Single-family rental portfolios offer stable, long-term income through steady tenant occupancy and lower management intensity compared to short-term rental portfolios, which generate higher revenue potential by targeting vacationers and business travelers but require frequent turnover and active marketing. Market trends indicate single-family rentals are favored for consistent cash flow and lower volatility, whereas short-term rentals benefit from peak-season pricing and flexibility in rental terms. Explore deeper insights into portfolio strategies and performance metrics to optimize your real estate investments.

Why it is important

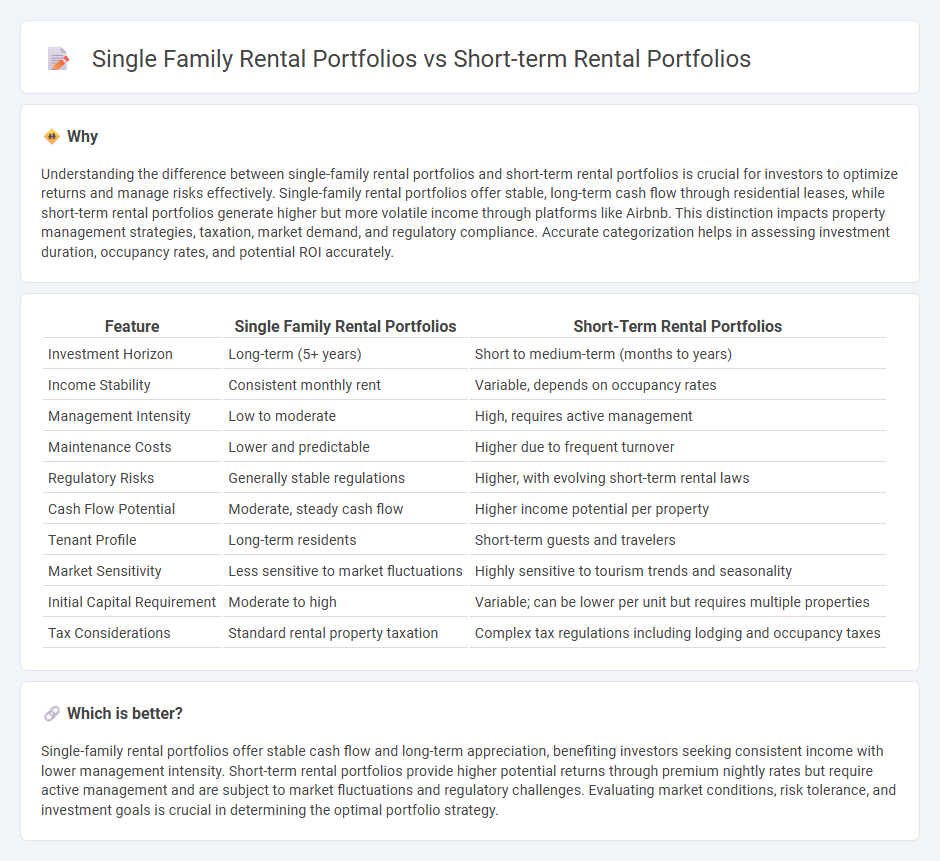

Understanding the difference between single-family rental portfolios and short-term rental portfolios is crucial for investors to optimize returns and manage risks effectively. Single-family rental portfolios offer stable, long-term cash flow through residential leases, while short-term rental portfolios generate higher but more volatile income through platforms like Airbnb. This distinction impacts property management strategies, taxation, market demand, and regulatory compliance. Accurate categorization helps in assessing investment duration, occupancy rates, and potential ROI accurately.

Comparison Table

| Feature | Single Family Rental Portfolios | Short-Term Rental Portfolios |

|---|---|---|

| Investment Horizon | Long-term (5+ years) | Short to medium-term (months to years) |

| Income Stability | Consistent monthly rent | Variable, depends on occupancy rates |

| Management Intensity | Low to moderate | High, requires active management |

| Maintenance Costs | Lower and predictable | Higher due to frequent turnover |

| Regulatory Risks | Generally stable regulations | Higher, with evolving short-term rental laws |

| Cash Flow Potential | Moderate, steady cash flow | Higher income potential per property |

| Tenant Profile | Long-term residents | Short-term guests and travelers |

| Market Sensitivity | Less sensitive to market fluctuations | Highly sensitive to tourism trends and seasonality |

| Initial Capital Requirement | Moderate to high | Variable; can be lower per unit but requires multiple properties |

| Tax Considerations | Standard rental property taxation | Complex tax regulations including lodging and occupancy taxes |

Which is better?

Single-family rental portfolios offer stable cash flow and long-term appreciation, benefiting investors seeking consistent income with lower management intensity. Short-term rental portfolios provide higher potential returns through premium nightly rates but require active management and are subject to market fluctuations and regulatory challenges. Evaluating market conditions, risk tolerance, and investment goals is crucial in determining the optimal portfolio strategy.

Connection

Single family rental portfolios and short-term rental portfolios intersect through their shared utilization of residential properties for generating rental income. Both investment strategies rely on property management efficiency, local market demand, and occupancy rates to maximize returns. Understanding tenant behavior and regulatory environments is crucial for optimizing cash flow and property valuation in these evolving real estate sectors.

Key Terms

Occupancy Rate

Short-term rental portfolios typically achieve higher occupancy rates due to their flexibility and appeal to travelers seeking temporary stays, often exceeding 75-85% occupancy compared to single-family rental portfolios averaging 90-95% but with longer lease commitments. Single-family rentals benefit from stability and lower tenant turnover, offering consistent occupancy driven by long-term leases that reduce vacancy periods, typically maintaining occupancy rates of around 92-95%. Explore in-depth analytics to optimize occupancy strategies for both short-term and single-family rental portfolios.

Cash Flow

Short-term rental portfolios generate higher cash flow per unit compared to single-family rental portfolios due to premium nightly rates and increased booking frequency. Single-family rentals provide steadier, more predictable income with lower management intensity but typically yield lower monthly cash flow. Explore detailed cash flow analyses to determine the optimal investment strategy for your real estate portfolio.

Property Management

Short-term rental portfolios require dynamic property management strategies that emphasize frequent guest turnover, meticulous cleaning schedules, and real-time pricing optimization to maximize occupancy and revenue. Single family rental portfolios benefit from stable, long-term tenants, reducing management intensity with routine maintenance and consistent rent collection. Discover effective property management techniques tailored to both portfolio types for enhanced operational efficiency and profitability.

Source and External Links

Starting a Short Term Rental Investment Portfolio - This article discusses the growth of short-term rentals as a lucrative investment strategy, offering higher income potential compared to long-term rentals.

Building a Short-Term Rental Portfolio from Scratch - It shares the story of Travis and Regan Perry, who successfully built a multi-state short-term rental portfolio by focusing on strategic market selection and leveraging tax benefits.

How to Find an Airbnb Portfolio for Sale (or Sell Yours) - This guide provides insights on purchasing or selling Airbnb portfolios, exploring sources like wholesalers, local real estate meetups, and online forums.

dowidth.com

dowidth.com