Brownfield redevelopment involves transforming previously used or contaminated land into valuable real estate, boosting urban renewal and sustainability. Land banking focuses on acquiring and holding undeveloped or underutilized properties for future investment and strategic growth. Explore the advantages and challenges of each approach to optimize your real estate portfolio.

Why it is important

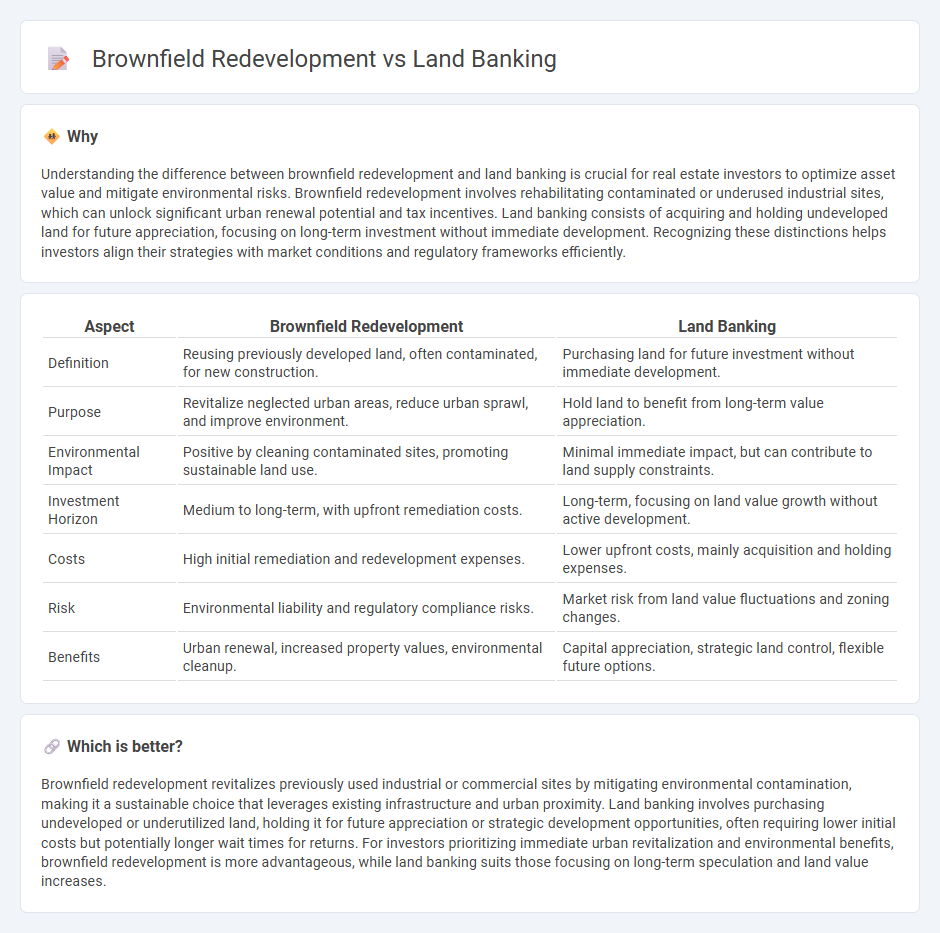

Understanding the difference between brownfield redevelopment and land banking is crucial for real estate investors to optimize asset value and mitigate environmental risks. Brownfield redevelopment involves rehabilitating contaminated or underused industrial sites, which can unlock significant urban renewal potential and tax incentives. Land banking consists of acquiring and holding undeveloped land for future appreciation, focusing on long-term investment without immediate development. Recognizing these distinctions helps investors align their strategies with market conditions and regulatory frameworks efficiently.

Comparison Table

| Aspect | Brownfield Redevelopment | Land Banking |

|---|---|---|

| Definition | Reusing previously developed land, often contaminated, for new construction. | Purchasing land for future investment without immediate development. |

| Purpose | Revitalize neglected urban areas, reduce urban sprawl, and improve environment. | Hold land to benefit from long-term value appreciation. |

| Environmental Impact | Positive by cleaning contaminated sites, promoting sustainable land use. | Minimal immediate impact, but can contribute to land supply constraints. |

| Investment Horizon | Medium to long-term, with upfront remediation costs. | Long-term, focusing on land value growth without active development. |

| Costs | High initial remediation and redevelopment expenses. | Lower upfront costs, mainly acquisition and holding expenses. |

| Risk | Environmental liability and regulatory compliance risks. | Market risk from land value fluctuations and zoning changes. |

| Benefits | Urban renewal, increased property values, environmental cleanup. | Capital appreciation, strategic land control, flexible future options. |

Which is better?

Brownfield redevelopment revitalizes previously used industrial or commercial sites by mitigating environmental contamination, making it a sustainable choice that leverages existing infrastructure and urban proximity. Land banking involves purchasing undeveloped or underutilized land, holding it for future appreciation or strategic development opportunities, often requiring lower initial costs but potentially longer wait times for returns. For investors prioritizing immediate urban revitalization and environmental benefits, brownfield redevelopment is more advantageous, while land banking suits those focusing on long-term speculation and land value increases.

Connection

Brownfield redevelopment involves repurposing previously industrial or contaminated sites, increasing urban land value and reducing sprawl. Land banking strategically acquires and holds these underutilized properties, enabling long-term planning and investment returns. Together, they optimize land use, enhance property portfolios, and support sustainable real estate development.

Key Terms

Appreciation

Land banking involves purchasing and holding undeveloped or underutilized land, anticipating significant appreciation over time driven by urban expansion and infrastructure improvements. Brownfield redevelopment focuses on revitalizing contaminated or previously developed sites, where appreciation hinges on successful site cleanup, regulatory approvals, and enhanced property utility. Explore the key differences in asset appreciation by understanding how land banking and brownfield redevelopment impact investment value growth.

Remediation

Land banking involves acquiring and holding undeveloped or underutilized land for future development, often requiring minimal initial remediation compared to brownfield sites, which are previously developed lands contaminated by hazardous substances needing extensive cleanup. Brownfield redevelopment emphasizes comprehensive remediation processes to restore environmental safety and facilitate new construction, boosting urban regeneration and sustainable development. Explore detailed strategies and benefits of remediation in land banking and brownfield redevelopment to optimize your investment and environmental impact.

Zoning

Zoning plays a critical role in land banking and brownfield redevelopment, with land banking often involving holding parcels designated for future zoning changes or urban expansion, preserving them for optimal use or sale. Brownfield redevelopment requires navigating existing zoning restrictions that may limit or guide the cleanup and repurposing of contaminated or underutilized industrial sites. Explore detailed zoning strategies influencing both land banking and brownfield redevelopment to optimize land use and investment outcomes.

Source and External Links

Land Banking - Wikipedia - Land banking refers to the practice of aggregating parcels of land for future sale or development, often managed by quasi-governmental entities in the United States.

Land Banks - Land banks are public entities that acquire and manage vacant properties to put them back into productive use according to community goals.

Land Banking: A Sound Approach to Residential Real Estate Pre - This article discusses land banking as a strategy that provides liquidity and shifts market risks, typically involving private credit vehicles and private equity funds.

dowidth.com

dowidth.com