Sale leaseback transactions allow property owners to sell their real estate assets while immediately leasing them back to maintain operational control and liquidity. Property management agreements involve hiring a third-party professional to oversee the day-to-day operations, maintenance, and tenant relations of rental properties. Explore the key differences and benefits of each strategy to determine the best fit for your real estate portfolio.

Why it is important

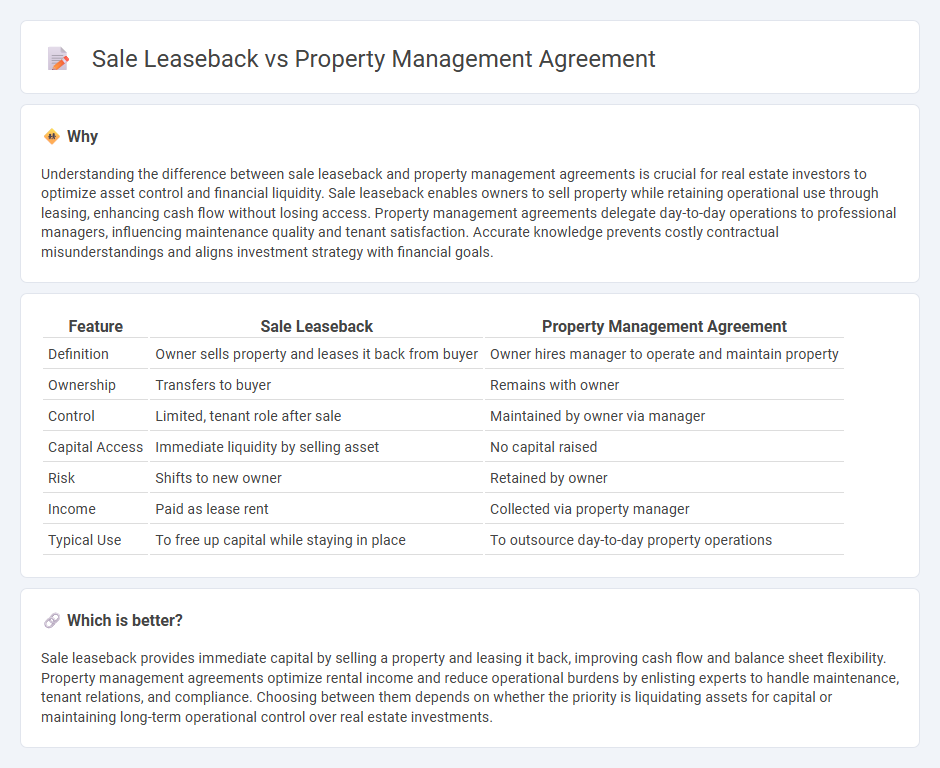

Understanding the difference between sale leaseback and property management agreements is crucial for real estate investors to optimize asset control and financial liquidity. Sale leaseback enables owners to sell property while retaining operational use through leasing, enhancing cash flow without losing access. Property management agreements delegate day-to-day operations to professional managers, influencing maintenance quality and tenant satisfaction. Accurate knowledge prevents costly contractual misunderstandings and aligns investment strategy with financial goals.

Comparison Table

| Feature | Sale Leaseback | Property Management Agreement |

|---|---|---|

| Definition | Owner sells property and leases it back from buyer | Owner hires manager to operate and maintain property |

| Ownership | Transfers to buyer | Remains with owner |

| Control | Limited, tenant role after sale | Maintained by owner via manager |

| Capital Access | Immediate liquidity by selling asset | No capital raised |

| Risk | Shifts to new owner | Retained by owner |

| Income | Paid as lease rent | Collected via property manager |

| Typical Use | To free up capital while staying in place | To outsource day-to-day property operations |

Which is better?

Sale leaseback provides immediate capital by selling a property and leasing it back, improving cash flow and balance sheet flexibility. Property management agreements optimize rental income and reduce operational burdens by enlisting experts to handle maintenance, tenant relations, and compliance. Choosing between them depends on whether the priority is liquidating assets for capital or maintaining long-term operational control over real estate investments.

Connection

Sale leaseback transactions involve a property owner selling an asset and simultaneously leasing it back to retain operational use, while property management agreements outline the duties of managing the leased property. Both legal frameworks facilitate continued control and optimized utilization of real estate assets for the owner-occupier or investor. Integrating sale leaseback with property management agreements ensures seamless asset oversight, maintenance, and tenant relations under a consistent management strategy.

Key Terms

Property Management Agreement:

A Property Management Agreement outlines the responsibilities and duties of a property manager in overseeing real estate assets, including tenant relations, rent collection, maintenance, and compliance with local laws. This contract ensures property owners retain ownership while delegating daily operational tasks to experienced professionals, enhancing asset value and operational efficiency. Explore the detailed benefits and contractual elements of Property Management Agreements to optimize your real estate investment strategy.

Management Fee

A property management agreement typically involves a management fee calculated as a percentage of collected rents, often ranging from 4% to 12%, covering services like tenant screening and maintenance coordination. In contrast, a sale leaseback transaction focuses on transferring property ownership while the seller becomes the lessee, with management fees potentially embedded in lease payments rather than separate charges. Explore detailed comparisons to understand which financial structure best suits your investment and operational goals.

Scope of Services

A property management agreement outlines specific services such as maintenance, rent collection, tenant relations, and property inspections, ensuring the ongoing operation and upkeep of the property. In contrast, a sale-leaseback primarily involves the sale of the property to an investor with a simultaneous leaseback arrangement, focusing on financing benefits rather than detailed management responsibilities. Explore deeper insights on how these distinct service scopes impact property ownership and cash flow strategies.

Source and External Links

The Complete Guide to a Property Management Agreement - This article provides a comprehensive overview of the essential elements in a property management agreement, including identification of parties, property description, and scope of services.

Property Management Agreement Template - This webpage offers a professional template for drafting a property management agreement, outlining key sections such as engagement, term, compensation, and indemnification.

Property Management Agreement Guide for Landlords - This guide equips landlords with detailed information on property management agreements, covering aspects like scope of services, financial arrangements, and protections for both parties.

dowidth.com

dowidth.com