Real estate crowdfunding allows multiple investors to pool funds online to finance property projects, offering low entry costs and diversified portfolios. Turnkey property investment involves purchasing fully renovated, rental-ready properties managed by professionals, providing immediate cash flow and hands-off management. Explore the differences to find the ideal investment strategy for your real estate goals.

Why it is important

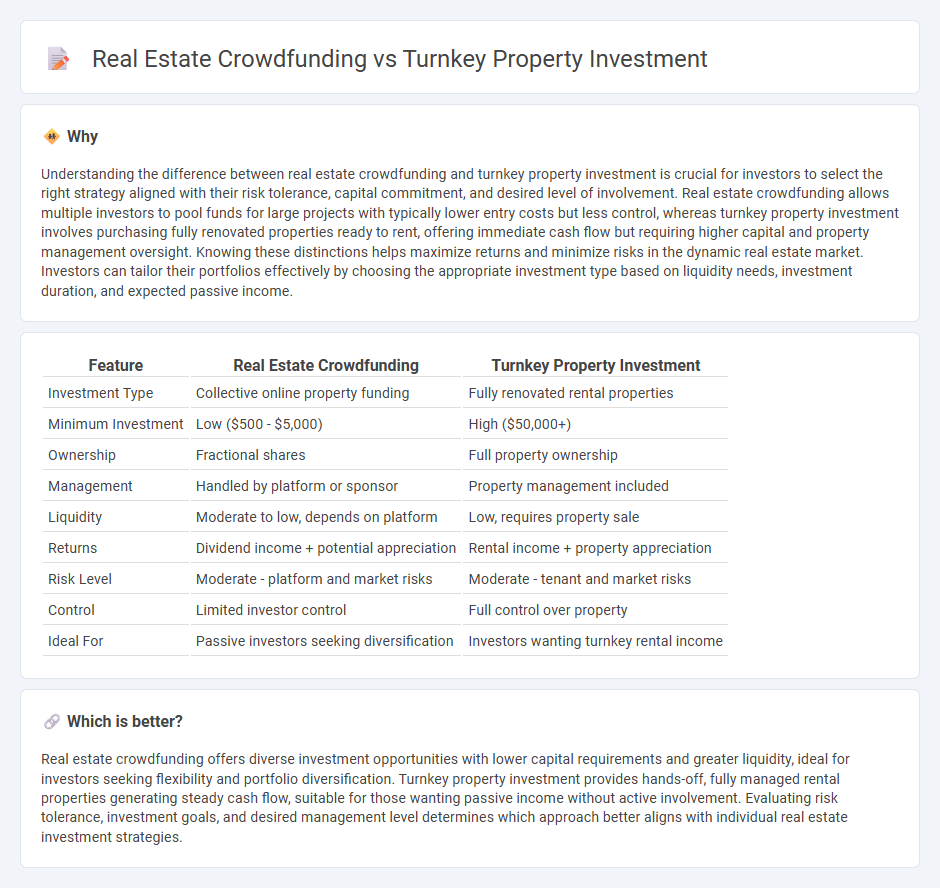

Understanding the difference between real estate crowdfunding and turnkey property investment is crucial for investors to select the right strategy aligned with their risk tolerance, capital commitment, and desired level of involvement. Real estate crowdfunding allows multiple investors to pool funds for large projects with typically lower entry costs but less control, whereas turnkey property investment involves purchasing fully renovated properties ready to rent, offering immediate cash flow but requiring higher capital and property management oversight. Knowing these distinctions helps maximize returns and minimize risks in the dynamic real estate market. Investors can tailor their portfolios effectively by choosing the appropriate investment type based on liquidity needs, investment duration, and expected passive income.

Comparison Table

| Feature | Real Estate Crowdfunding | Turnkey Property Investment |

|---|---|---|

| Investment Type | Collective online property funding | Fully renovated rental properties |

| Minimum Investment | Low ($500 - $5,000) | High ($50,000+) |

| Ownership | Fractional shares | Full property ownership |

| Management | Handled by platform or sponsor | Property management included |

| Liquidity | Moderate to low, depends on platform | Low, requires property sale |

| Returns | Dividend income + potential appreciation | Rental income + property appreciation |

| Risk Level | Moderate - platform and market risks | Moderate - tenant and market risks |

| Control | Limited investor control | Full control over property |

| Ideal For | Passive investors seeking diversification | Investors wanting turnkey rental income |

Which is better?

Real estate crowdfunding offers diverse investment opportunities with lower capital requirements and greater liquidity, ideal for investors seeking flexibility and portfolio diversification. Turnkey property investment provides hands-off, fully managed rental properties generating steady cash flow, suitable for those wanting passive income without active involvement. Evaluating risk tolerance, investment goals, and desired management level determines which approach better aligns with individual real estate investment strategies.

Connection

Real estate crowdfunding and turnkey property investment are connected through their shared goal of simplifying property investment for individuals by providing accessible and diversified opportunities. Crowdfunding platforms pool funds from multiple investors to finance turnkey properties, which are fully renovated and ready for immediate rental income. This synergy enables investors to benefit from passive income streams while minimizing hands-on management and entry barriers.

Key Terms

Ownership structure

Turnkey property investment offers direct ownership of fully renovated rental properties, giving investors full control and the ability to manage or outsource property operations. Real estate crowdfunding provides fractional ownership through pooled funds, allowing investors to diversify across multiple projects with limited management responsibilities and lower capital requirements. Explore the nuances of ownership structures and how they impact your investment strategy.

Passive income

Turnkey property investment offers fully renovated, tenant-ready properties managed by professionals, providing a stable passive income stream with minimal effort. Real estate crowdfunding allows investors to pool funds to access diversified real estate projects, often with lower entry costs and varying returns. Explore detailed comparisons to find the best passive income strategy suited to your financial goals.

Liquidity

Turnkey property investment typically involves purchasing fully renovated rental properties, offering stable long-term cash flow but limited liquidity due to the time needed to sell real estate assets. Real estate crowdfunding platforms provide greater liquidity by allowing investors to buy and sell shares in property projects, often with shorter holding periods and easier exit options. Explore the advantages of liquidity in both investment strategies to determine the best fit for your portfolio goals.

Source and External Links

Turnkey Rentals | Rent to Retirement - Offers turnkey real estate investments with features like passive income, depreciation, equity growth, and leverage, along with a team of professionals for support.

Turnkey Real Estate Investing - Stessa - Provides a guide to turnkey real estate investing, highlighting its benefits for both new and experienced investors in various markets.

Turnkey Real Estate Investing | Norada Real Estate - Offers turnkey property investments with a focus on building passive income and equity, providing resources and knowledge for investors.

dowidth.com

dowidth.com