Scrap metal arbitrage exploits price differences in recyclable metals across regional markets, generating profit through buying low and selling high. Tax arbitrage involves shifting income or expenses to jurisdictions with favorable tax rates, minimizing liabilities and maximizing after-tax gains. Explore the distinct strategies and implications of both arbitrage forms in the modern economy.

Why it is important

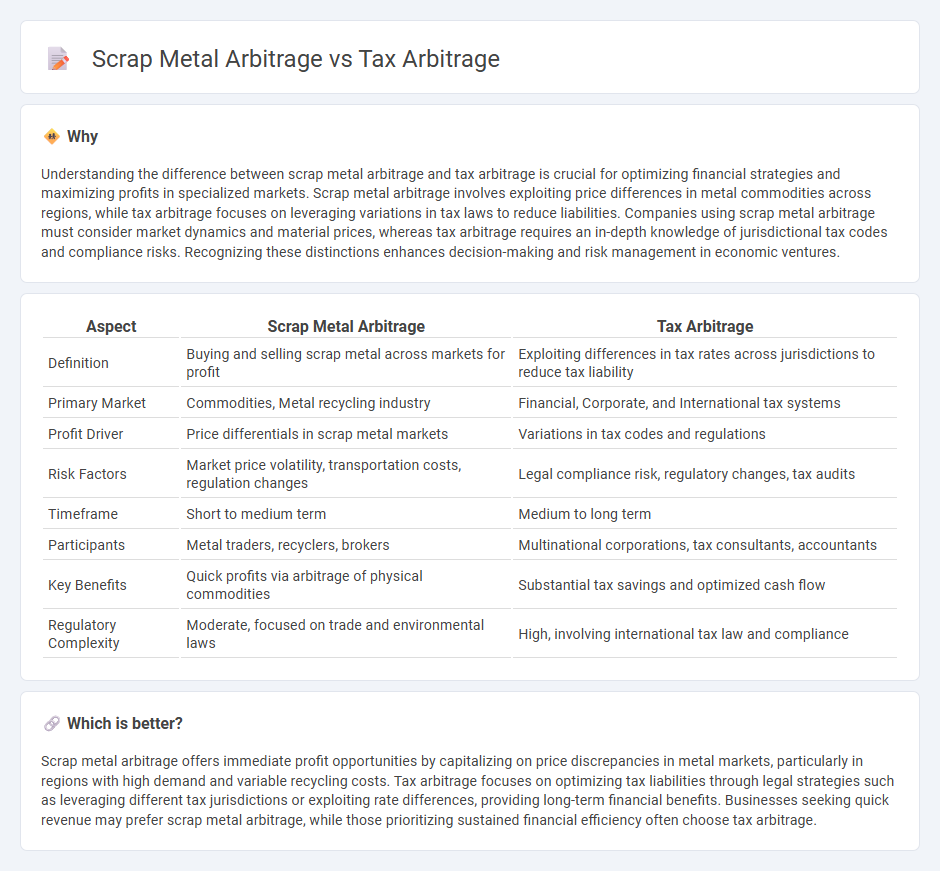

Understanding the difference between scrap metal arbitrage and tax arbitrage is crucial for optimizing financial strategies and maximizing profits in specialized markets. Scrap metal arbitrage involves exploiting price differences in metal commodities across regions, while tax arbitrage focuses on leveraging variations in tax laws to reduce liabilities. Companies using scrap metal arbitrage must consider market dynamics and material prices, whereas tax arbitrage requires an in-depth knowledge of jurisdictional tax codes and compliance risks. Recognizing these distinctions enhances decision-making and risk management in economic ventures.

Comparison Table

| Aspect | Scrap Metal Arbitrage | Tax Arbitrage |

|---|---|---|

| Definition | Buying and selling scrap metal across markets for profit | Exploiting differences in tax rates across jurisdictions to reduce tax liability |

| Primary Market | Commodities, Metal recycling industry | Financial, Corporate, and International tax systems |

| Profit Driver | Price differentials in scrap metal markets | Variations in tax codes and regulations |

| Risk Factors | Market price volatility, transportation costs, regulation changes | Legal compliance risk, regulatory changes, tax audits |

| Timeframe | Short to medium term | Medium to long term |

| Participants | Metal traders, recyclers, brokers | Multinational corporations, tax consultants, accountants |

| Key Benefits | Quick profits via arbitrage of physical commodities | Substantial tax savings and optimized cash flow |

| Regulatory Complexity | Moderate, focused on trade and environmental laws | High, involving international tax law and compliance |

Which is better?

Scrap metal arbitrage offers immediate profit opportunities by capitalizing on price discrepancies in metal markets, particularly in regions with high demand and variable recycling costs. Tax arbitrage focuses on optimizing tax liabilities through legal strategies such as leveraging different tax jurisdictions or exploiting rate differences, providing long-term financial benefits. Businesses seeking quick revenue may prefer scrap metal arbitrage, while those prioritizing sustained financial efficiency often choose tax arbitrage.

Connection

Scrap metal arbitrage and tax arbitrage intersect through the strategic movement of assets and transactions across borders to capitalize on price differences and favorable tax regulations. Companies engaged in scrap metal arbitrage often leverage tax arbitrage by optimizing tax liabilities via jurisdictions with lenient tax policies, maximizing overall profitability. This interconnected approach enables businesses to reduce operational costs while exploiting global market inefficiencies in both commodity prices and tax frameworks.

Key Terms

Differential Pricing

Tax arbitrage exploits differences in tax rates across jurisdictions to maximize after-tax returns, relying heavily on regulatory frameworks and legal loopholes. Scrap metal arbitrage leverages price disparities in raw material markets across regions, capitalizing on supply and demand imbalances and transportation costs. Explore the detailed mechanisms and strategic implications of these arbitrage types to enhance your financial acumen.

Regulatory Exploitation

Tax arbitrage leverages differences in tax laws across jurisdictions to minimize taxable income, exploiting loopholes or incentives for financial gain. Scrap metal arbitrage capitalizes on price discrepancies in precious and base metals markets, navigating regulatory frameworks governing trade, export restrictions, and environmental compliance. Explore the nuances of regulatory exploitation in these arbitrage strategies to understand their economic and legal impacts.

Profit Margin

Tax arbitrage exploits differences in tax rates to enhance profit margins by strategically reallocating income or expenses, often yielding significant tax savings and increasing net earnings. Scrap metal arbitrage involves buying scrap metals from low-cost sources and selling them in markets with higher demand or prices, capitalizing on price discrepancies to maximize profit margins in the commodities sector. Discover detailed strategies and comparative analyses to boost profitability in both arbitrage types.

Source and External Links

Tax Arbitrage: Definition, Types, and Benefits - Tax arbitrage is the practice of exploiting differences in tax laws or rates in various jurisdictions to reduce tax liability, including strategies like international tax arbitrage and municipal bond arbitrage, which can increase investment returns and improve cash flow while requiring careful legal compliance.

What are the Forms of Tax Arbitrage and How it Works - Tax arbitrage involves profiting from discrepancies in the taxation of different income types or capital gains, often by recognizing revenues in low-tax areas and expenses in high-tax areas, thereby reducing overall tax burdens.

Arbitrage - NABL - In the context of tax-exempt bonds, tax arbitrage means borrowing at a lower tax-exempt interest rate and investing proceeds in taxable securities with higher yields, with regulations in place to limit profit from such differences under Section 148 of the Internal Revenue Code.

dowidth.com

dowidth.com