leakage more effectively, while cap and trade offers flexibility and financial incentives for innovation.

Connection

Carbon border tax and cap and trade systems are interconnected climate policies designed to reduce greenhouse gas emissions by incentivizing cleaner production methods. Cap and trade establishes a market-driven approach by setting emission limits and allowing companies to buy or sell allowances, while a carbon border tax levels the playing field by imposing fees on imported goods based on their carbon intensity. Both mechanisms aim to prevent carbon leakage and encourage global emission reductions by integrating environmental costs into economic decisions.

Key Terms

Emissions Allowance

Carbon cap and trade systems allocate emissions allowances that companies can trade, creating a financial incentive to reduce greenhouse gas emissions by setting a firm emissions limit. In contrast, a carbon border tax imposes a fee on imported goods based on their carbon content, addressing emissions embedded in overseas production without directly involving emissions allowances. Explore more to understand how these mechanisms impact global carbon markets and trade policies.

Carbon Leakage

Cap and trade systems set a maximum emissions limit, allowing companies to trade permits while incentivizing reductions, but risk carbon leakage when production shifts to regions with less stringent rules. Carbon border tax imposes fees on imports from countries with weaker climate policies to level the playing field and prevent carbon leakage by discouraging offshoring emissions. Explore the effectiveness and implementation challenges of both approaches to better understand their impact on global carbon leakage mitigation.

Border Adjustment

Cap and trade systems set a limit on total emissions and allow companies to buy and sell emission allowances, incentivizing reductions within a defined boundary, while carbon border taxes impose fees on imported goods based on their carbon footprint to prevent carbon leakage and ensure fair competition. Border adjustment mechanisms in both policies aim to equalize costs between domestic producers and foreign exporters by accounting for carbon content, but carbon border taxes directly target imports to protect local industries from unfair competition. Explore how these border adjustments impact global trade dynamics and climate policies.

Source and External Links

Cap and Trade Basics - C2ES - Cap and trade is a market-based approach to reduce emissions cost-effectively by setting a cap on emissions and allowing trading of allowances, providing emissions certainty but leaving carbon prices to market forces.

How cap and trade works - Environmental Defense Fund - Cap and trade sets a pollution limit and creates a market where companies that reduce emissions faster can sell allowances, encouraging flexibility, innovation, and earlier pollution cuts.

Cap-and-trade programme | UNFCCC - An Emission Trading System (ETS) or cap and trade sets a limit on greenhouse gas emissions and allows entities to buy or sell permits, with caps and permit allocations determined according to governmental policies and emission targets.

dowidth.com

dowidth.com