Greenflation describes the rise in prices caused by the increased costs of environmentally friendly goods and technologies driven by global decarbonization efforts. Environmental taxation imposes levies on carbon emissions and pollution to incentivize sustainable practices while generating government revenue for green initiatives. Explore how these interconnected economic factors shape the transition to a low-carbon future.

Why it is important

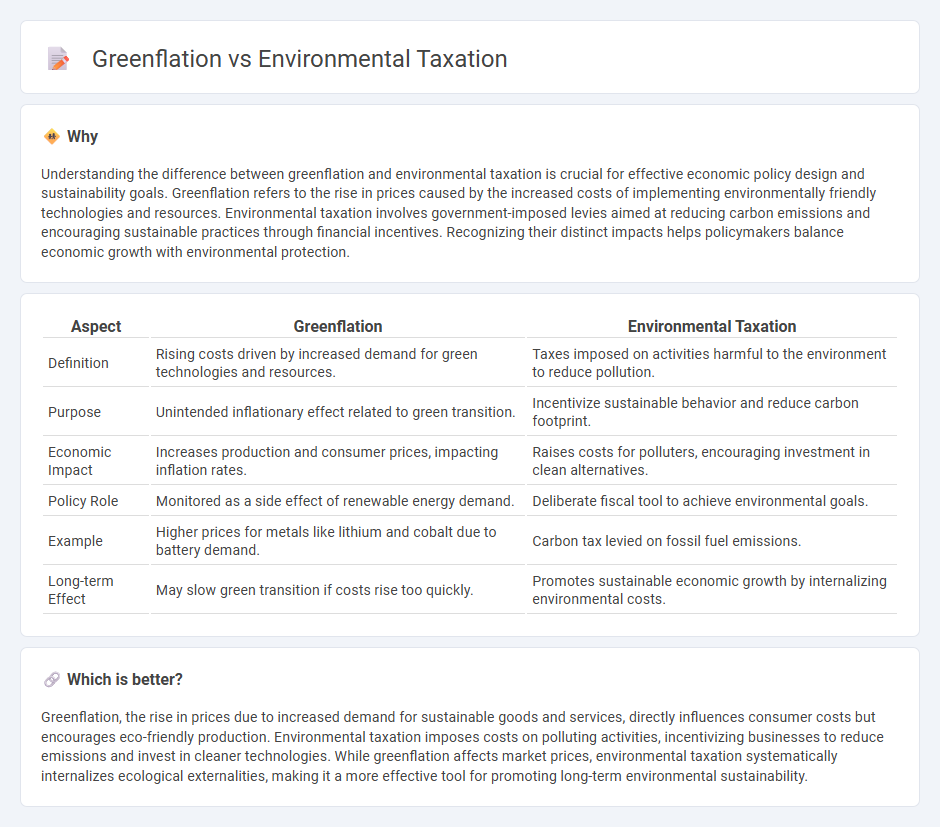

Understanding the difference between greenflation and environmental taxation is crucial for effective economic policy design and sustainability goals. Greenflation refers to the rise in prices caused by the increased costs of implementing environmentally friendly technologies and resources. Environmental taxation involves government-imposed levies aimed at reducing carbon emissions and encouraging sustainable practices through financial incentives. Recognizing their distinct impacts helps policymakers balance economic growth with environmental protection.

Comparison Table

| Aspect | Greenflation | Environmental Taxation |

|---|---|---|

| Definition | Rising costs driven by increased demand for green technologies and resources. | Taxes imposed on activities harmful to the environment to reduce pollution. |

| Purpose | Unintended inflationary effect related to green transition. | Incentivize sustainable behavior and reduce carbon footprint. |

| Economic Impact | Increases production and consumer prices, impacting inflation rates. | Raises costs for polluters, encouraging investment in clean alternatives. |

| Policy Role | Monitored as a side effect of renewable energy demand. | Deliberate fiscal tool to achieve environmental goals. |

| Example | Higher prices for metals like lithium and cobalt due to battery demand. | Carbon tax levied on fossil fuel emissions. |

| Long-term Effect | May slow green transition if costs rise too quickly. | Promotes sustainable economic growth by internalizing environmental costs. |

Which is better?

Greenflation, the rise in prices due to increased demand for sustainable goods and services, directly influences consumer costs but encourages eco-friendly production. Environmental taxation imposes costs on polluting activities, incentivizing businesses to reduce emissions and invest in cleaner technologies. While greenflation affects market prices, environmental taxation systematically internalizes ecological externalities, making it a more effective tool for promoting long-term environmental sustainability.

Connection

Greenflation arises as increased demand for eco-friendly materials and technologies drives up costs, directly impacting the prices of goods and services in the economy. Environmental taxation incentivizes reduced carbon emissions and resource consumption, potentially raising production expenses that contribute to greenflation. The interplay between higher green energy adoption costs and environmental taxes creates a feedback loop influencing inflationary pressures within the green economy transition.

Key Terms

Carbon Tax

Carbon tax serves as a pivotal environmental taxation tool designed to reduce greenhouse gas emissions by assigning a cost to carbon dioxide output. Greenflation refers to the inflationary pressures experienced in an economy as the transition to greener technologies and compliance with carbon taxes increases operational costs. Explore the dynamics between carbon tax policies and greenflation to understand their impact on sustainable economic growth.

Emissions Trading

Environmental taxation and greenflation are critical dynamics in carbon pricing mechanisms, especially when analyzing Emissions Trading Systems (ETS). Environmental taxation directly imposes costs on polluters based on emission levels, incentivizing reductions, whereas greenflation reflects the inflationary pressure on green goods and services due to increased regulatory costs and demand shifts caused by environmental policies. Explore deeper insights into how Emissions Trading uniquely balances economic and ecological goals by understanding market-based incentives and price signals.

Renewable Energy Costs

Environmental taxation directly influences the cost structure of renewable energy by internalizing carbon emissions, thereby promoting cleaner energy sources. Greenflation, characterized by rising prices in green technologies and raw materials, elevates renewable energy costs, potentially slowing the energy transition. Explore more to understand the nuanced impact of these factors on the future of sustainable energy.

Source and External Links

Understanding environmental taxation - European Parliament - Environmental taxation aims to factor environmental damage (negative externalities) into prices to steer production and consumption toward more eco-friendly choices, addressing climate change, pollution, and resource depletion.

Environmental Taxation - Resources for the Future - Environmental taxes act as corrective (Pigouvian) taxes, incentivizing lower pollution emissions while also raising revenue, and can be designed to offset other taxes for economic efficiency.

Environmental tax - OECD - Environmental taxes are levied on energy, transport, emissions, waste, and natural resources, and their characteristics include defined tax bases, rates, and exemptions, measured as a percentage of GDP and total tax revenue.

dowidth.com

dowidth.com