Ghost listings refer to properties marketed discreetly without public MLS exposure, often to attract exclusive buyers or test market interest. Multi-family listings involve properties designed to house several separate families, such as duplexes, triplexes, or apartment buildings, offering investors rental income potential. Explore further to understand which listing strategy best suits your real estate goals.

Why it is important

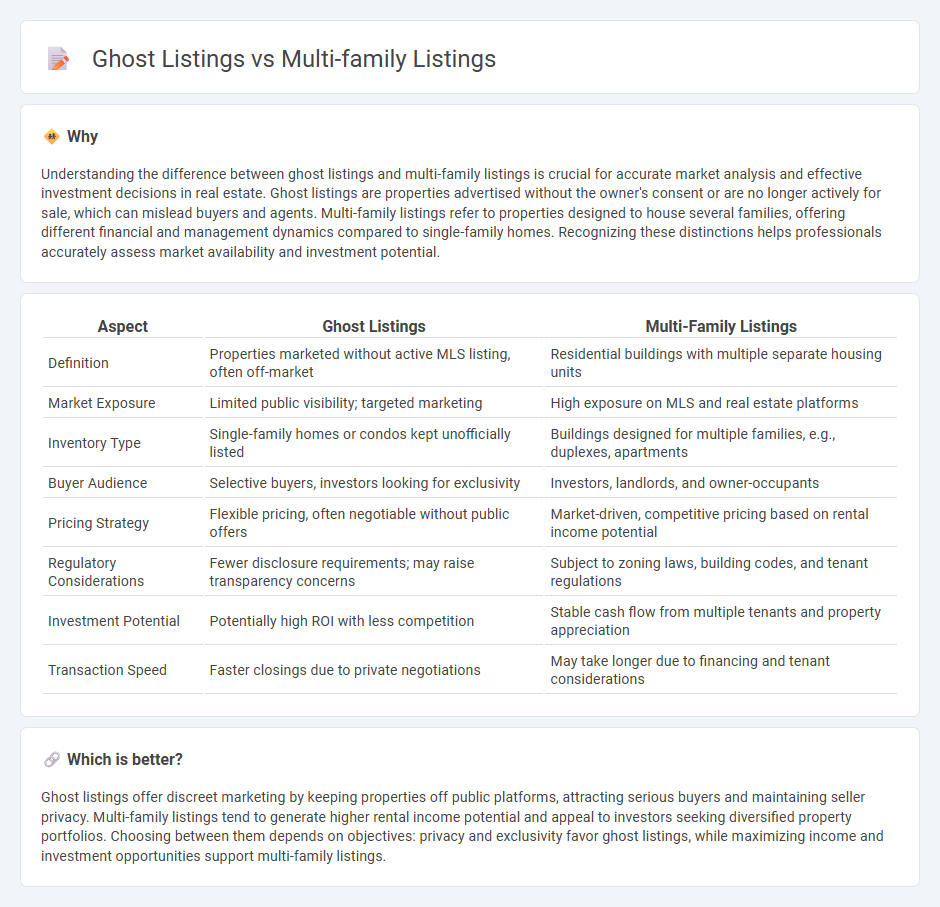

Understanding the difference between ghost listings and multi-family listings is crucial for accurate market analysis and effective investment decisions in real estate. Ghost listings are properties advertised without the owner's consent or are no longer actively for sale, which can mislead buyers and agents. Multi-family listings refer to properties designed to house several families, offering different financial and management dynamics compared to single-family homes. Recognizing these distinctions helps professionals accurately assess market availability and investment potential.

Comparison Table

| Aspect | Ghost Listings | Multi-Family Listings |

|---|---|---|

| Definition | Properties marketed without active MLS listing, often off-market | Residential buildings with multiple separate housing units |

| Market Exposure | Limited public visibility; targeted marketing | High exposure on MLS and real estate platforms |

| Inventory Type | Single-family homes or condos kept unofficially listed | Buildings designed for multiple families, e.g., duplexes, apartments |

| Buyer Audience | Selective buyers, investors looking for exclusivity | Investors, landlords, and owner-occupants |

| Pricing Strategy | Flexible pricing, often negotiable without public offers | Market-driven, competitive pricing based on rental income potential |

| Regulatory Considerations | Fewer disclosure requirements; may raise transparency concerns | Subject to zoning laws, building codes, and tenant regulations |

| Investment Potential | Potentially high ROI with less competition | Stable cash flow from multiple tenants and property appreciation |

| Transaction Speed | Faster closings due to private negotiations | May take longer due to financing and tenant considerations |

Which is better?

Ghost listings offer discreet marketing by keeping properties off public platforms, attracting serious buyers and maintaining seller privacy. Multi-family listings tend to generate higher rental income potential and appeal to investors seeking diversified property portfolios. Choosing between them depends on objectives: privacy and exclusivity favor ghost listings, while maximizing income and investment opportunities support multi-family listings.

Connection

Ghost listings and multi-family listings intersect through the strategy of covert marketing, where real estate agents list multi-family properties without public exposure to gauge genuine buyer interest. This tactic helps maintain market exclusivity for multi-family units, preventing public price wars and attracting serious investors through private networks. By combining ghost listings with multi-family properties, agents can manage property availability and optimize sales outcomes in competitive urban markets.

Key Terms

Occupancy Rate

Multi-family listings typically provide transparent data on occupancy rates, helping investors assess property performance and rental income potential. Ghost listings, in contrast, often inflate occupancy rates or hide vacancies to attract potential buyers, leading to misleading market insights. Explore how understanding true occupancy rates can improve investment decisions in multi-family real estate.

Verified Ownership

Verified ownership is a critical factor distinguishing multi-family listings from ghost listings, as it ensures that the listed properties have legitimate and traceable owners. Multi-family listings with verified ownership provide accurate information for buyers and investors, reducing risks associated with fraudulent or outdated listings commonly found in ghost listings. Explore more to understand how verified ownership impacts property transparency and investment confidence.

Listing Authenticity

Multi-family listings that emphasize transparent owner information and accurate property details build stronger trust with potential renters, enhancing listing authenticity. Ghost listings, often lacking verifiable ownership or containing misleading data, undermine credibility and can lead to wasted time and effort. Explore how verifying listing authenticity improves decision-making and rental success.

Source and External Links

Multi Unit - Philadelphia PA Real Estate - 132 Homes For Sale - Zillow lists 132 multi-family homes for sale in Philadelphia, including detailed photos and sales history for a range of properties from about $190,000 to over $5 million with varying bed/bath counts and sizes.

Multifamily Properties & Apartment Buildings for Sale - Crexi offers a large nationwide selection of 19,963 multifamily properties, with detailed inventories by city such as Miami, Los Angeles, Chicago, and Philadelphia, providing extensive commercial multifamily real estate options.

CT Multi-Family Homes for Sale - All Points Homes features currently listed multi-family homes for sale in Connecticut, offering browsing of listings with photos and property details for interested buyers.

dowidth.com

dowidth.com