Opportunity Zones and New Markets Tax Credit (NMTC) are two powerful federal programs designed to stimulate investment in economically distressed areas, driving significant growth in real estate development. Opportunity Zones offer tax deferrals and potential exclusions on capital gains for investments held in designated low-income communities, while NMTC provides tax credits to investors funding projects that create jobs and boost infrastructure in underserved areas. Explore the unique benefits and investment strategies of these programs to maximize your real estate portfolio's growth potential.

Why it is important

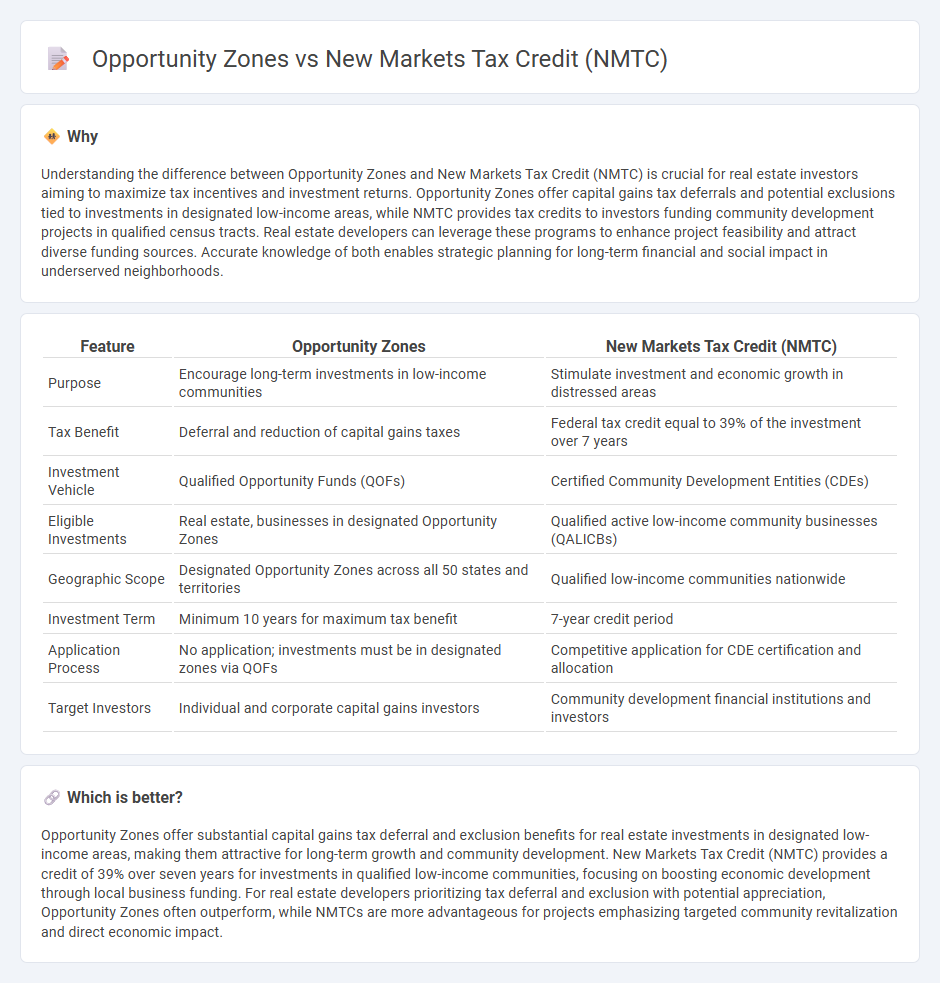

Understanding the difference between Opportunity Zones and New Markets Tax Credit (NMTC) is crucial for real estate investors aiming to maximize tax incentives and investment returns. Opportunity Zones offer capital gains tax deferrals and potential exclusions tied to investments in designated low-income areas, while NMTC provides tax credits to investors funding community development projects in qualified census tracts. Real estate developers can leverage these programs to enhance project feasibility and attract diverse funding sources. Accurate knowledge of both enables strategic planning for long-term financial and social impact in underserved neighborhoods.

