Shadow bailouts involve indirect financial support to banks through backdoor mechanisms like guarantees and liquidity provisions, minimizing public exposure while stabilizing the economy. Bank nationalization entails the government taking ownership of failing banks to restore confidence and maintain systemic stability during severe financial crises. Explore the nuances and implications of shadow bailouts versus bank nationalization for a deeper understanding of economic interventions.

Why it is important

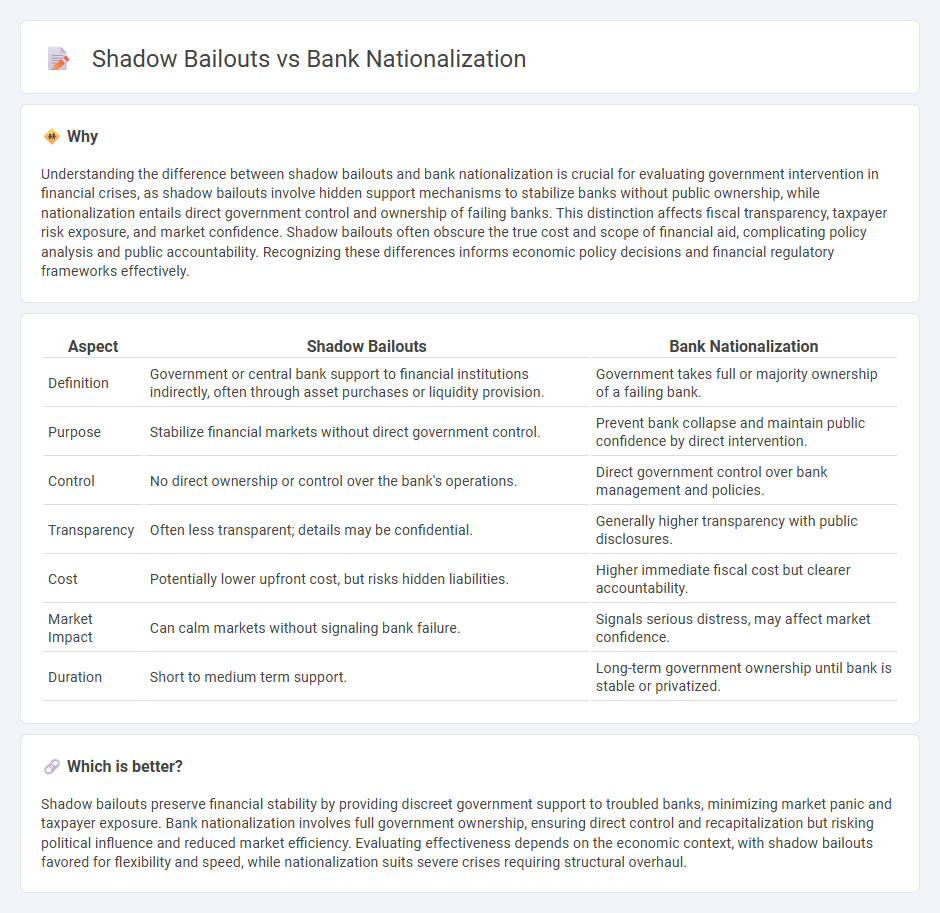

Understanding the difference between shadow bailouts and bank nationalization is crucial for evaluating government intervention in financial crises, as shadow bailouts involve hidden support mechanisms to stabilize banks without public ownership, while nationalization entails direct government control and ownership of failing banks. This distinction affects fiscal transparency, taxpayer risk exposure, and market confidence. Shadow bailouts often obscure the true cost and scope of financial aid, complicating policy analysis and public accountability. Recognizing these differences informs economic policy decisions and financial regulatory frameworks effectively.

Comparison Table

| Aspect | Shadow Bailouts | Bank Nationalization |

|---|---|---|

| Definition | Government or central bank support to financial institutions indirectly, often through asset purchases or liquidity provision. | Government takes full or majority ownership of a failing bank. |

| Purpose | Stabilize financial markets without direct government control. | Prevent bank collapse and maintain public confidence by direct intervention. |

| Control | No direct ownership or control over the bank's operations. | Direct government control over bank management and policies. |

| Transparency | Often less transparent; details may be confidential. | Generally higher transparency with public disclosures. |

| Cost | Potentially lower upfront cost, but risks hidden liabilities. | Higher immediate fiscal cost but clearer accountability. |

| Market Impact | Can calm markets without signaling bank failure. | Signals serious distress, may affect market confidence. |

| Duration | Short to medium term support. | Long-term government ownership until bank is stable or privatized. |

Which is better?

Shadow bailouts preserve financial stability by providing discreet government support to troubled banks, minimizing market panic and taxpayer exposure. Bank nationalization involves full government ownership, ensuring direct control and recapitalization but risking political influence and reduced market efficiency. Evaluating effectiveness depends on the economic context, with shadow bailouts favored for flexibility and speed, while nationalization suits severe crises requiring structural overhaul.

Connection

Shadow bailouts occur when governments or central banks provide financial support to struggling banks off the official balance sheets, minimizing public awareness, while bank nationalization involves the outright government takeover of failing financial institutions. Both mechanisms aim to stabilize the economy during banking crises by preventing systemic collapse and preserving confidence in the financial system. Shadow bailouts can serve as a precursor to nationalization if the temporary support fails to restore bank solvency, indicating a progression from covert assistance to direct government ownership.

Key Terms

Ownership Structure

Bank nationalization involves the government taking full ownership and control of financial institutions to stabilize the banking sector, often during financial crises. Shadow bailouts refer to implicit or indirect government support without formal ownership transfer, typically through emergency lending or asset purchases, maintaining private control while mitigating systemic risks. Explore deeper insights on how these mechanisms influence financial stability and public accountability.

Regulatory Oversight

Bank nationalization involves direct government ownership to stabilize failing banks, ensuring comprehensive regulatory oversight and transparency. Shadow bailouts refer to indirect government support through unconventional measures like asset purchases or liquidity provisions, often implemented with less regulatory scrutiny. Explore the nuances of regulatory oversight in bank nationalization versus shadow bailouts for a deeper understanding of financial stability mechanisms.

Moral Hazard

Bank nationalization involves government takeover of failing banks to stabilize the financial system, reducing immediate systemic risk but potentially encouraging moral hazard by signaling implicit safety nets. Shadow bailouts refer to covert government or central bank interventions, such as capital injections or asset purchases, which prevent bank failures without formal recognition, also fostering moral hazard through lack of transparency. Explore further to understand how these mechanisms impact financial stability and regulatory frameworks.

Source and External Links

Nationalization of Banks: History of Indian Banks - Finology Blog - Bank nationalization refers to the transfer of ownership and control of banks from private entities to the government, with Indian history noting major nationalizations in 1955 and 1969 under Indira Gandhi, involving a compensation process to shareholders and subsequent government governance under the Reserve Bank of India.

Permanently Nationalize the Banks During the Next Crisis - Bank nationalization is commonly used during financial crises where the government takes ownership of failing banks to maintain a public banking sector, intended to serve public needs through a centralized managing agency or holding company.

The case for and against bank nationalisation - CEPR - Nationalization of banks can serve as a tool to stabilize the financial system by addressing the "too big to fail" problem, cleansing bad assets, restoring market discipline, and facilitating reform, but it also entails government ownership risks and requires careful implementation.

dowidth.com

dowidth.com