Real estate crowdfunding and real estate investment trusts (REITs) both offer accessible pathways for investors to enter the property market with varying risk profiles and liquidity options. Crowdfunding platforms typically allow direct investments in individual projects with potential for higher returns but increased risk, while REITs provide diversified, professionally managed portfolios that trade like stocks, offering steady income and liquidity. Explore the distinct advantages and considerations of each to determine the best fit for your real estate investment goals.

Why it is important

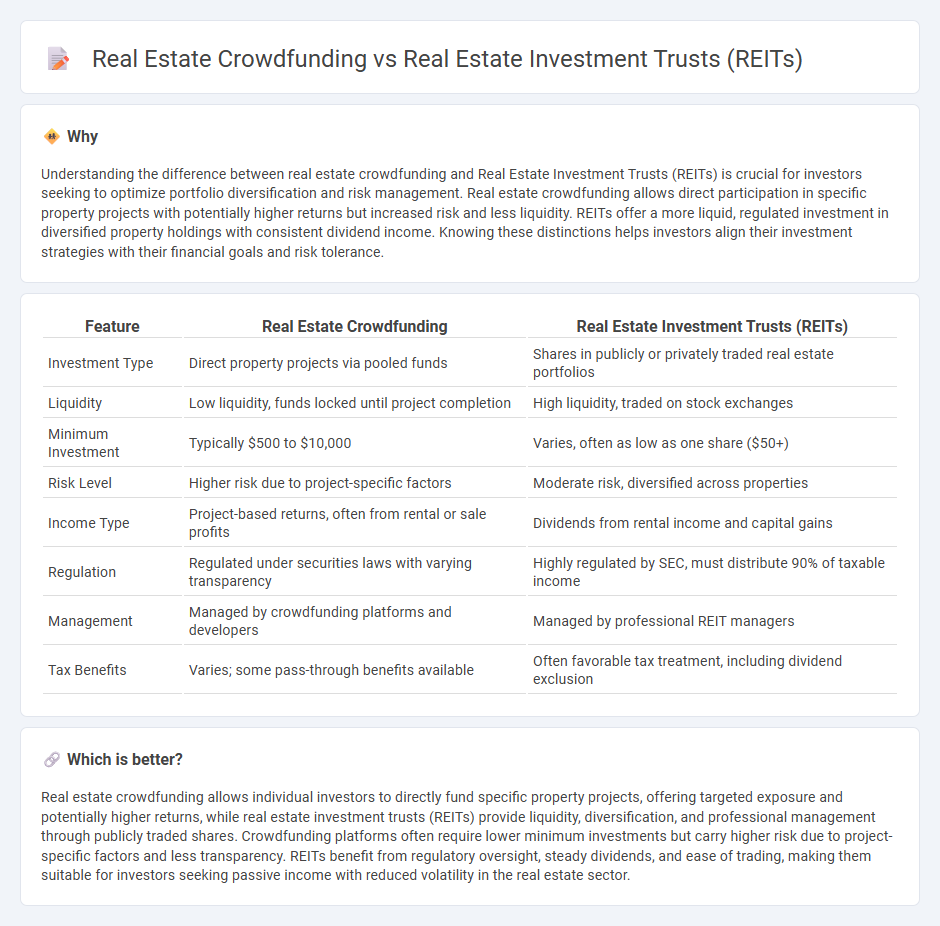

Understanding the difference between real estate crowdfunding and Real Estate Investment Trusts (REITs) is crucial for investors seeking to optimize portfolio diversification and risk management. Real estate crowdfunding allows direct participation in specific property projects with potentially higher returns but increased risk and less liquidity. REITs offer a more liquid, regulated investment in diversified property holdings with consistent dividend income. Knowing these distinctions helps investors align their investment strategies with their financial goals and risk tolerance.

Comparison Table

| Feature | Real Estate Crowdfunding | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Investment Type | Direct property projects via pooled funds | Shares in publicly or privately traded real estate portfolios |

| Liquidity | Low liquidity, funds locked until project completion | High liquidity, traded on stock exchanges |

| Minimum Investment | Typically $500 to $10,000 | Varies, often as low as one share ($50+) |

| Risk Level | Higher risk due to project-specific factors | Moderate risk, diversified across properties |

| Income Type | Project-based returns, often from rental or sale profits | Dividends from rental income and capital gains |

| Regulation | Regulated under securities laws with varying transparency | Highly regulated by SEC, must distribute 90% of taxable income |

| Management | Managed by crowdfunding platforms and developers | Managed by professional REIT managers |

| Tax Benefits | Varies; some pass-through benefits available | Often favorable tax treatment, including dividend exclusion |

Which is better?

Real estate crowdfunding allows individual investors to directly fund specific property projects, offering targeted exposure and potentially higher returns, while real estate investment trusts (REITs) provide liquidity, diversification, and professional management through publicly traded shares. Crowdfunding platforms often require lower minimum investments but carry higher risk due to project-specific factors and less transparency. REITs benefit from regulatory oversight, steady dividends, and ease of trading, making them suitable for investors seeking passive income with reduced volatility in the real estate sector.

Connection

Real estate crowdfunding and real estate investment trusts (REITs) both provide investors with access to diversified property portfolios without directly owning physical real estate, enabling fractional ownership and liquidity. Crowdfunding platforms often pool capital from multiple investors to finance specific real estate projects, similar to how REITs aggregate funds to invest in income-generating properties. Both investment vehicles democratize real estate investing by lowering entry barriers and offering passive income streams through rental yields or asset appreciation.

Key Terms

Liquidity

Real estate investment trusts (REITs) offer high liquidity with shares traded on major stock exchanges, allowing investors to buy or sell quickly, whereas real estate crowdfunding typically involves longer lock-in periods and limited secondary market options, reducing liquidity. REITs provide daily market pricing, facilitating easier portfolio adjustments, compared to crowdfunding platforms where asset exit depends on project completion or platform policies. Explore the key liquidity differences to optimize your real estate investment strategy.

Diversification

Real estate investment trusts (REITs) offer diversification by pooling funds from numerous investors to own a broad portfolio of properties, reducing risk through asset variety. Real estate crowdfunding allows investors to selectively invest in specific projects, providing targeted exposure but potentially higher risk due to concentrated holdings. Explore detailed comparisons to determine which option best suits your diversification strategy.

Minimum Investment

Real estate investment trusts (REITs) typically require a minimum investment ranging from $500 to $1,000, making them accessible for individual investors seeking liquidity and diversification. In contrast, real estate crowdfunding platforms often set lower minimum investments, sometimes as low as $10 to $100, allowing broader participation in specific property projects with potentially higher returns but increased risk. Explore detailed comparisons to determine which investment aligns best with your financial goals and risk tolerance.

Source and External Links

Real Estate Investment Trusts (REITs) on Wikipedia - This webpage provides comprehensive information about REITs, including their types, benefits, and tax advantages.

What's a REIT (Real Estate Investment Trust)? - This webpage explains the basics of REITs, their operation, and the benefits they offer to investors.

Real Estate Investment Trusts (REITs) on Investor.gov - This webpage provides an introduction to REITs, explaining how they work and the different types available to investors.

dowidth.com

dowidth.com