Fractional ownership platforms grant investors direct equity in specific properties, offering tangible asset control and potential rental income, whereas real estate ETFs provide diversified exposure to property markets through pooled shares, facilitating liquidity and ease of trading. Both investment vehicles diversify portfolios but differ in risk profiles, management involvement, and capital requirements. Explore how these options align with your investment goals to make informed real estate decisions.

Why it is important

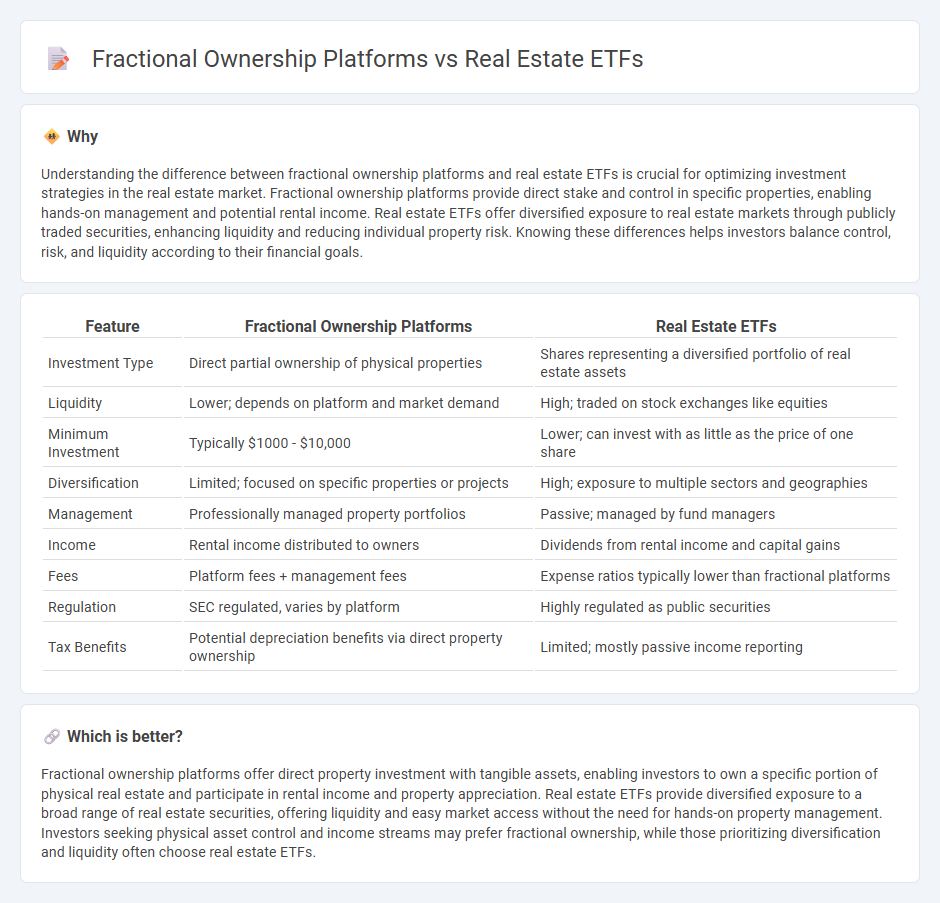

Understanding the difference between fractional ownership platforms and real estate ETFs is crucial for optimizing investment strategies in the real estate market. Fractional ownership platforms provide direct stake and control in specific properties, enabling hands-on management and potential rental income. Real estate ETFs offer diversified exposure to real estate markets through publicly traded securities, enhancing liquidity and reducing individual property risk. Knowing these differences helps investors balance control, risk, and liquidity according to their financial goals.

Comparison Table

| Feature | Fractional Ownership Platforms | Real Estate ETFs |

|---|---|---|

| Investment Type | Direct partial ownership of physical properties | Shares representing a diversified portfolio of real estate assets |

| Liquidity | Lower; depends on platform and market demand | High; traded on stock exchanges like equities |

| Minimum Investment | Typically $1000 - $10,000 | Lower; can invest with as little as the price of one share |

| Diversification | Limited; focused on specific properties or projects | High; exposure to multiple sectors and geographies |

| Management | Professionally managed property portfolios | Passive; managed by fund managers |

| Income | Rental income distributed to owners | Dividends from rental income and capital gains |

| Fees | Platform fees + management fees | Expense ratios typically lower than fractional platforms |

| Regulation | SEC regulated, varies by platform | Highly regulated as public securities |

| Tax Benefits | Potential depreciation benefits via direct property ownership | Limited; mostly passive income reporting |

Which is better?

Fractional ownership platforms offer direct property investment with tangible assets, enabling investors to own a specific portion of physical real estate and participate in rental income and property appreciation. Real estate ETFs provide diversified exposure to a broad range of real estate securities, offering liquidity and easy market access without the need for hands-on property management. Investors seeking physical asset control and income streams may prefer fractional ownership, while those prioritizing diversification and liquidity often choose real estate ETFs.

Connection

Fractional ownership platforms enable investors to purchase partial shares of real estate assets, lowering entry barriers and enhancing portfolio diversification. Real estate ETFs aggregate fractional interests in multiple properties, allowing investors to trade diversified real estate exposure on public exchanges. Both vehicles leverage fractionalization to increase liquidity and accessibility in the real estate investment market.

Key Terms

Liquidity

Real estate ETFs offer high liquidity by allowing investors to buy and sell shares on stock exchanges throughout the trading day, similar to traditional stocks. Fractional ownership platforms provide partial stakes in properties but often have limited secondary markets, resulting in lower liquidity and longer holding periods. Explore the differences in liquidity features to determine which investment suits your financial goals.

Diversification

Real estate ETFs provide broad diversification by pooling investments across multiple properties and geographic regions, reducing risk through exposure to various market sectors. Fractional ownership platforms offer targeted investment in specific real estate assets, allowing investors to select properties based on personal preference but with less inherent diversification. Explore detailed comparisons to understand which investment aligns best with your diversification goals.

Ownership structure

Real estate ETFs offer investors indirect ownership through shares in a diversified portfolio managed by professionals, providing liquidity and ease of trading on stock exchanges. Fractional ownership platforms allow direct ownership of specific properties by dividing the asset into shares, giving investors tangible equity and potential rental income streams. Explore how ownership structures impact control, risk, and returns in real estate investments to make informed decisions.

Source and External Links

5 Best-Performing Real Estate ETFs for July 2025 - Real estate ETFs offer diversification, liquidity, and inflation hedging by investing in a basket of real estate securities; top performers include JRE, SRVR, and BYRE with returns ranging from about 9% to 16% annually.

The Best REIT ETFs to Buy - Vanguard Real Estate ETF is highly recommended for its large size, diversification across equity REITs and real estate firms, low fees, and balanced portfolio across property types, making it a solid proxy for US real estate market exposure.

Cohen & Steers Real Estate Active ETF - This ETF is actively managed with a high-conviction strategy that aims to generate excess returns through access to attractive valuations and growth opportunities in listed real estate securities with enhanced diversification benefits.

dowidth.com

dowidth.com