Short-term rental arbitrage involves leasing properties and renting them out on platforms like Airbnb to generate consistent cash flow, leveraging occupancy rates and location demand. Wholesaling real estate focuses on securing contracts to purchase properties below market value and then selling those contracts to investors for a profit, emphasizing speed and volume. Explore the key differences and profitability factors between these two strategies to determine the best fit for your investment goals.

Why it is important

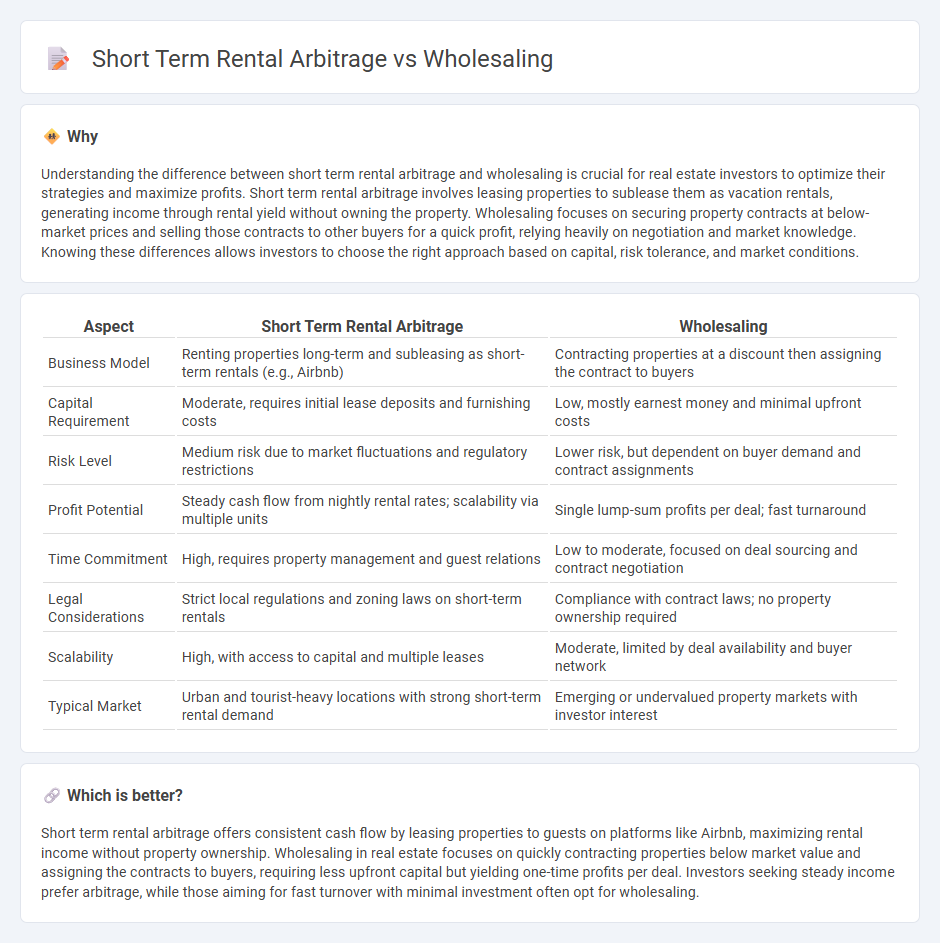

Understanding the difference between short term rental arbitrage and wholesaling is crucial for real estate investors to optimize their strategies and maximize profits. Short term rental arbitrage involves leasing properties to sublease them as vacation rentals, generating income through rental yield without owning the property. Wholesaling focuses on securing property contracts at below-market prices and selling those contracts to other buyers for a quick profit, relying heavily on negotiation and market knowledge. Knowing these differences allows investors to choose the right approach based on capital, risk tolerance, and market conditions.

Comparison Table

| Aspect | Short Term Rental Arbitrage | Wholesaling |

|---|---|---|

| Business Model | Renting properties long-term and subleasing as short-term rentals (e.g., Airbnb) | Contracting properties at a discount then assigning the contract to buyers |

| Capital Requirement | Moderate, requires initial lease deposits and furnishing costs | Low, mostly earnest money and minimal upfront costs |

| Risk Level | Medium risk due to market fluctuations and regulatory restrictions | Lower risk, but dependent on buyer demand and contract assignments |

| Profit Potential | Steady cash flow from nightly rental rates; scalability via multiple units | Single lump-sum profits per deal; fast turnaround |

| Time Commitment | High, requires property management and guest relations | Low to moderate, focused on deal sourcing and contract negotiation |

| Legal Considerations | Strict local regulations and zoning laws on short-term rentals | Compliance with contract laws; no property ownership required |

| Scalability | High, with access to capital and multiple leases | Moderate, limited by deal availability and buyer network |

| Typical Market | Urban and tourist-heavy locations with strong short-term rental demand | Emerging or undervalued property markets with investor interest |

Which is better?

Short term rental arbitrage offers consistent cash flow by leasing properties to guests on platforms like Airbnb, maximizing rental income without property ownership. Wholesaling in real estate focuses on quickly contracting properties below market value and assigning the contracts to buyers, requiring less upfront capital but yielding one-time profits per deal. Investors seeking steady income prefer arbitrage, while those aiming for fast turnover with minimal investment often opt for wholesaling.

Connection

Short term rental arbitrage and wholesaling intersect through their focus on maximizing real estate profit margins without significant capital investment. Both strategies rely on identifying undervalued properties--wholesalers secure contracts to sell properties quickly, while arbitrageurs lease these properties to sublet as short term rentals for higher income. Leveraging market insights and negotiation skills is crucial in both models to capitalize on fast-paced real estate opportunities.

Key Terms

Assignment Contract

Assignment contracts in wholesaling allow investors to secure property rights temporarily and transfer them to end buyers for a fee, facilitating quick, low-capital transactions. Short term rental arbitrage typically involves leasing properties with the owner's consent to sublet on platforms like Airbnb, generating rental income rather than transferring contracts. Explore deeper insights on how assignment contracts strategically impact investment approaches and profitability.

Lease Agreement

Wholesaling real estate involves assigning purchase contracts to investors without taking ownership, typically requiring simple or no long-term lease agreements, while short-term rental arbitrage depends heavily on lease agreements that permit subleasing and short-term rentals compliant with local laws. Wholesaling minimizes landlord obligations, whereas successful short-term rental arbitrage requires detailed lease clauses addressing occupancy limits, maintenance responsibilities, and rental platform permissions. Explore the nuances of lease agreements in these investment strategies to understand legal protections and maximize profitability.

Cash Flow

Wholesaling real estate generates cash flow through quick property flips by assigning contracts to buyers for a fee, often requiring minimal upfront investment but yielding less recurring income. Short-term rental arbitrage leverages leased properties to create steady cash flow from nightly rentals, benefiting from dynamic pricing and longer occupancy periods. Discover how each strategy can maximize your cash flow potential in real estate investments.

Source and External Links

Wholesaling - Wikipedia - Wholesaling is the sale of goods in large quantities, usually directly from manufacturers, to retailers, businesses, or other wholesalers, rather than to end consumers, often at a discounted price.

Wholesale real estate: A beginner's guide | Rocket Mortgage - In real estate, wholesaling involves signing a contract to purchase a property and then selling that contract to an investor for a profit without ever owning the property.

Retailing & Wholesaling - Food Markets & Prices - ERS USDA - Food wholesaling refers to assembling, storing, and transporting food products to customers such as restaurants and grocery stores, with specialized distributors serving different segments of the food service industry.

dowidth.com

dowidth.com