House hacking allows homeowners to generate rental income by living in one part of their property while leasing out other units or rooms, maximizing living space efficiency and reducing mortgage expenses. Real Estate Investment Trusts (REITs) enable investors to participate in commercial and residential property markets through publicly traded shares without owning physical property, offering liquidity and diversification. Explore the advantages and differences between house hacking and REITs to determine which real estate investment strategy best suits your financial goals.

Why it is important

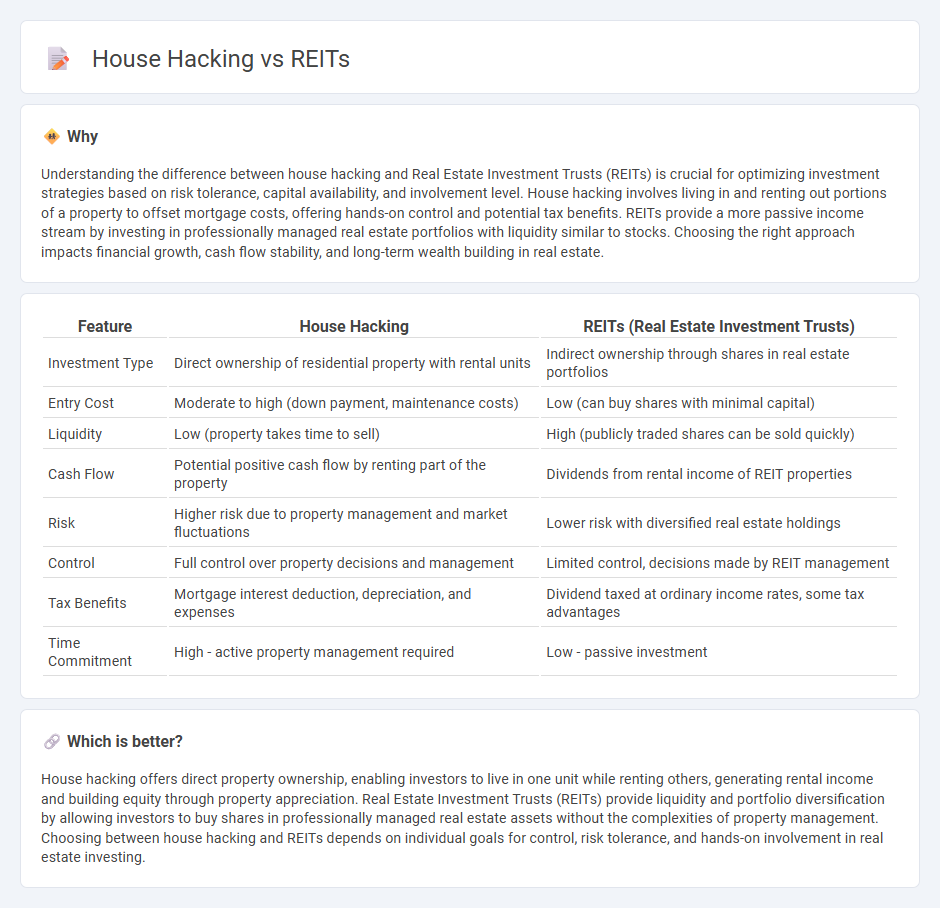

Understanding the difference between house hacking and Real Estate Investment Trusts (REITs) is crucial for optimizing investment strategies based on risk tolerance, capital availability, and involvement level. House hacking involves living in and renting out portions of a property to offset mortgage costs, offering hands-on control and potential tax benefits. REITs provide a more passive income stream by investing in professionally managed real estate portfolios with liquidity similar to stocks. Choosing the right approach impacts financial growth, cash flow stability, and long-term wealth building in real estate.

Comparison Table

| Feature | House Hacking | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Investment Type | Direct ownership of residential property with rental units | Indirect ownership through shares in real estate portfolios |

| Entry Cost | Moderate to high (down payment, maintenance costs) | Low (can buy shares with minimal capital) |

| Liquidity | Low (property takes time to sell) | High (publicly traded shares can be sold quickly) |

| Cash Flow | Potential positive cash flow by renting part of the property | Dividends from rental income of REIT properties |

| Risk | Higher risk due to property management and market fluctuations | Lower risk with diversified real estate holdings |

| Control | Full control over property decisions and management | Limited control, decisions made by REIT management |

| Tax Benefits | Mortgage interest deduction, depreciation, and expenses | Dividend taxed at ordinary income rates, some tax advantages |

| Time Commitment | High - active property management required | Low - passive investment |

Which is better?

House hacking offers direct property ownership, enabling investors to live in one unit while renting others, generating rental income and building equity through property appreciation. Real Estate Investment Trusts (REITs) provide liquidity and portfolio diversification by allowing investors to buy shares in professionally managed real estate assets without the complexities of property management. Choosing between house hacking and REITs depends on individual goals for control, risk tolerance, and hands-on involvement in real estate investing.

Connection

House hacking and Real Estate Investment Trusts (REITs) both offer accessible entry points into real estate investing by allowing individuals to generate income from property ownership without managing multiple properties directly. House hacking involves living in a multi-unit property while renting out units to cover mortgage costs, creating cash flow similarly to how REITs provide dividends to investors through pooled real estate assets. Both strategies leverage real estate ownership to build wealth and passive income streams, catering to different levels of involvement and capital commitment.

Key Terms

Liquidity

REITs provide high liquidity as shares can be bought or sold on public stock exchanges, allowing investors to quickly access capital. House hacking involves purchasing and living in a property, offering less liquidity due to the time and costs associated with selling real estate. Explore more to understand which liquidity strategy aligns best with your investment goals.

Passive Income

REITs (Real Estate Investment Trusts) offer a fully passive income stream through dividends generated from professionally managed real estate portfolios. House hacking involves living in a property while renting out portions to cover mortgage costs, requiring more active management but providing significant cash flow and property appreciation potential. Explore the pros and cons of REITs and house hacking to determine the best passive income strategy for your financial goals.

Ownership Structure

REITs (Real Estate Investment Trusts) offer investors collective ownership through shares in portfolios of income-generating properties, providing liquidity and passive income without direct management responsibilities. House hacking involves owning a residential property, living in part of it while renting out other units, allowing hands-on control and immediate cash flow benefits from tenants. Explore the distinctions in ownership structures and investment strategies to determine which approach aligns best with your financial goals.

Source and External Links

Real Estate Investment Trust - Wikipedia - A real estate investment trust (REIT) is a company that owns, and usually operates, income-producing real estate, providing investors with various tax benefits and income streams.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individuals to invest in large-scale, income-producing real estate without directly owning properties, offering a revenue stream through dividends.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs are companies that own or finance income-producing real estate, offering investors regular income and diversification benefits.

dowidth.com

dowidth.com