Comparison Table

| Feature | Opportunity Zones | New Markets Tax Credit (NMTC) |

|---|---|---|

| Purpose | Encourage long-term investments in low-income communities | Stimulate investment and economic growth in distressed areas |

| Tax Benefit | Deferral and reduction of capital gains taxes | Federal tax credit equal to 39% of the investment over 7 years |

| Investment Vehicle | Qualified Opportunity Funds (QOFs) | Certified Community Development Entities (CDEs) |

| Eligible Investments | Real estate, businesses in designated Opportunity Zones | Qualified active low-income community businesses (QALICBs) |

| Geographic Scope | Designated Opportunity Zones across all 50 states and territories | Qualified low-income communities nationwide |

| Investment Term | Minimum 10 years for maximum tax benefit | 7-year credit period |

| Application Process | No application; investments must be in designated zones via QOFs | Competitive application for CDE certification and allocation |

| Target Investors | Individual and corporate capital gains investors | Community development financial institutions and investors |

Which is better?

Opportunity Zones offer substantial capital gains tax deferral and exclusion benefits for real estate investments in designated low-income areas, making them attractive for long-term growth and community development. New Markets Tax Credit (NMTC) provides a credit of 39% over seven years for investments in qualified low-income communities, focusing on boosting economic development through local business funding. For real estate developers prioritizing tax deferral and exclusion with potential appreciation, Opportunity Zones often outperform, while NMTCs are more advantageous for projects emphasizing targeted community revitalization and direct economic impact.

Connection

Opportunity Zones and the New Markets Tax Credit (NMTC) both incentivize investments in economically distressed communities by providing tax benefits to investors. Opportunity Zones offer capital gains tax deferral and potential exclusions when investments are held long-term, while NMTC provides a credit against federal income tax equal to 39% of the investment over seven years. These programs often complement each other, attracting real estate development and revitalization in underserved areas by reducing financial risk and enhancing project feasibility.

Key Terms

Community Development Entities (CDEs)

Community Development Entities (CDEs) play a central role in the New Markets Tax Credit (NMTC) program by channeling investments into low-income communities for economic growth. In contrast, Opportunity Zones encourage long-term private investment by offering tax incentives without the intermediary function of CDEs. Discover how CDEs uniquely impact community revitalization through NMTC compared to Opportunity Zones.

Qualified Opportunity Funds (QOFs)

The New Markets Tax Credit (NMTC) incentivizes investment in low-income communities through tax credits, while Qualified Opportunity Funds (QOFs) under Opportunity Zones offer tax deferrals and exclusions for capital gains invested in designated economically distressed areas. QOFs enable investors to defer and potentially reduce capital gains taxes by investing in Opportunity Zones, promoting long-term community development and economic growth. Explore the detailed benefits and strategies of NMTC and QOFs to maximize your impact and tax advantages.

Eligible Census Tracts

Eligible Census Tracts for New Markets Tax Credit (NMTC) target low-income communities with median incomes at or below 80% of the area median, often emphasizing economic distress indicators like poverty rates and unemployment levels. Opportunity Zones focus on Census Tracts nominated by states and certified by the Treasury, prioritizing areas with low income but offering broader incentives for long-term investments in designated zones. Explore the specific eligibility criteria and benefits of each program to maximize impact in underserved markets.

Source and External Links

New Markets Tax Credit Program - The NMTC Program incentivizes investment in low-income communities by providing tax credits to investors who make equity investments in Community Development Entities, totaling 39% of the investment spread over seven years, which has generated significant private investment and job creation in distressed areas.

The New Markets Tax Credit Program - Established by Congress in 2000 and managed by the Treasury's CDFI Fund, the NMTC aims to spur investment in communities with high unemployment and low income, funding projects from for-profit businesses to medical clinics, while prohibiting investments in certain types of businesses like massage parlors and racetracks.

What is the New Markets Tax Credit and how does it work? - NMTC allows investors to receive federal tax credits by investing capital into CDEs which fund projects in qualifying low-income areas; since 2003, it has allocated around $40 billion in credits supporting over 7,100 projects and focusing on severely distressed census tracts.

dowidth.com

dowidth.com