Dynamic pricing in real estate adjusts property prices based on market demand, seasonality, and local trends, enabling sellers to optimize returns in real time. Negotiated pricing involves direct discussions between buyers and sellers to agree on a mutually beneficial price, often allowing for personalized terms and flexibility. Explore detailed insights on how these pricing strategies impact property sales and investment decisions.

Why it is important

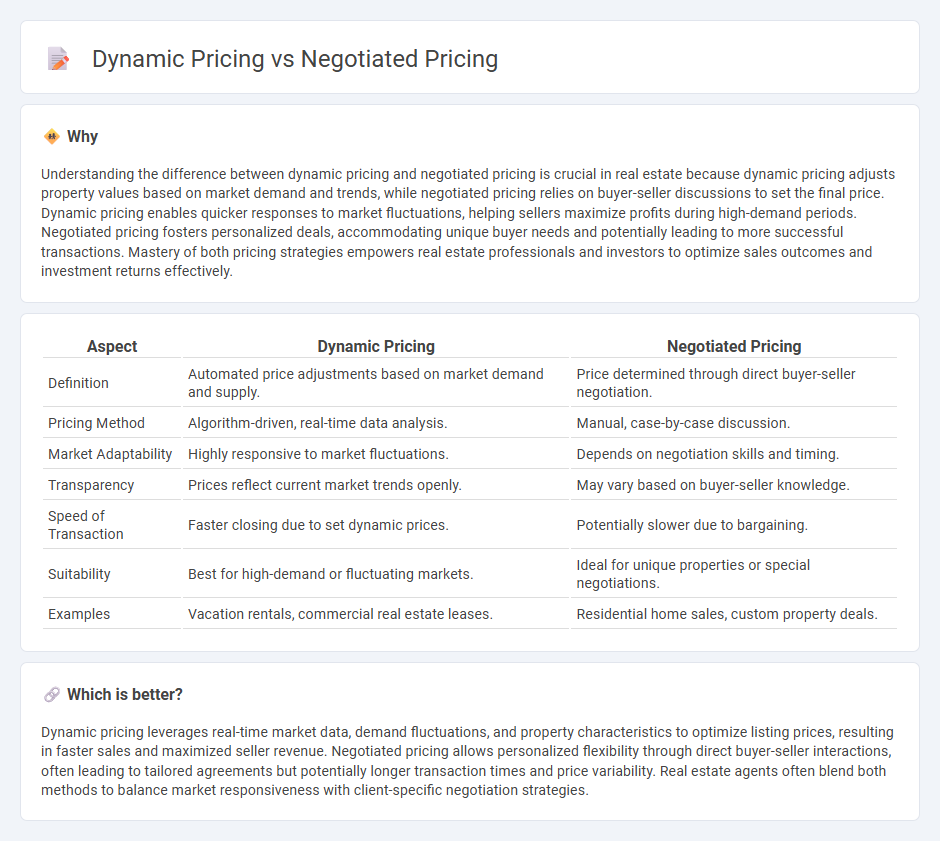

Understanding the difference between dynamic pricing and negotiated pricing is crucial in real estate because dynamic pricing adjusts property values based on market demand and trends, while negotiated pricing relies on buyer-seller discussions to set the final price. Dynamic pricing enables quicker responses to market fluctuations, helping sellers maximize profits during high-demand periods. Negotiated pricing fosters personalized deals, accommodating unique buyer needs and potentially leading to more successful transactions. Mastery of both pricing strategies empowers real estate professionals and investors to optimize sales outcomes and investment returns effectively.

Comparison Table

| Aspect | Dynamic Pricing | Negotiated Pricing |

|---|---|---|

| Definition | Automated price adjustments based on market demand and supply. | Price determined through direct buyer-seller negotiation. |

| Pricing Method | Algorithm-driven, real-time data analysis. | Manual, case-by-case discussion. |

| Market Adaptability | Highly responsive to market fluctuations. | Depends on negotiation skills and timing. |

| Transparency | Prices reflect current market trends openly. | May vary based on buyer-seller knowledge. |

| Speed of Transaction | Faster closing due to set dynamic prices. | Potentially slower due to bargaining. |

| Suitability | Best for high-demand or fluctuating markets. | Ideal for unique properties or special negotiations. |

| Examples | Vacation rentals, commercial real estate leases. | Residential home sales, custom property deals. |

Which is better?

Dynamic pricing leverages real-time market data, demand fluctuations, and property characteristics to optimize listing prices, resulting in faster sales and maximized seller revenue. Negotiated pricing allows personalized flexibility through direct buyer-seller interactions, often leading to tailored agreements but potentially longer transaction times and price variability. Real estate agents often blend both methods to balance market responsiveness with client-specific negotiation strategies.

Connection

Dynamic pricing in real estate utilizes real-time market data and demand fluctuations to adjust property prices, while negotiated pricing involves direct interaction between buyers and sellers to settle on a final price. Both methods aim to maximize value by considering market conditions, buyer interest, and seller flexibility. Integrating dynamic pricing algorithms with negotiated deals enhances pricing accuracy, ensuring competitive offers align with current market trends.

Key Terms

Price Discovery

Negotiated pricing relies on personalized agreements between buyer and seller to determine the final price, often resulting in customized deals based on individual needs and market conditions. Dynamic pricing utilizes algorithms and real-time data to adjust prices automatically, optimizing revenue by responding swiftly to supply, demand, and competitive factors. Explore further to understand how these pricing strategies impact effective price discovery and market efficiency.

Market Demand

Negotiated pricing allows for personalized price determination based on individual buyer-seller interactions, adapting prices according to specific market demand conditions. Dynamic pricing continuously adjusts prices in real-time using algorithms that analyze market demand fluctuations, competitor prices, and consumer behavior data for optimal revenue. Explore the nuances of these pricing strategies to enhance your market responsiveness and profitability.

Negotiation Power

Negotiated pricing leverages direct negotiation power between buyers and sellers, allowing tailored agreements based on volume, relationship, or strategic value, often resulting in mutually beneficial deals. Dynamic pricing adjusts prices algorithmically based on market demand, competition, and customer behavior, minimizing negotiation influence but maximizing real-time revenue optimization. Discover how enhancing negotiation power can provide strategic advantages in pricing flexibility and customer loyalty.

Source and External Links

What are Negotiated Pricing Strategies? - Negociated pricing strategies are methods used by health benefit plans to secure favorable pricing for healthcare services and control costs.

15.405 Price Negotiation - Price negotiation involves developing a negotiation position through cost or price analysis to reach a fair and reasonable agreement between the government and contractors.

What is Price Negotiation? - Price negotiation is the process of discussing and adjusting the price of a product or service to reach a mutually acceptable agreement between buyer and seller.

dowidth.com

dowidth.com