Real estate crowdfunding and private equity real estate funds offer distinct investment pathways: crowdfunding provides smaller investors access to property projects through online platforms, while private equity funds involve pooled capital from accredited investors targeting larger-scale developments. Crowdfunding typically features lower entry thresholds and liquidity but may carry higher risks and less regulatory oversight compared to private equity funds. Explore the differences in risk, returns, and investment structure to determine the best fit for your real estate portfolio.

Why it is important

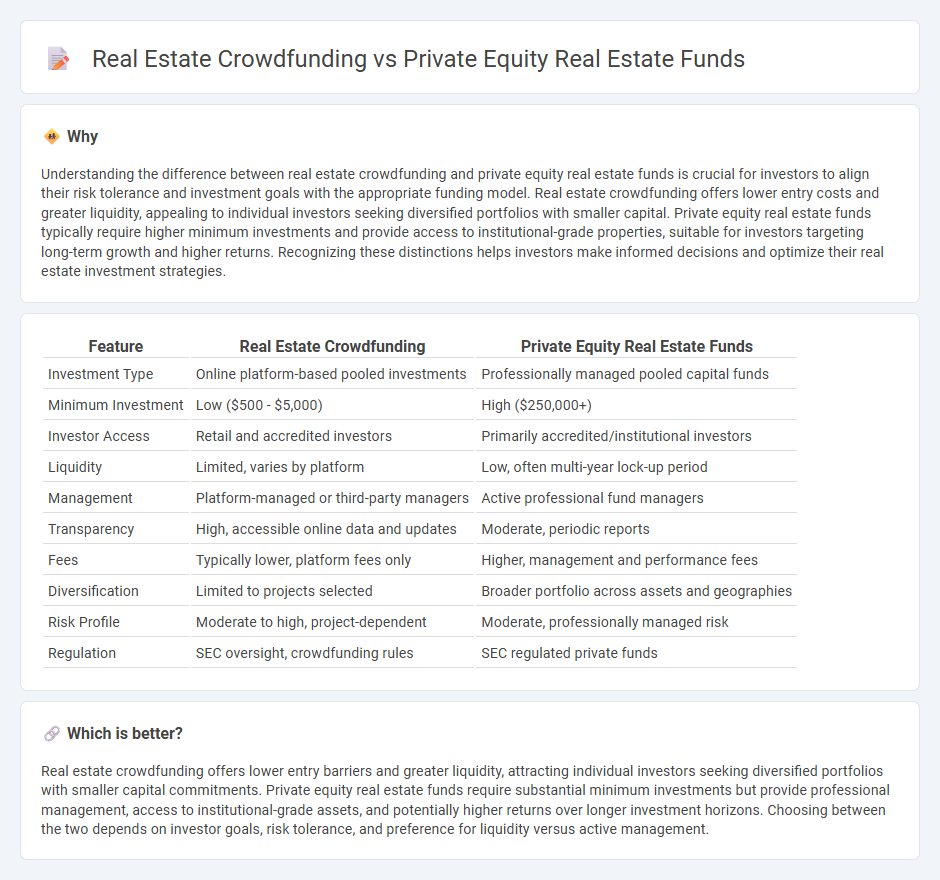

Understanding the difference between real estate crowdfunding and private equity real estate funds is crucial for investors to align their risk tolerance and investment goals with the appropriate funding model. Real estate crowdfunding offers lower entry costs and greater liquidity, appealing to individual investors seeking diversified portfolios with smaller capital. Private equity real estate funds typically require higher minimum investments and provide access to institutional-grade properties, suitable for investors targeting long-term growth and higher returns. Recognizing these distinctions helps investors make informed decisions and optimize their real estate investment strategies.

Comparison Table

| Feature | Real Estate Crowdfunding | Private Equity Real Estate Funds |

|---|---|---|

| Investment Type | Online platform-based pooled investments | Professionally managed pooled capital funds |

| Minimum Investment | Low ($500 - $5,000) | High ($250,000+) |

| Investor Access | Retail and accredited investors | Primarily accredited/institutional investors |

| Liquidity | Limited, varies by platform | Low, often multi-year lock-up period |

| Management | Platform-managed or third-party managers | Active professional fund managers |

| Transparency | High, accessible online data and updates | Moderate, periodic reports |

| Fees | Typically lower, platform fees only | Higher, management and performance fees |

| Diversification | Limited to projects selected | Broader portfolio across assets and geographies |

| Risk Profile | Moderate to high, project-dependent | Moderate, professionally managed risk |

| Regulation | SEC oversight, crowdfunding rules | SEC regulated private funds |

Which is better?

Real estate crowdfunding offers lower entry barriers and greater liquidity, attracting individual investors seeking diversified portfolios with smaller capital commitments. Private equity real estate funds require substantial minimum investments but provide professional management, access to institutional-grade assets, and potentially higher returns over longer investment horizons. Choosing between the two depends on investor goals, risk tolerance, and preference for liquidity versus active management.

Connection

Real estate crowdfunding and private equity real estate funds both provide alternative investment opportunities in property markets by pooling capital from multiple investors to acquire, manage, and develop real estate assets. Crowdfunding platforms democratize access to real estate investments, allowing smaller investors to participate, while private equity real estate funds typically involve larger, institutional investors with higher minimum commitments. Both models offer diversified portfolios, professional management, and potential for attractive risk-adjusted returns in commercial and residential real estate sectors.

Key Terms

Investment Structure

Private equity real estate funds pool capital from accredited investors to acquire and manage diversified property portfolios, typically involving higher minimum investments and longer lock-in periods. Real estate crowdfunding platforms enable individual investors to participate in specific property projects with lower minimum investments and more flexible exit options through online marketplaces. Explore detailed comparisons to determine which investment structure aligns best with your financial goals and risk tolerance.

Minimum Investment

Private equity real estate funds typically require minimum investments ranging from $250,000 to $1 million, making them accessible primarily to institutional and accredited investors. Real estate crowdfunding platforms offer significantly lower minimum investments, often as low as $500 to $5,000, allowing a broader audience to participate in property investments. Explore detailed comparisons to understand which investment option aligns best with your financial goals and risk tolerance.

Liquidity

Private equity real estate funds typically have lower liquidity due to longer lock-in periods and limited redemption opportunities, making them suitable for investors with extended time horizons. In contrast, real estate crowdfunding platforms offer more liquidity by enabling smaller investments and shorter commitment durations, often through secondary markets or periodic redemption options. Explore the differences in liquidity to determine which investment vehicle aligns best with your financial goals.

Source and External Links

The Ultimate Guide to Private Equity Real Estate Investing - This guide provides an overview of private equity real estate investing, highlighting how funds are raised, the role of sponsors, and the types of investments they typically make.

How to Set Up a Private Equity Real Estate Fund - This article outlines the steps to create and manage a private equity real estate fund, explaining its structure and benefits in diversifying and expanding funding sources.

Detailed Guide on Private Equity Real Estate (PERE) - This guide covers various aspects of private equity real estate, including its definition, how it works, pros and cons, and roles within the industry.

dowidth.com

dowidth.com