Tokenized real estate allows investors to purchase digital tokens representing ownership shares of a property on a blockchain, enabling secure, transparent, and easily transferable investments. Fractional real estate ownership divides property stakes among investors but typically involves traditional legal structures and less liquidity compared to tokenization. Explore the advantages and challenges of tokenized versus fractional real estate ownership to make informed investment decisions.

Why it is important

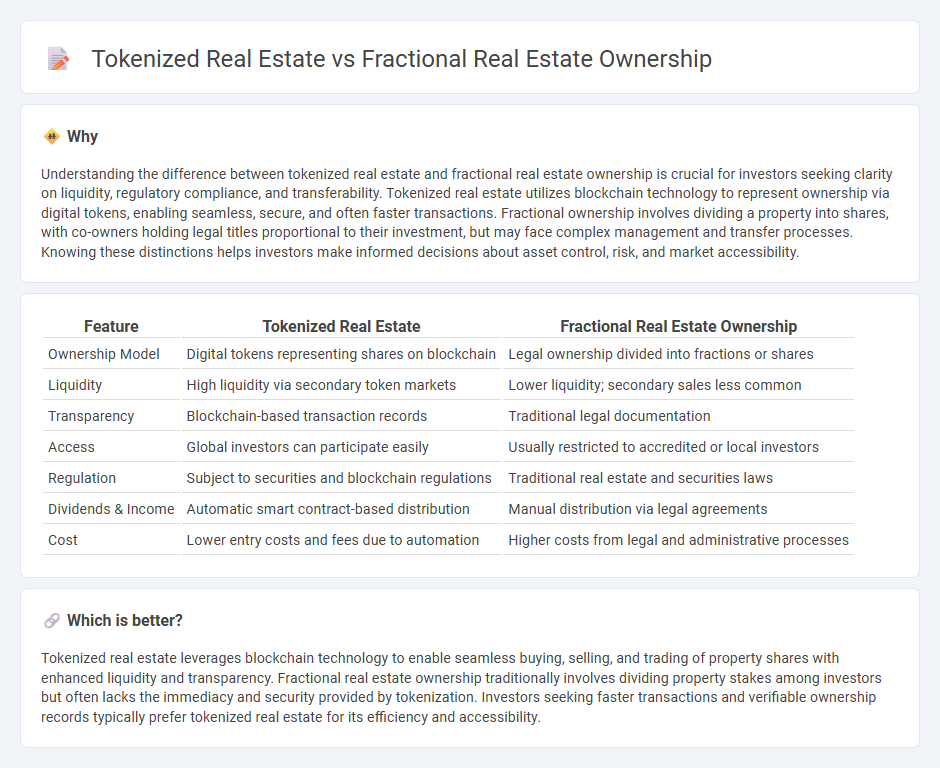

Understanding the difference between tokenized real estate and fractional real estate ownership is crucial for investors seeking clarity on liquidity, regulatory compliance, and transferability. Tokenized real estate utilizes blockchain technology to represent ownership via digital tokens, enabling seamless, secure, and often faster transactions. Fractional ownership involves dividing a property into shares, with co-owners holding legal titles proportional to their investment, but may face complex management and transfer processes. Knowing these distinctions helps investors make informed decisions about asset control, risk, and market accessibility.

Comparison Table

| Feature | Tokenized Real Estate | Fractional Real Estate Ownership |

|---|---|---|

| Ownership Model | Digital tokens representing shares on blockchain | Legal ownership divided into fractions or shares |

| Liquidity | High liquidity via secondary token markets | Lower liquidity; secondary sales less common |

| Transparency | Blockchain-based transaction records | Traditional legal documentation |

| Access | Global investors can participate easily | Usually restricted to accredited or local investors |

| Regulation | Subject to securities and blockchain regulations | Traditional real estate and securities laws |

| Dividends & Income | Automatic smart contract-based distribution | Manual distribution via legal agreements |

| Cost | Lower entry costs and fees due to automation | Higher costs from legal and administrative processes |

Which is better?

Tokenized real estate leverages blockchain technology to enable seamless buying, selling, and trading of property shares with enhanced liquidity and transparency. Fractional real estate ownership traditionally involves dividing property stakes among investors but often lacks the immediacy and security provided by tokenization. Investors seeking faster transactions and verifiable ownership records typically prefer tokenized real estate for its efficiency and accessibility.

Connection

Tokenized real estate enables fractional ownership by converting property assets into digital tokens on a blockchain, allowing investors to purchase and trade shares easily. This technology increases market liquidity and democratizes access to high-value real estate investments by lowering entry barriers. Fractional ownership leverages tokenization to enhance transparency, security, and real-time transferability of property shares among diverse investors.

Key Terms

Fractional Ownership

Fractional real estate ownership involves multiple investors holding a legal share of a physical property, often through a legally binding agreement or a limited liability company, providing traditional asset security and potential rental income. This method typically requires higher minimum investments and has longer transaction times compared to tokenized real estate, which uses blockchain technology to divide property into digital tokens for easier liquidity and accessibility. Explore the benefits and mechanisms of fractional ownership to understand how it can diversify your real estate portfolio.

Tokenization

Tokenized real estate leverages blockchain technology to digitize property assets into tradable tokens, enabling fractional ownership with enhanced liquidity and transparency compared to traditional fractional real estate ownership. This approach reduces entry barriers for investors, streamlines transactions through smart contracts, and offers real-time asset tracking on decentralized ledgers. Discover how tokenization is revolutionizing real estate investments and unlocking new opportunities for global investors.

Blockchain

Fractional real estate ownership involves dividing property shares among multiple investors, relying primarily on traditional legal frameworks, whereas tokenized real estate leverages blockchain technology to represent property shares as digital tokens on a decentralized ledger, enhancing transparency, liquidity, and security. Blockchain enables instantaneous transactions and immutable records, drastically reducing intermediary costs and increasing accessibility to a global investor base. Explore further to understand how tokenization is revolutionizing real estate investment and asset management.

Source and External Links

Pros and Cons of Fractional Ownership in Real Estate - Fractional ownership allows multiple investors to share the cost and benefits of a property, offering benefits like affordability and shared responsibilities.

Fractional Interest Ownership - This type of ownership involves splitting the cost of an asset among individuals, who share benefits like income and usage rights.

Lofty - Fractional Real Estate Marketplace - Lofty enables investors to buy fractional ownership in rental properties across America without requiring experience or down payments.

dowidth.com

dowidth.com