Leaseback programs allow property owners to sell their real estate while continuing to lease it, providing liquidity without disrupting operations. Triple net leases require tenants to pay rent plus property taxes, insurance, and maintenance, transferring most expenses to lessees. Explore the benefits and risks of each strategy to determine which aligns best with your real estate investment goals.

Why it is important

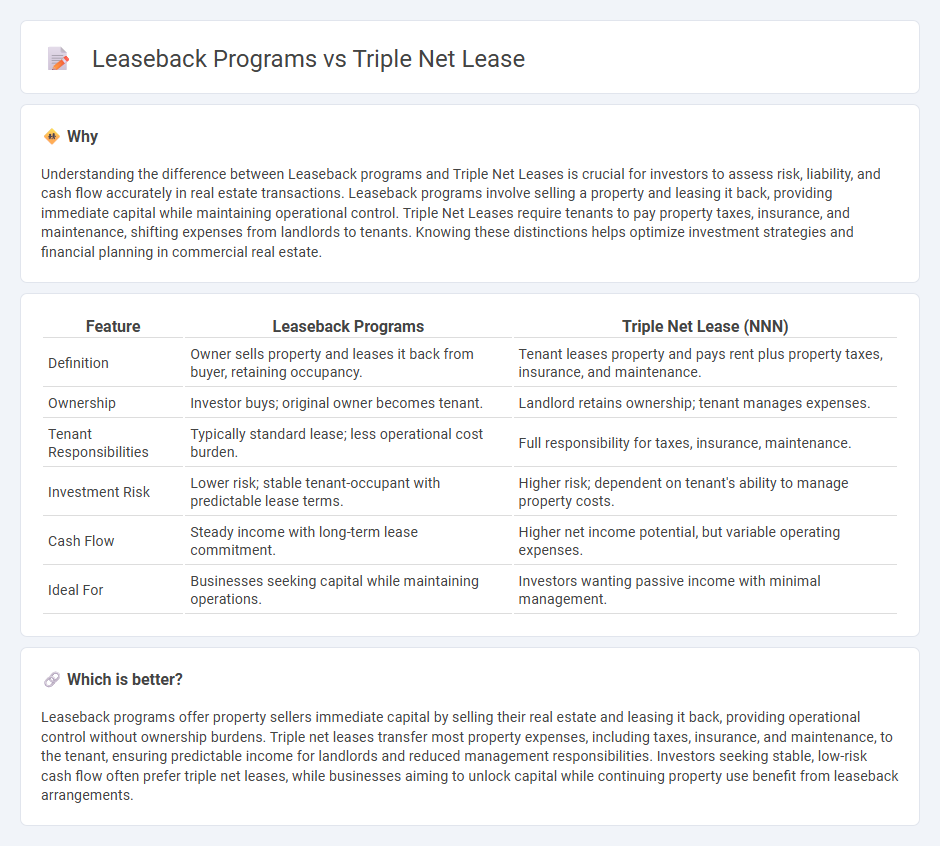

Understanding the difference between Leaseback programs and Triple Net Leases is crucial for investors to assess risk, liability, and cash flow accurately in real estate transactions. Leaseback programs involve selling a property and leasing it back, providing immediate capital while maintaining operational control. Triple Net Leases require tenants to pay property taxes, insurance, and maintenance, shifting expenses from landlords to tenants. Knowing these distinctions helps optimize investment strategies and financial planning in commercial real estate.

Comparison Table

| Feature | Leaseback Programs | Triple Net Lease (NNN) |

|---|---|---|

| Definition | Owner sells property and leases it back from buyer, retaining occupancy. | Tenant leases property and pays rent plus property taxes, insurance, and maintenance. |

| Ownership | Investor buys; original owner becomes tenant. | Landlord retains ownership; tenant manages expenses. |

| Tenant Responsibilities | Typically standard lease; less operational cost burden. | Full responsibility for taxes, insurance, maintenance. |

| Investment Risk | Lower risk; stable tenant-occupant with predictable lease terms. | Higher risk; dependent on tenant's ability to manage property costs. |

| Cash Flow | Steady income with long-term lease commitment. | Higher net income potential, but variable operating expenses. |

| Ideal For | Businesses seeking capital while maintaining operations. | Investors wanting passive income with minimal management. |

Which is better?

Leaseback programs offer property sellers immediate capital by selling their real estate and leasing it back, providing operational control without ownership burdens. Triple net leases transfer most property expenses, including taxes, insurance, and maintenance, to the tenant, ensuring predictable income for landlords and reduced management responsibilities. Investors seeking stable, low-risk cash flow often prefer triple net leases, while businesses aiming to unlock capital while continuing property use benefit from leaseback arrangements.

Connection

Leaseback programs involve a property owner selling real estate and then leasing it back from the buyer, often under a triple net lease agreement where the tenant assumes responsibility for property taxes, insurance, and maintenance costs. This lease structure reduces risk for investors by ensuring consistent cash flow with minimized expenses tied to property management. Real estate investors leverage leaseback combined with triple net leases to stabilize income streams and enhance the asset's investment appeal.

Key Terms

Tenant Responsibilities

In a triple net lease (NNN), tenants are responsible for paying property taxes, insurance, and maintenance costs, significantly increasing their financial obligations beyond base rent. Leaseback programs typically shift operational responsibilities to the landlord, while tenants primarily focus on lease payments with limited additional expenses. Explore more to understand which arrangement aligns best with your business needs and financial strategy.

Ownership Structure

Triple net leases transfer property expenses such as taxes, insurance, and maintenance to the tenant, providing owners with predictable income and minimal operational responsibilities. Leaseback programs involve selling a property to an investor and leasing it back, allowing the original owner to free up capital while maintaining operational control. Explore detailed comparisons of ownership benefits and financial structures to determine the best fit for your investment strategy.

Long-term Income Stability

Triple net leases ensure long-term income stability by transferring property expenses such as taxes, insurance, and maintenance to tenants, providing predictable cash flow for landlords. Leaseback programs offer immediate capital infusion by selling property and leasing it back, balancing liquidity with ongoing operational control. Explore detailed comparisons to understand which strategy aligns best with your investment objectives.

Source and External Links

What Is A Triple Net Lease (NNN) | Definition & Examples - This webpage provides a detailed explanation of triple net leases, highlighting their structure and how they differ from other commercial real estate leases.

Triple Net Lease - This definition explains the components of a triple net lease, including rent, utilities, insurance, maintenance, and taxes, and their implications for tenants and landlords.

Benefits and Drawbacks of a Triple Net Lease (NNN) - This article discusses the advantages and disadvantages of triple net leases for both tenants and landlords, including financial responsibilities and management roles.

dowidth.com

dowidth.com