Leaseback programs allow property owners to sell their assets to investors while continuing to occupy or use the property under a lease, ensuring steady income and reduced management responsibilities. Management agreements grant property owners the option to hire professional firms to handle day-to-day operations, maintenance, and tenant relations without transferring ownership. Explore the key differences and benefits of each to determine the best strategy for your real estate portfolio.

Why it is important

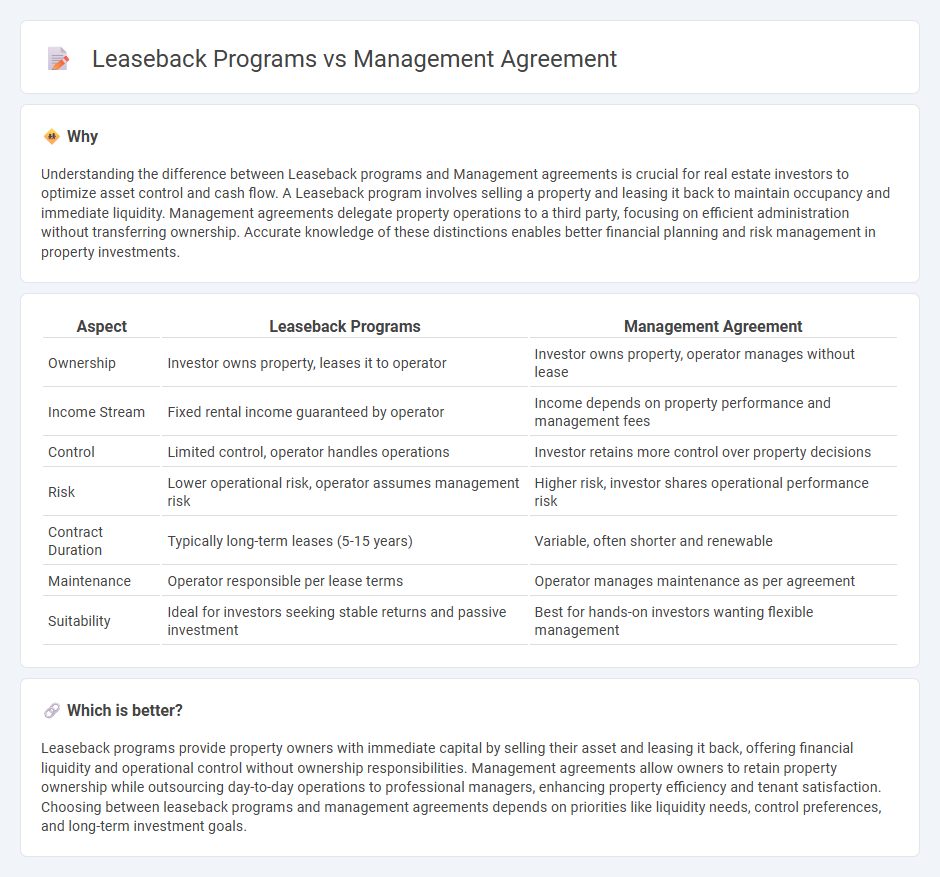

Understanding the difference between Leaseback programs and Management agreements is crucial for real estate investors to optimize asset control and cash flow. A Leaseback program involves selling a property and leasing it back to maintain occupancy and immediate liquidity. Management agreements delegate property operations to a third party, focusing on efficient administration without transferring ownership. Accurate knowledge of these distinctions enables better financial planning and risk management in property investments.

Comparison Table

| Aspect | Leaseback Programs | Management Agreement |

|---|---|---|

| Ownership | Investor owns property, leases it to operator | Investor owns property, operator manages without lease |

| Income Stream | Fixed rental income guaranteed by operator | Income depends on property performance and management fees |

| Control | Limited control, operator handles operations | Investor retains more control over property decisions |

| Risk | Lower operational risk, operator assumes management risk | Higher risk, investor shares operational performance risk |

| Contract Duration | Typically long-term leases (5-15 years) | Variable, often shorter and renewable |

| Maintenance | Operator responsible per lease terms | Operator manages maintenance as per agreement |

| Suitability | Ideal for investors seeking stable returns and passive investment | Best for hands-on investors wanting flexible management |

Which is better?

Leaseback programs provide property owners with immediate capital by selling their asset and leasing it back, offering financial liquidity and operational control without ownership responsibilities. Management agreements allow owners to retain property ownership while outsourcing day-to-day operations to professional managers, enhancing property efficiency and tenant satisfaction. Choosing between leaseback programs and management agreements depends on priorities like liquidity needs, control preferences, and long-term investment goals.

Connection

Leaseback programs involve property owners selling their real estate while retaining the right to lease it back, ensuring continued occupancy and income stability. Management agreements complement leaseback programs by assigning professional firms to handle leasing, maintenance, and tenant relations, optimizing property performance and value. Together, they create a synergistic model that maximizes asset liquidity and operational efficiency in real estate investments.

Key Terms

Authority

Management agreements grant the property manager authority to oversee daily operations, maintenance, and tenant relations without transferring ownership rights, ensuring the owner retains control over strategic decisions. Leaseback programs transfer property ownership to an investor while the original owner leases the property back, limiting the owner's control and authority over property management. Explore the differences in authority and control between these two arrangements to determine the best fit for your investment goals.

Income distribution

Management agreements typically provide income distribution through fixed fees or profit-sharing based on property performance, ensuring predictable cash flow for owners. Leaseback programs generate income by leasing the asset back to the seller, often resulting in steady rental payments and potential tax benefits. Explore the nuances of these income distribution strategies to optimize your investment returns.

Responsibility allocation

Management agreements allocate operational responsibilities to a third party while the property owner retains ownership and financial liability. Leaseback programs transfer both property ownership and lease obligations to an investor, shifting maintenance and risk to the new owner. Explore further to understand how these structures impact financial and operational control.

Source and External Links

Management Agreement: What is it? Key Terms, Considerations - This webpage provides an overview of management agreements, including steps to create one and key considerations like consultation with an attorney and specifying remedies for violations.

Management Agreement - Legal GPS - This resource offers guidance on writing a management agreement, including essential provisions like the introduction, definition of services, and sample language for clarity.

What is a Management Contract? - PandaDoc - This webpage explains what a management contract is and outlines critical elements to include when drafting one, such as duration, expectations, payment details, and breach consequences.

dowidth.com

dowidth.com