House hacking leverages owner-occupied properties to generate rental income, reducing personal living expenses while building equity. Turnkey investing involves purchasing fully renovated, income-generating properties managed by professionals for a hands-off investment experience. Explore the benefits and strategies of house hacking versus turnkey investing to determine the best approach for your real estate goals.

Why it is important

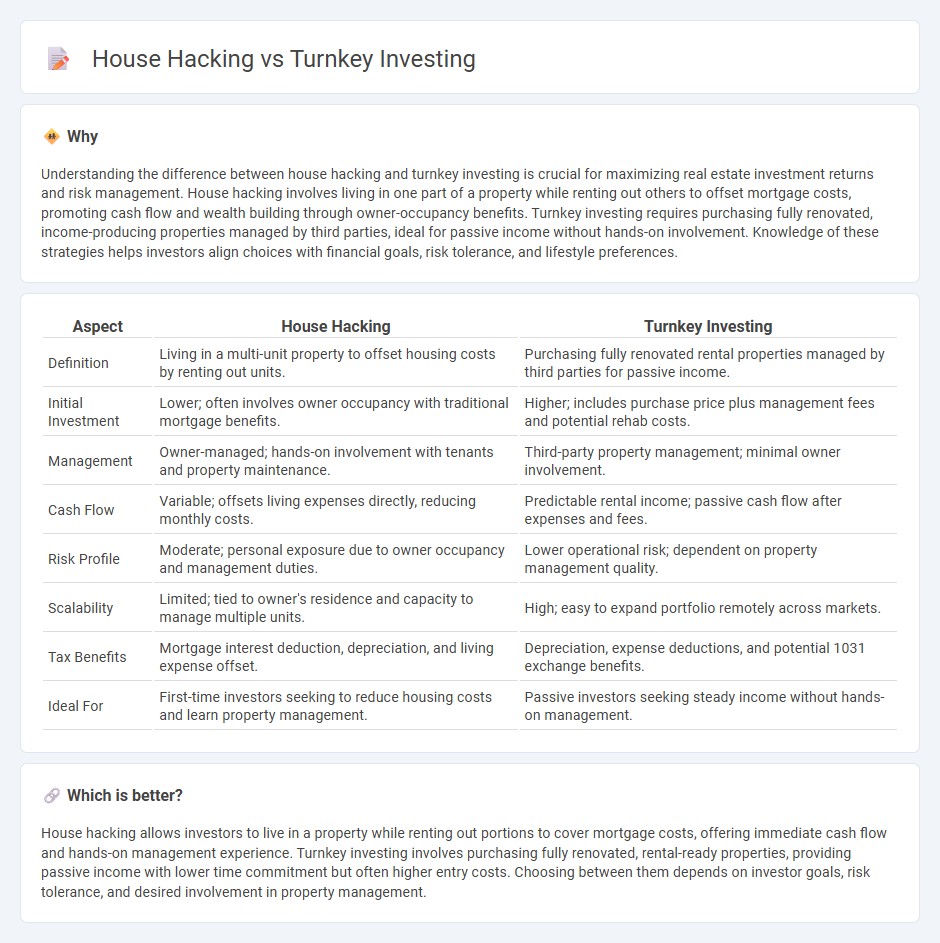

Understanding the difference between house hacking and turnkey investing is crucial for maximizing real estate investment returns and risk management. House hacking involves living in one part of a property while renting out others to offset mortgage costs, promoting cash flow and wealth building through owner-occupancy benefits. Turnkey investing requires purchasing fully renovated, income-producing properties managed by third parties, ideal for passive income without hands-on involvement. Knowledge of these strategies helps investors align choices with financial goals, risk tolerance, and lifestyle preferences.

Comparison Table

| Aspect | House Hacking | Turnkey Investing |

|---|---|---|

| Definition | Living in a multi-unit property to offset housing costs by renting out units. | Purchasing fully renovated rental properties managed by third parties for passive income. |

| Initial Investment | Lower; often involves owner occupancy with traditional mortgage benefits. | Higher; includes purchase price plus management fees and potential rehab costs. |

| Management | Owner-managed; hands-on involvement with tenants and property maintenance. | Third-party property management; minimal owner involvement. |

| Cash Flow | Variable; offsets living expenses directly, reducing monthly costs. | Predictable rental income; passive cash flow after expenses and fees. |

| Risk Profile | Moderate; personal exposure due to owner occupancy and management duties. | Lower operational risk; dependent on property management quality. |

| Scalability | Limited; tied to owner's residence and capacity to manage multiple units. | High; easy to expand portfolio remotely across markets. |

| Tax Benefits | Mortgage interest deduction, depreciation, and living expense offset. | Depreciation, expense deductions, and potential 1031 exchange benefits. |

| Ideal For | First-time investors seeking to reduce housing costs and learn property management. | Passive investors seeking steady income without hands-on management. |

Which is better?

House hacking allows investors to live in a property while renting out portions to cover mortgage costs, offering immediate cash flow and hands-on management experience. Turnkey investing involves purchasing fully renovated, rental-ready properties, providing passive income with lower time commitment but often higher entry costs. Choosing between them depends on investor goals, risk tolerance, and desired involvement in property management.

Connection

House hacking and turnkey investing both maximize real estate income by leveraging property ownership with minimal effort. House hacking involves living in a multi-unit property while renting out other units to cover mortgage expenses, creating instant cash flow. Turnkey investing complements this by providing fully renovated, tenant-ready properties, enabling investors to generate passive income without the hassle of repairs or management.

Key Terms

Passive income

Turnkey investing involves purchasing fully renovated properties managed by professionals, offering a hands-off approach to generating steady passive income. House hacking requires living in one part of a multi-unit property while renting out the others, combining active residency with rental income to reduce living expenses. Explore more to discover which strategy aligns best with your financial goals and lifestyle preferences.

Owner-occupied

Owner-occupied investing strategies, such as turnkey investing and house hacking, both leverage primary residences to build equity and generate income through rental units. Turnkey investing typically involves purchasing ready-to-rent properties requiring minimal immediate management, whereas house hacking requires occupying part of the home while renting out other units, maximizing personal housing cost reduction. Explore detailed comparisons to determine which owner-occupied approach aligns best with your investment goals and lifestyle.

Property management

Turnkey investing involves purchasing fully renovated properties managed by professional companies, minimizing the owner's direct involvement in property management and tenant relations. House hacking requires active management, including maintenance, tenant screening, and rent collection, offering more control but demanding significant personal time and effort. Explore in-depth comparisons of property management responsibilities to determine the best strategy for your investment goals.

Source and External Links

Turnkey Rental Properties for Sale - Offers turnkey rental properties that provide immediate rental income and require minimal management effort from investors.

Turnkey Real Estate Investing - Provides a comprehensive guide to turnkey real estate investing, highlighting its benefits as a hands-off investment strategy.

Turnkey Rentals | Rent to Retirement - Focuses on offering turnkey rental properties with predictable income and potential for long-term growth, complete with professional management services.

dowidth.com

dowidth.com