Smart lease agreements leverage technology to automate rent calculations, enhance transparency, and provide real-time data analytics for landlords and tenants. Percentage leases tie rent to a tenant's sales revenue, aligning rental costs with business performance in retail or commercial properties. Explore how each lease type can optimize income strategies and tenant relationships in various real estate markets.

Why it is important

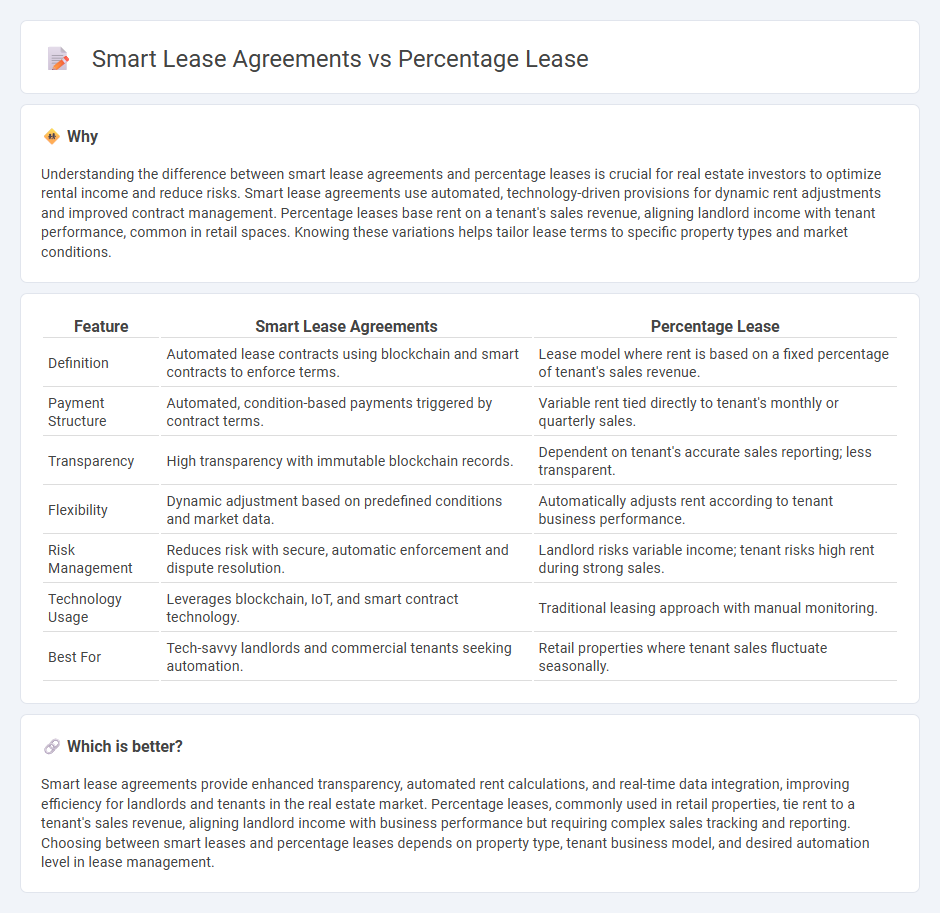

Understanding the difference between smart lease agreements and percentage leases is crucial for real estate investors to optimize rental income and reduce risks. Smart lease agreements use automated, technology-driven provisions for dynamic rent adjustments and improved contract management. Percentage leases base rent on a tenant's sales revenue, aligning landlord income with tenant performance, common in retail spaces. Knowing these variations helps tailor lease terms to specific property types and market conditions.

Comparison Table

| Feature | Smart Lease Agreements | Percentage Lease |

|---|---|---|

| Definition | Automated lease contracts using blockchain and smart contracts to enforce terms. | Lease model where rent is based on a fixed percentage of tenant's sales revenue. |

| Payment Structure | Automated, condition-based payments triggered by contract terms. | Variable rent tied directly to tenant's monthly or quarterly sales. |

| Transparency | High transparency with immutable blockchain records. | Dependent on tenant's accurate sales reporting; less transparent. |

| Flexibility | Dynamic adjustment based on predefined conditions and market data. | Automatically adjusts rent according to tenant business performance. |

| Risk Management | Reduces risk with secure, automatic enforcement and dispute resolution. | Landlord risks variable income; tenant risks high rent during strong sales. |

| Technology Usage | Leverages blockchain, IoT, and smart contract technology. | Traditional leasing approach with manual monitoring. |

| Best For | Tech-savvy landlords and commercial tenants seeking automation. | Retail properties where tenant sales fluctuate seasonally. |

Which is better?

Smart lease agreements provide enhanced transparency, automated rent calculations, and real-time data integration, improving efficiency for landlords and tenants in the real estate market. Percentage leases, commonly used in retail properties, tie rent to a tenant's sales revenue, aligning landlord income with business performance but requiring complex sales tracking and reporting. Choosing between smart leases and percentage leases depends on property type, tenant business model, and desired automation level in lease management.

Connection

Smart lease agreements incorporate real-time data and automated adjustments, allowing percentage leases to dynamically align rent payments with actual sales performance. Percentage leases benefit from blockchain technology and IoT integration within smart leases, ensuring transparent and accurate revenue tracking. This connection enhances trust and financial efficiency between landlords and tenants in commercial real estate.

Key Terms

Rent Calculation

Percentage leases calculate rent based on a fixed percentage of gross sales, providing flexibility aligned with business performance, often used in retail settings. Smart lease agreements leverage advanced data analytics and IoT technologies to dynamically adjust rent based on real-time operational metrics, enhancing precision and tenant-landlord transparency. Explore the benefits and mechanisms of each rent calculation method to optimize your lease strategy.

Technology Integration

Percentage lease agreements link rental payments directly to a tenant's revenue, promoting alignment between landlords and businesses, commonly seen in retail sectors benefiting from shared success. Smart lease agreements leverage technology integration such as IoT sensors, automated maintenance alerts, and digital payment systems to enhance operational efficiency and data transparency in commercial property management. Explore how these innovative lease structures are transforming property leasing dynamics with technology-driven benefits.

Expense Sharing

Percentage lease agreements allocate rent as a proportion of gross sales, aligning landlord income with tenant revenue, which facilitates transparent expense sharing by correlating financial obligations to business performance. Smart lease agreements integrate technology-driven data analytics and IoT-enabled expense tracking, enabling real-time expense monitoring and automated cost distribution between landlord and tenant for enhanced accuracy. Explore how these innovative leasing models optimize expense sharing and improve landlord-tenant financial dynamics.

Source and External Links

Percentage Lease | Formula + Calculator - A percentage lease is a leasing arrangement where the tenant pays a base rent plus a percentage of their gross sales once it exceeds a predefined breakpoint.

Percentage Lease: How Does It Work in Commercial Real Estate - A percentage lease involves a tenant paying a base rent plus a percentage of sales above a break-even point, aligning both parties' interests in the tenant's success.

Percentage Lease - Overview, How It Works, Components, Example - A percentage lease is an arrangement where a tenant pays a predetermined base rent plus a percentage of sales above a specified breakpoint, typically used in retail commercial real estate.

dowidth.com

dowidth.com