Ghost kitchens leasing offers flexible, cost-effective spaces tailored for food delivery businesses, optimizing operational efficiency without the need for customer-facing premises. Multi-tenant retail center leasing involves renting storefronts designed to attract diverse foot traffic, supporting direct consumer interactions and varied business types. Explore deeper insights to determine which leasing strategy aligns best with your real estate investment goals.

Why it is important

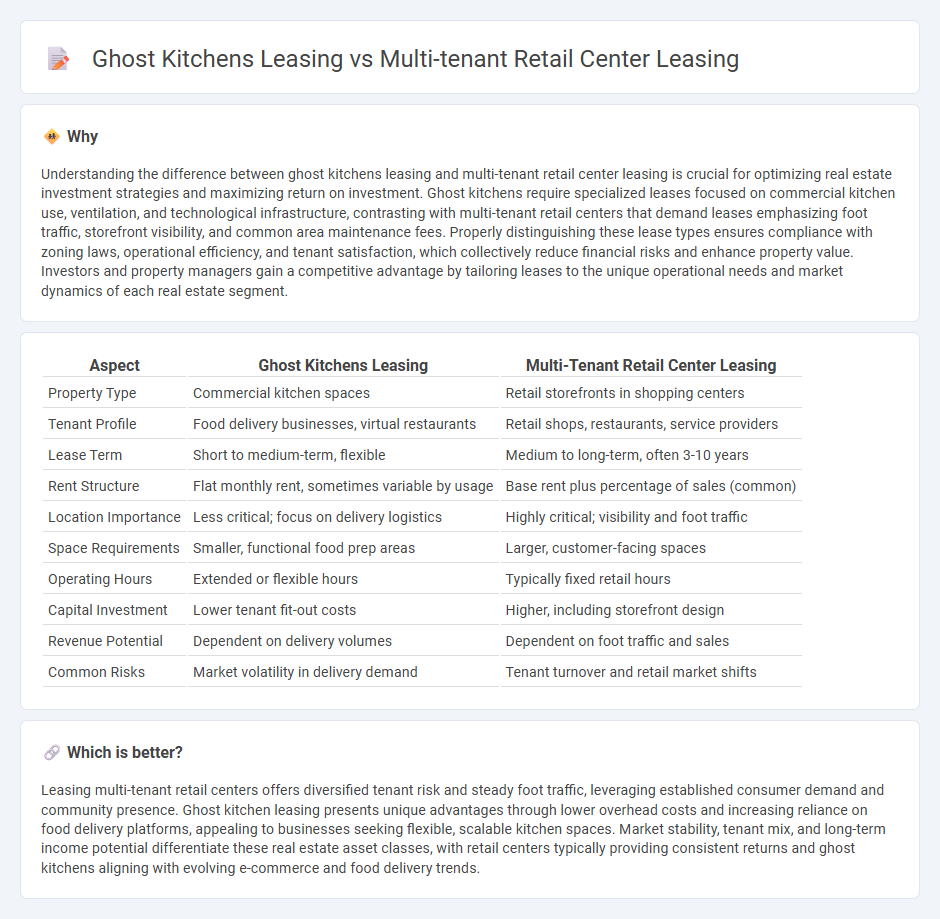

Understanding the difference between ghost kitchens leasing and multi-tenant retail center leasing is crucial for optimizing real estate investment strategies and maximizing return on investment. Ghost kitchens require specialized leases focused on commercial kitchen use, ventilation, and technological infrastructure, contrasting with multi-tenant retail centers that demand leases emphasizing foot traffic, storefront visibility, and common area maintenance fees. Properly distinguishing these lease types ensures compliance with zoning laws, operational efficiency, and tenant satisfaction, which collectively reduce financial risks and enhance property value. Investors and property managers gain a competitive advantage by tailoring leases to the unique operational needs and market dynamics of each real estate segment.

