Fractional ownership platforms allow investors to buy partial stakes in specific properties, offering direct asset control and potential rental income. Real estate mutual funds pool capital to invest in diversified portfolios of commercial properties or real estate securities, providing liquidity and professional management. Explore the unique benefits and strategies of each investment model to enhance your real estate portfolio.

Why it is important

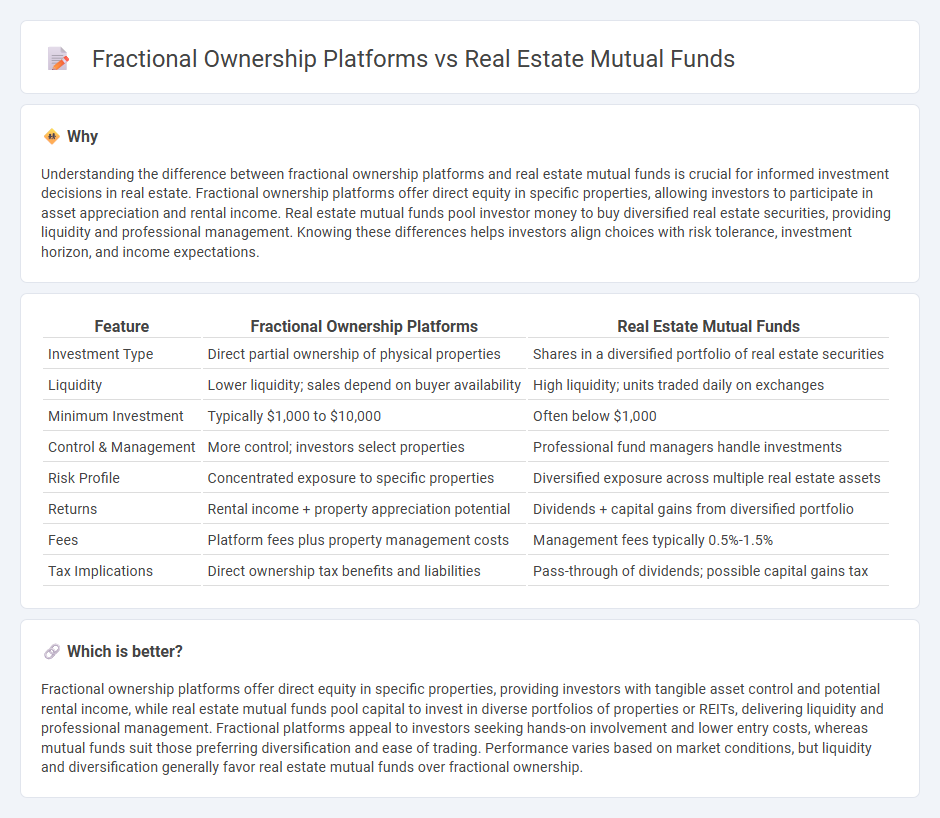

Understanding the difference between fractional ownership platforms and real estate mutual funds is crucial for informed investment decisions in real estate. Fractional ownership platforms offer direct equity in specific properties, allowing investors to participate in asset appreciation and rental income. Real estate mutual funds pool investor money to buy diversified real estate securities, providing liquidity and professional management. Knowing these differences helps investors align choices with risk tolerance, investment horizon, and income expectations.

Comparison Table

| Feature | Fractional Ownership Platforms | Real Estate Mutual Funds |

|---|---|---|

| Investment Type | Direct partial ownership of physical properties | Shares in a diversified portfolio of real estate securities |

| Liquidity | Lower liquidity; sales depend on buyer availability | High liquidity; units traded daily on exchanges |

| Minimum Investment | Typically $1,000 to $10,000 | Often below $1,000 |

| Control & Management | More control; investors select properties | Professional fund managers handle investments |

| Risk Profile | Concentrated exposure to specific properties | Diversified exposure across multiple real estate assets |

| Returns | Rental income + property appreciation potential | Dividends + capital gains from diversified portfolio |

| Fees | Platform fees plus property management costs | Management fees typically 0.5%-1.5% |

| Tax Implications | Direct ownership tax benefits and liabilities | Pass-through of dividends; possible capital gains tax |

Which is better?

Fractional ownership platforms offer direct equity in specific properties, providing investors with tangible asset control and potential rental income, while real estate mutual funds pool capital to invest in diverse portfolios of properties or REITs, delivering liquidity and professional management. Fractional platforms appeal to investors seeking hands-on involvement and lower entry costs, whereas mutual funds suit those preferring diversification and ease of trading. Performance varies based on market conditions, but liquidity and diversification generally favor real estate mutual funds over fractional ownership.

Connection

Fractional ownership platforms and real estate mutual funds both democratize real estate investment by allowing multiple investors to pool capital for shared property ownership. These platforms enable diversification across various real estate assets, similar to how mutual funds spread investments over multiple properties to mitigate risk. By leveraging collective investment, both models enhance access to real estate markets for small investors seeking liquid, managed portfolios.

Key Terms

Diversification

Real estate mutual funds offer investors broad diversification by pooling assets across multiple properties and geographic locations, reducing risk exposure. Fractional ownership platforms provide access to specific properties but often with limited diversification, concentrating investment risk on fewer assets. Explore our detailed comparison to understand which option aligns with your investment strategy.

Liquidity

Real estate mutual funds offer higher liquidity by allowing investors to buy and sell shares on stock exchanges or directly from fund managers, often with daily or weekly redemption opportunities. Fractional ownership platforms typically have limited liquidity, as resale depends on secondary market availability or holding periods set by the platform. Explore detailed comparisons to understand which investment suits your liquidity preferences better.

Ownership structure

Real estate mutual funds pool investor capital to acquire diverse property portfolios managed by professionals, offering indirect ownership through shares in the fund. Fractional ownership platforms allow investors to directly own a portion of specific properties, providing tangible equity stakes and individualized asset control. Explore the nuances of these ownership structures to determine the best fit for your investment strategy.

Source and External Links

Understanding REITs and Mutual Funds - This article discusses the differences and similarities between REITs and real estate mutual funds, highlighting their investment structures and benefits.

List of REITs & Real Estate Funds - This webpage provides information on mutual funds as a means to access the real estate asset class, offering a list of real estate funds for investors.

PGIM US Real Estate Fund - This fund seeks to provide investors with capital appreciation and income by investing in domestic real estate securities.

dowidth.com

dowidth.com