Blockchain technology revolutionizes real estate by enabling secure, transparent property transactions and ownership records through decentralized ledgers. Fractional ownership allows multiple investors to purchase shares in high-value properties, reducing entry barriers and increasing liquidity in the real estate market. Explore how these innovations reshape property investment opportunities and streamline asset management.

Why it is important

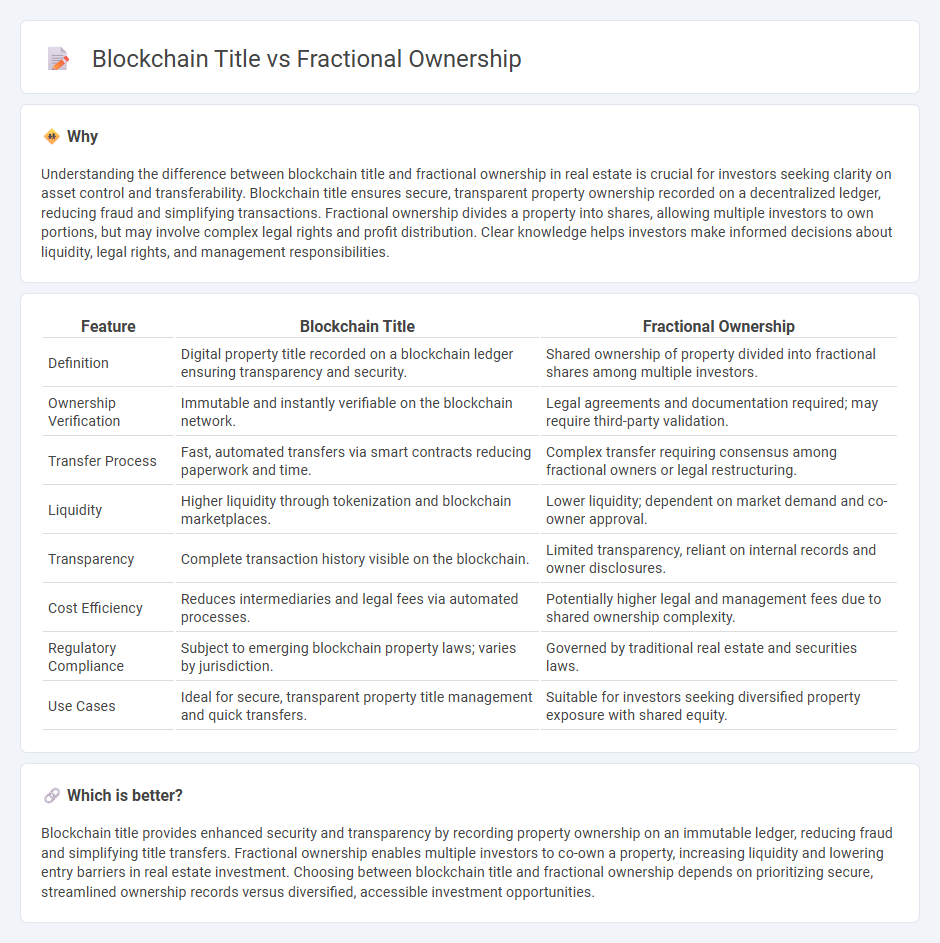

Understanding the difference between blockchain title and fractional ownership in real estate is crucial for investors seeking clarity on asset control and transferability. Blockchain title ensures secure, transparent property ownership recorded on a decentralized ledger, reducing fraud and simplifying transactions. Fractional ownership divides a property into shares, allowing multiple investors to own portions, but may involve complex legal rights and profit distribution. Clear knowledge helps investors make informed decisions about liquidity, legal rights, and management responsibilities.

Comparison Table

| Feature | Blockchain Title | Fractional Ownership |

|---|---|---|

| Definition | Digital property title recorded on a blockchain ledger ensuring transparency and security. | Shared ownership of property divided into fractional shares among multiple investors. |

| Ownership Verification | Immutable and instantly verifiable on the blockchain network. | Legal agreements and documentation required; may require third-party validation. |

| Transfer Process | Fast, automated transfers via smart contracts reducing paperwork and time. | Complex transfer requiring consensus among fractional owners or legal restructuring. |

| Liquidity | Higher liquidity through tokenization and blockchain marketplaces. | Lower liquidity; dependent on market demand and co-owner approval. |

| Transparency | Complete transaction history visible on the blockchain. | Limited transparency, reliant on internal records and owner disclosures. |

| Cost Efficiency | Reduces intermediaries and legal fees via automated processes. | Potentially higher legal and management fees due to shared ownership complexity. |

| Regulatory Compliance | Subject to emerging blockchain property laws; varies by jurisdiction. | Governed by traditional real estate and securities laws. |

| Use Cases | Ideal for secure, transparent property title management and quick transfers. | Suitable for investors seeking diversified property exposure with shared equity. |

Which is better?

Blockchain title provides enhanced security and transparency by recording property ownership on an immutable ledger, reducing fraud and simplifying title transfers. Fractional ownership enables multiple investors to co-own a property, increasing liquidity and lowering entry barriers in real estate investment. Choosing between blockchain title and fractional ownership depends on prioritizing secure, streamlined ownership records versus diversified, accessible investment opportunities.

Connection

Blockchain technology enhances real estate title management by providing a secure, transparent, and tamper-proof ledger for property ownership records. Fractional ownership leverages this technology to enable multiple investors to hold verifiable shares in a property, facilitating easier transfer and division of assets. This connection reduces fraud, streamlines transactions, and opens real estate investment to a broader range of participants.

Key Terms

Tokenization

Tokenization revolutionizes fractional ownership by converting physical assets into digital tokens on a blockchain, enabling secure, transparent, and efficient property division. Unlike traditional fractional ownership, blockchain titles ensure immutable records and easier transferability of shares, reducing fraud and administrative costs. Discover how tokenization is reshaping asset management and democratizing investment opportunities.

Smart Contracts

Smart contracts enable automated, transparent execution of fractional ownership agreements by embedding terms directly into blockchain code, reducing reliance on intermediaries and minimizing fraud risk. Unlike traditional title systems, blockchain-based titles provide immutable records and seamless transferability, enhancing security and liquidity for fractional assets. Explore how smart contracts revolutionize ownership models and safeguard property rights in modern transactions.

Legal Title

Fractional ownership involves multiple parties holding legally recognized shares of a property's title, each recorded on official government registries, ensuring clear legal ownership and transfer rights. Blockchain title systems use decentralized digital ledgers to record and verify property ownership, enhancing transparency and security while still needing legal integration for formal title recognition. Explore the legal distinctions and practical implications of these ownership models in real estate.

Source and External Links

Fractional ownership - Fractional ownership allows several unrelated parties to share ownership and costs of a high-value tangible asset such as jets, yachts, or resort real estate, with each owner guaranteed a defined usage amount and sharing maintenance expenses, typically managed by a company on owners' behalf.

The Definitive Guide to Fractional Ownership - In fractional ownership, multiple people co-own a property through deeded shares, commonly within an LLC structure, dividing the asset into fractions that dictate usage time and share ongoing costs and maintenance handled by a management company.

Fractional Ownership - Answers To Frequently Asked ... - Fractional ownership typically pertains to shared ownership of vacation properties where usage rights are allocated based on time, often within legal timeshare frameworks but distinct from timeshares and other shared-use arrangements.

dowidth.com

dowidth.com