Comparison Table

| Aspect | Ghost Kitchens Leasing | Multi-Tenant Retail Center Leasing |

|---|---|---|

| Property Type | Commercial kitchen spaces | Retail storefronts in shopping centers |

| Tenant Profile | Food delivery businesses, virtual restaurants | Retail shops, restaurants, service providers |

| Lease Term | Short to medium-term, flexible | Medium to long-term, often 3-10 years |

| Rent Structure | Flat monthly rent, sometimes variable by usage | Base rent plus percentage of sales (common) |

| Location Importance | Less critical; focus on delivery logistics | Highly critical; visibility and foot traffic |

| Space Requirements | Smaller, functional food prep areas | Larger, customer-facing spaces |

| Operating Hours | Extended or flexible hours | Typically fixed retail hours |

| Capital Investment | Lower tenant fit-out costs | Higher, including storefront design |

| Revenue Potential | Dependent on delivery volumes | Dependent on foot traffic and sales |

| Common Risks | Market volatility in delivery demand | Tenant turnover and retail market shifts |

Which is better?

Leasing multi-tenant retail centers offers diversified tenant risk and steady foot traffic, leveraging established consumer demand and community presence. Ghost kitchen leasing presents unique advantages through lower overhead costs and increasing reliance on food delivery platforms, appealing to businesses seeking flexible, scalable kitchen spaces. Market stability, tenant mix, and long-term income potential differentiate these real estate asset classes, with retail centers typically providing consistent returns and ghost kitchens aligning with evolving e-commerce and food delivery trends.

Connection

Ghost kitchens and multi-tenant retail center leasing intersect through their focus on maximizing commercial real estate utility and revenue generation. Both models emphasize flexible leasing arrangements tailored to emerging consumer trends, with ghost kitchens leveraging shared kitchen spaces in retail-heavy locations while multi-tenant centers optimize tenant mix to increase foot traffic. The integration of ghost kitchens into multi-tenant retail centers enhances property value by diversifying income streams and attracting new customer demographics.

Key Terms

**Multi-tenant retail center leasing:**

Multi-tenant retail center leasing offers diverse tenant mixes, increasing foot traffic and boosting business exposure through strategic location advantages and versatile leasing options. These centers provide scalable spaces suitable for various retail brands, ensuring stable income streams for landlords and dynamic environments for retailers. Explore the benefits of multi-tenant retail center leasing to optimize your commercial real estate portfolio.

Common Area Maintenance (CAM)

Multi-tenant retail center leasing typically involves Common Area Maintenance (CAM) fees that cover shared expenses such as landscaping, security, lighting, and parking lot upkeep, apportioned based on tenants' leased square footage. Ghost kitchen leasing, by contrast, often includes CAM fees primarily focused on utilities, waste management, and minimal shared spaces due to the commercial kitchen's operational nature and limited customer-facing areas. Explore detailed differences in CAM structures and cost implications to optimize your leasing strategy.

Anchor Tenant

Anchor tenants in multi-tenant retail center leasing typically consist of well-established retail brands that drive consistent foot traffic and enhance the leasing appeal for smaller tenants, often securing long-term, high-value leases. In contrast, ghost kitchens leasing emphasizes flexible, short-term agreements with food delivery-focused operators, lacking traditional anchor tenants but relying on multiple virtual brands to diversify revenue streams. Explore how these differing anchor tenant strategies impact profitability and tenant mix in commercial leasing models.

Source and External Links

Why Multi-Tenant Retail is a Strong Asset Class - This article discusses the benefits of multi-tenant retail properties, including diversified income streams and lower vacancy risk, making them a strong asset class for investors.

Multi-Tenant Retail on the Rise - This piece highlights the advantages and challenges of investing in multi-tenant retail properties, including potential for diversified income and tenant stability.

4 Reasons Investors Love Multi-Tenant Retail Centers - This article outlines reasons why investors favor multi-tenant retail centers, such as tenant stability with national credit tenants and potential for higher returns.

dowidth.com

dowidth.com