Leaseback programs and sale-leaseback agreements offer strategic benefits in real estate by enabling property owners to unlock capital while retaining occupancy. Leaseback programs typically involve selling a property and leasing it back from the buyer, providing liquidity without relocating, whereas sale-leaseback transactions focus on transferring asset ownership for operational or financial optimization. Explore the distinctive advantages and applications of each approach to maximize your real estate investment potential.

Why it is important

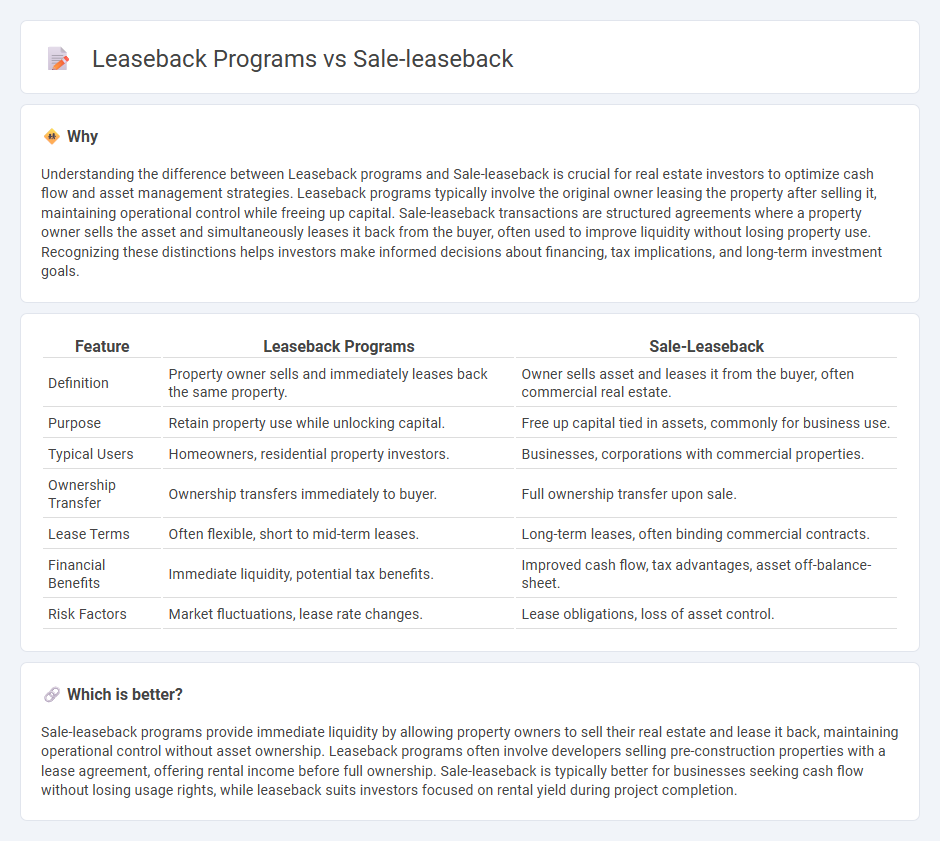

Understanding the difference between Leaseback programs and Sale-leaseback is crucial for real estate investors to optimize cash flow and asset management strategies. Leaseback programs typically involve the original owner leasing the property after selling it, maintaining operational control while freeing up capital. Sale-leaseback transactions are structured agreements where a property owner sells the asset and simultaneously leases it back from the buyer, often used to improve liquidity without losing property use. Recognizing these distinctions helps investors make informed decisions about financing, tax implications, and long-term investment goals.

Comparison Table

| Feature | Leaseback Programs | Sale-Leaseback |

|---|---|---|

| Definition | Property owner sells and immediately leases back the same property. | Owner sells asset and leases it from the buyer, often commercial real estate. |

| Purpose | Retain property use while unlocking capital. | Free up capital tied in assets, commonly for business use. |

| Typical Users | Homeowners, residential property investors. | Businesses, corporations with commercial properties. |

| Ownership Transfer | Ownership transfers immediately to buyer. | Full ownership transfer upon sale. |

| Lease Terms | Often flexible, short to mid-term leases. | Long-term leases, often binding commercial contracts. |

| Financial Benefits | Immediate liquidity, potential tax benefits. | Improved cash flow, tax advantages, asset off-balance-sheet. |

| Risk Factors | Market fluctuations, lease rate changes. | Lease obligations, loss of asset control. |

Which is better?

Sale-leaseback programs provide immediate liquidity by allowing property owners to sell their real estate and lease it back, maintaining operational control without asset ownership. Leaseback programs often involve developers selling pre-construction properties with a lease agreement, offering rental income before full ownership. Sale-leaseback is typically better for businesses seeking cash flow without losing usage rights, while leaseback suits investors focused on rental yield during project completion.

Connection

Leaseback programs and sale-leaseback transactions both involve the sale of a property with the seller immediately leasing it back from the buyer, allowing the original owner to retain operational control while freeing up capital. These strategies optimize cash flow for businesses by converting real estate assets into liquid funds without disrupting their use of the property. Commonly used in commercial real estate, sale-leaseback agreements provide long-term lease arrangements that support financial flexibility and asset management.

Key Terms

Ownership Transfer

Sale-leaseback transactions involve transferring property ownership to a buyer while leasing it back immediately, allowing the original owner to free capital without relocating. Leaseback programs typically retain ownership with the original party, structuring lease agreements for operational use without selling assets. Explore detailed comparisons to understand which strategy aligns best with your financial and operational goals.

Lease Agreement

Sale-leaseback programs involve selling an asset and leasing it back to maintain operational use, providing immediate capital infusion while retaining property access. Leaseback programs, particularly those centered on lease agreements, emphasize flexible contractual terms that prioritize tenant usage rights and long-term occupancy without transferring ownership. Explore detailed comparisons to understand how lease agreements impact financial and operational strategies in both programs.

Capital Release

Sale-leaseback transactions unlock capital by selling an asset and leasing it back, freeing up funds tied in ownership while retaining operational use. Leaseback programs typically involve returning leased assets to the lessor, offering flexibility without asset divestment but less immediate capital release. Explore detailed comparisons and benefits of both programs to optimize your financial strategy.

Source and External Links

What is a sale-leaseback transaction? - This webpage discusses sale-leaseback transactions and their potential tax consequences, emphasizing the importance of careful drafting to manage these implications.

Sale-Leasebacks: A Tool for the Times - This article explains how sale-leasebacks allow companies to raise capital by selling assets and leasing them back, providing benefits such as improved liquidity and reduced financial burdens.

Sale-Leaseback Transaction: An Attractive Option in Today's Market? - This blog post examines the pros and cons of sale-leaseback transactions, highlighting advantages for both buyers and sellers in achieving financial goals and maintaining operational stability.

dowidth.com

dowidth.com