Blockchain technology revolutionizes real estate by enhancing transparency, security, and transaction speed through decentralized ledgers. Tokenization transforms property ownership into digital tokens, enabling fractional investment and increased liquidity in real estate markets. Discover how these innovations reshape real estate investment and ownership models.

Why it is important

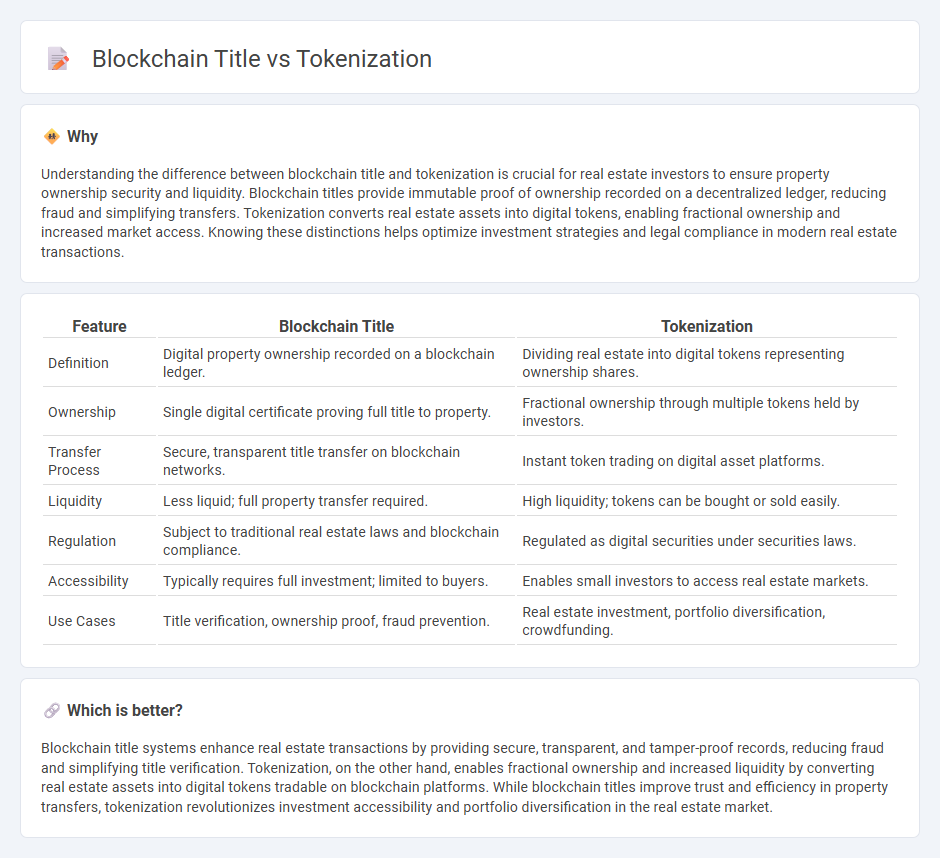

Understanding the difference between blockchain title and tokenization is crucial for real estate investors to ensure property ownership security and liquidity. Blockchain titles provide immutable proof of ownership recorded on a decentralized ledger, reducing fraud and simplifying transfers. Tokenization converts real estate assets into digital tokens, enabling fractional ownership and increased market access. Knowing these distinctions helps optimize investment strategies and legal compliance in modern real estate transactions.

Comparison Table

| Feature | Blockchain Title | Tokenization |

|---|---|---|

| Definition | Digital property ownership recorded on a blockchain ledger. | Dividing real estate into digital tokens representing ownership shares. |

| Ownership | Single digital certificate proving full title to property. | Fractional ownership through multiple tokens held by investors. |

| Transfer Process | Secure, transparent title transfer on blockchain networks. | Instant token trading on digital asset platforms. |

| Liquidity | Less liquid; full property transfer required. | High liquidity; tokens can be bought or sold easily. |

| Regulation | Subject to traditional real estate laws and blockchain compliance. | Regulated as digital securities under securities laws. |

| Accessibility | Typically requires full investment; limited to buyers. | Enables small investors to access real estate markets. |

| Use Cases | Title verification, ownership proof, fraud prevention. | Real estate investment, portfolio diversification, crowdfunding. |

Which is better?

Blockchain title systems enhance real estate transactions by providing secure, transparent, and tamper-proof records, reducing fraud and simplifying title verification. Tokenization, on the other hand, enables fractional ownership and increased liquidity by converting real estate assets into digital tokens tradable on blockchain platforms. While blockchain titles improve trust and efficiency in property transfers, tokenization revolutionizes investment accessibility and portfolio diversification in the real estate market.

Connection

Blockchain technology revolutionizes real estate by enabling secure, transparent property title management through immutable digital records. Tokenization divides real estate assets into digital tokens representing ownership shares, enhancing liquidity and accessibility for investors. Combining blockchain's decentralized ledger with tokenization facilitates seamless property transfers and fractional investment opportunities.

Key Terms

Asset Fractionalization

Asset fractionalization transforms high-value assets into tradeable digital tokens, increasing liquidity and accessibility on blockchain platforms. Tokenization enables precise asset division, allowing multiple investors to hold fractional ownership securely and transparently. Explore how blockchain-powered tokenization is revolutionizing asset management and democratizing investment opportunities.

Smart Contracts

Smart contracts revolutionize tokenization by automating asset transfers on blockchain networks, enhancing transparency and security. Tokenization converts physical or digital assets into tradable tokens, while blockchain provides the decentralized ledger that enforces smart contract rules without intermediaries. Discover how integrating smart contracts with tokenization optimizes asset management and investment opportunities.

Immutable Ledger

Tokenization enhances the ability of blockchain to serve as an immutable ledger by converting assets into digital tokens that can be securely and transparently tracked. Blockchain's decentralized and cryptographic framework ensures that once transactions are recorded, they cannot be altered, providing a tamper-proof history. Explore the benefits of combining tokenization with blockchain for robust, immutable record-keeping.

Source and External Links

Payment tokenization: What it is and how it works - Tokenization is a security process that replaces sensitive payment data with a unique token, allowing businesses to securely store and process payments without exposing original data, improving security and reducing fraud risk.

Tokenization (data security) - Tokenization substitutes sensitive data with non-sensitive tokens and can apply to asset rights on blockchain, allowing secure, tamper-resistant digital representation and transfer of assets and data access control.

Tokenization | Identification for Development - ID4D - Tokenization replaces sensitive identifiers or personal data with non-sensitive tokens to protect privacy by limiting data exposure and reducing the risk of identity correlation and fraud across databases.

dowidth.com

dowidth.com