Escrow crowdfunding and timeshare investments offer distinct approaches to real estate ownership, with escrow crowdfunding allowing multiple investors to pool funds securely for property acquisitions, ensuring transaction transparency and protection. Timeshare investments provide shared usage rights for vacation properties, offering cost-effective access but limited ownership and resale flexibility. Explore the advantages and drawbacks of each method to determine the best fit for your real estate portfolio.

Why it is important

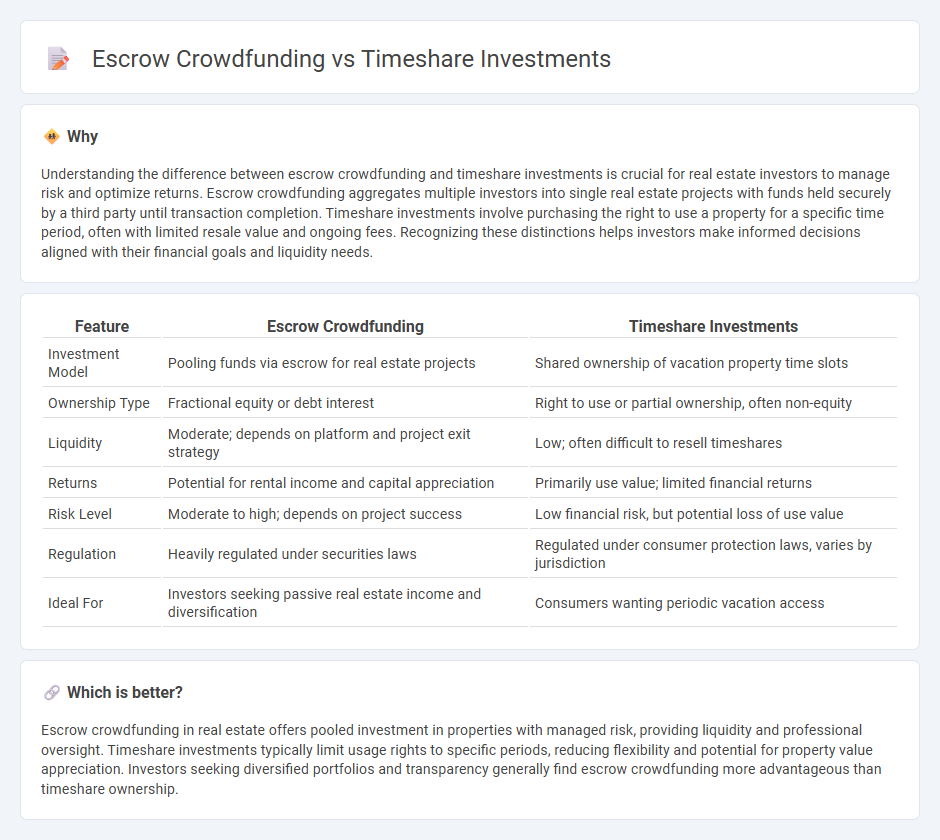

Understanding the difference between escrow crowdfunding and timeshare investments is crucial for real estate investors to manage risk and optimize returns. Escrow crowdfunding aggregates multiple investors into single real estate projects with funds held securely by a third party until transaction completion. Timeshare investments involve purchasing the right to use a property for a specific time period, often with limited resale value and ongoing fees. Recognizing these distinctions helps investors make informed decisions aligned with their financial goals and liquidity needs.

Comparison Table

| Feature | Escrow Crowdfunding | Timeshare Investments |

|---|---|---|

| Investment Model | Pooling funds via escrow for real estate projects | Shared ownership of vacation property time slots |

| Ownership Type | Fractional equity or debt interest | Right to use or partial ownership, often non-equity |

| Liquidity | Moderate; depends on platform and project exit strategy | Low; often difficult to resell timeshares |

| Returns | Potential for rental income and capital appreciation | Primarily use value; limited financial returns |

| Risk Level | Moderate to high; depends on project success | Low financial risk, but potential loss of use value |

| Regulation | Heavily regulated under securities laws | Regulated under consumer protection laws, varies by jurisdiction |

| Ideal For | Investors seeking passive real estate income and diversification | Consumers wanting periodic vacation access |

Which is better?

Escrow crowdfunding in real estate offers pooled investment in properties with managed risk, providing liquidity and professional oversight. Timeshare investments typically limit usage rights to specific periods, reducing flexibility and potential for property value appreciation. Investors seeking diversified portfolios and transparency generally find escrow crowdfunding more advantageous than timeshare ownership.

Connection

Escrow in real estate crowdfunding secures investors' funds until project milestones are met, ensuring transparency and trust. Timeshare investments similarly use escrow accounts to hold buyers' payments, safeguarding transactions amid shared property ownership. Both methods leverage escrow to mitigate risks and provide a structured financial framework in fractional real estate investments.

Key Terms

Timeshare Investments:

Timeshare investments offer shared ownership of vacation properties, allowing investors to enjoy fixed weeks or points annually while potentially benefiting from property appreciation and rental income. Unlike escrow crowdfunding, which pools funds for various projects under strict regulatory oversight, timeshare investments provide direct access to leisure real estate with tangible usage rights and established resale markets. Explore detailed comparisons and investment strategies to maximize returns in the timeshare market.

Right-to-Use

Timeshare investments typically grant a Right-to-Use (RTU) agreement, allowing buyers limited-time access to a property without ownership, while escrow crowdfunding involves pooling funds under legal escrow to finance real estate projects with shared equity or debt returns. RTU in timeshare limits investor control and resale value compared to equity stakes often available in escrow crowdfunding, which may provide clearer asset ownership and regulatory protections. Explore detailed comparisons of RTU structures and investor rights to make informed real estate investment decisions.

Maintenance Fees

Timeshare investments often involve ongoing maintenance fees that can increase over time, impacting overall profitability and requiring consistent financial commitment from owners. Escrow crowdfunding platforms typically manage funds transparently and allocate maintenance costs through pooled investments, reducing individual financial risk and promoting shared responsibility. Explore the differences in fee structures and financial management to make informed investment decisions.

Source and External Links

Are Timeshares A Good Investment - Fidelity Real Estate - Timeshares offer flexible vacation access and promote annual getaways, but they should not be viewed as financial investments as their value typically depreciates and comes with ongoing fees.

What is a timeshare and how does it work? - Rocket Mortgage - Buying a timeshare involves a significant upfront cost, annual maintenance fees that often rise over time, and potential exchange fees, while resale values are usually much lower than the original purchase price.

How Timeshares Work and Their Costs Explained - Pacaso - Timeshares grant usage rights for a specific property during set periods each year, but they lack equity, tax benefits, or rental income, and reselling is difficult due to a saturated market.

dowidth.com

dowidth.com