Automated valuation models (AVMs) utilize algorithms and extensive property data to estimate home values quickly and cost-effectively, providing a scalable solution for lenders and real estate professionals. Drive-by appraisals involve licensed appraisers conducting a physical exterior inspection to assess property conditions, offering more accuracy but at higher time and expense. Explore the detailed comparisons between AVMs and drive-by appraisals to determine the best valuation method for your real estate needs.

Why it is important

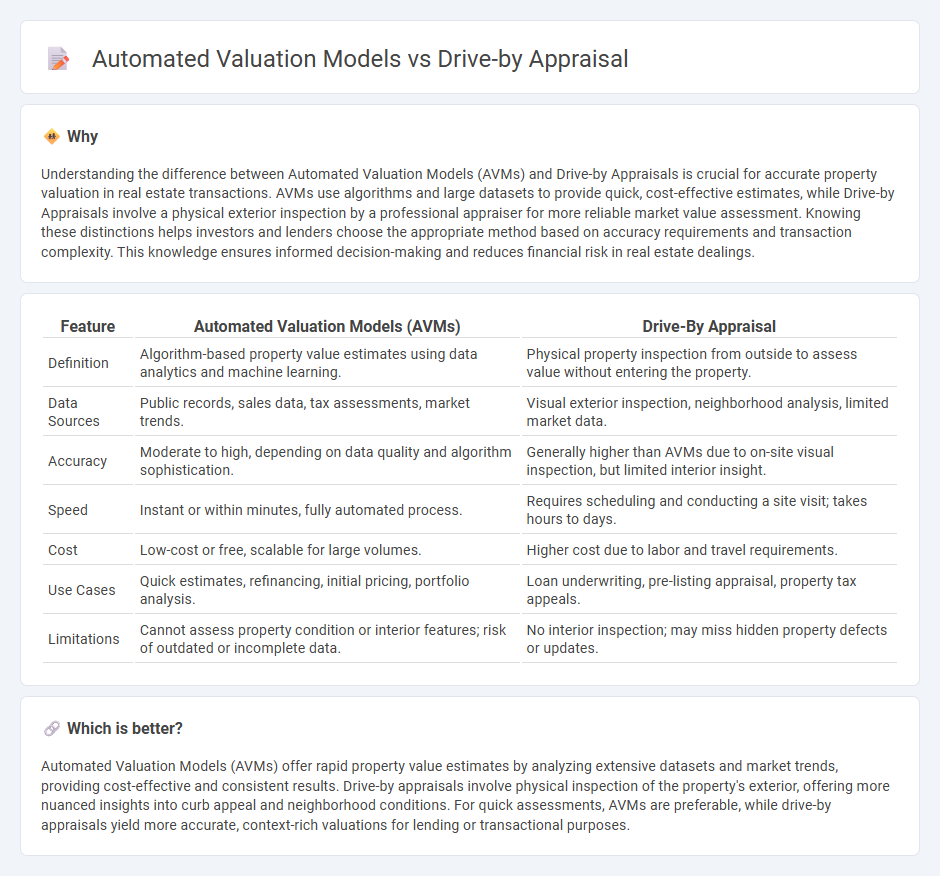

Understanding the difference between Automated Valuation Models (AVMs) and Drive-by Appraisals is crucial for accurate property valuation in real estate transactions. AVMs use algorithms and large datasets to provide quick, cost-effective estimates, while Drive-by Appraisals involve a physical exterior inspection by a professional appraiser for more reliable market value assessment. Knowing these distinctions helps investors and lenders choose the appropriate method based on accuracy requirements and transaction complexity. This knowledge ensures informed decision-making and reduces financial risk in real estate dealings.

Comparison Table

| Feature | Automated Valuation Models (AVMs) | Drive-By Appraisal |

|---|---|---|

| Definition | Algorithm-based property value estimates using data analytics and machine learning. | Physical property inspection from outside to assess value without entering the property. |

| Data Sources | Public records, sales data, tax assessments, market trends. | Visual exterior inspection, neighborhood analysis, limited market data. |

| Accuracy | Moderate to high, depending on data quality and algorithm sophistication. | Generally higher than AVMs due to on-site visual inspection, but limited interior insight. |

| Speed | Instant or within minutes, fully automated process. | Requires scheduling and conducting a site visit; takes hours to days. |

| Cost | Low-cost or free, scalable for large volumes. | Higher cost due to labor and travel requirements. |

| Use Cases | Quick estimates, refinancing, initial pricing, portfolio analysis. | Loan underwriting, pre-listing appraisal, property tax appeals. |

| Limitations | Cannot assess property condition or interior features; risk of outdated or incomplete data. | No interior inspection; may miss hidden property defects or updates. |

Which is better?

Automated Valuation Models (AVMs) offer rapid property value estimates by analyzing extensive datasets and market trends, providing cost-effective and consistent results. Drive-by appraisals involve physical inspection of the property's exterior, offering more nuanced insights into curb appeal and neighborhood conditions. For quick assessments, AVMs are preferable, while drive-by appraisals yield more accurate, context-rich valuations for lending or transactional purposes.

Connection

Automated Valuation Models (AVMs) utilize algorithms and data analytics to estimate property values quickly, incorporating recent sales, market trends, and property attributes. Drive-by appraisals complement AVMs by providing on-site property inspections without entering the home, validating and refining automated estimates with physical observations. This synergy enhances accuracy in real estate valuation by combining data-driven insights with real-world condition assessments.

Key Terms

Exterior Inspection

Drive-by appraisals involve a licensed appraiser conducting a physical exterior inspection to assess property conditions and neighborhood characteristics, ensuring accurate valuation based on observable factors. Automated Valuation Models (AVMs) rely on algorithmic data analysis, using property records, recent sales, and tax assessments without any physical inspection, which may overlook unique exterior property features. Explore the detailed differences between these valuation methods to understand their impact on real estate accuracy and reliability.

Algorithmic Analysis

Drive-by appraisals rely on licensed appraisers conducting exterior inspections to assess property value, emphasizing human judgment and contextual understanding. Automated Valuation Models (AVMs) utilize advanced algorithms and extensive data sets, including recent sales, tax records, and market trends, delivering rapid and cost-effective property valuations. Explore how these algorithmic approaches transform real estate appraisals and impact market accuracy.

Market Comparables

Drive-by appraisals provide detailed, on-site property inspections, capturing market comparables with precision by assessing neighborhood conditions and recent sales firsthand. Automated valuation models (AVMs) rely on extensive databases and algorithms to generate quick estimates based on statistical analysis of comparable sales data. Explore the differences and benefits of each method to understand which appraisal approach best suits your property valuation needs.

Source and External Links

What Is A Drive-By Appraisal? - A drive-by appraisal is a home valuation method where appraisers assess the property's exterior without entering the home, relying on research and exterior observations to estimate value.

Drive-By Appraisal: How Does it Work? - This appraisal type involves evaluating a property's exterior and using online research to determine its value, often used in situations where interior access is not required.

What is a Drive-By Appraisal? - Drive-by appraisals are a cost-effective method for assessing property value by focusing on exterior conditions and market data, without the need for interior inspections.

dowidth.com

dowidth.com