Micro flipping involves quickly buying and reselling properties with minimal renovations to generate fast profits, while seller financing allows buyers to purchase real estate through direct loan agreements with the seller, bypassing traditional lenders. Both strategies offer unique advantages: micro flipping capitalizes on market timing and quick transactions, whereas seller financing provides flexible terms and accessibility for buyers with limited credit. Explore the benefits and challenges of each approach to determine the best fit for your real estate investment goals.

Why it is important

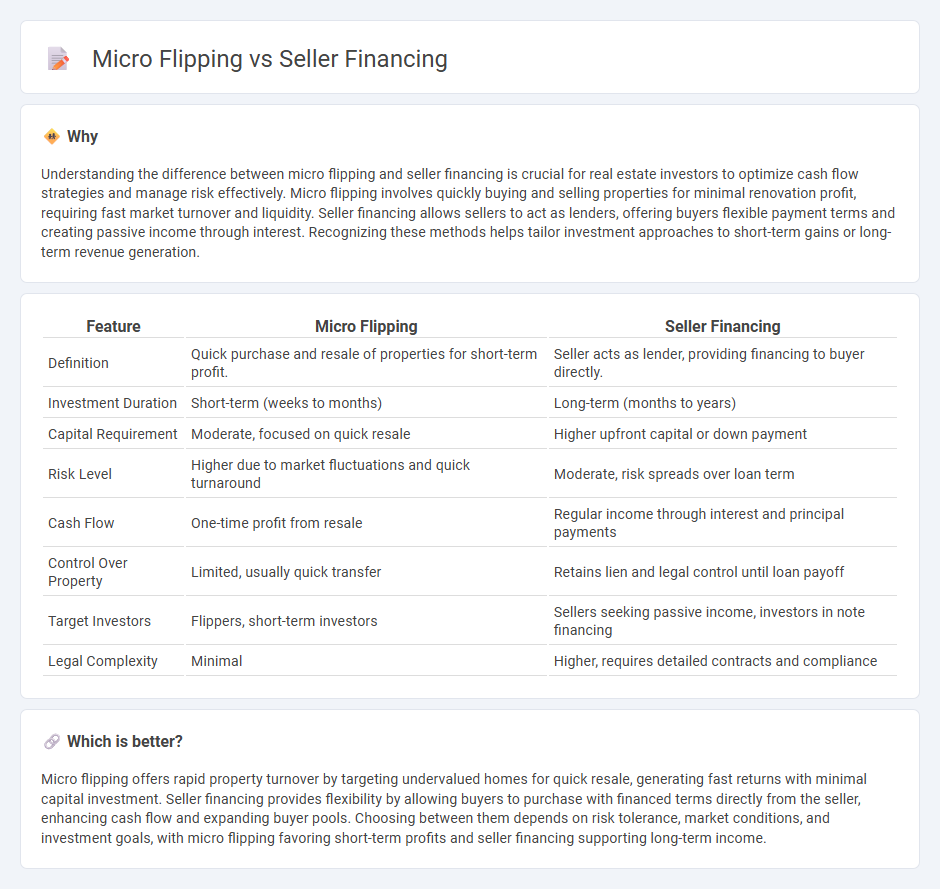

Understanding the difference between micro flipping and seller financing is crucial for real estate investors to optimize cash flow strategies and manage risk effectively. Micro flipping involves quickly buying and selling properties for minimal renovation profit, requiring fast market turnover and liquidity. Seller financing allows sellers to act as lenders, offering buyers flexible payment terms and creating passive income through interest. Recognizing these methods helps tailor investment approaches to short-term gains or long-term revenue generation.

Comparison Table

| Feature | Micro Flipping | Seller Financing |

|---|---|---|

| Definition | Quick purchase and resale of properties for short-term profit. | Seller acts as lender, providing financing to buyer directly. |

| Investment Duration | Short-term (weeks to months) | Long-term (months to years) |

| Capital Requirement | Moderate, focused on quick resale | Higher upfront capital or down payment |

| Risk Level | Higher due to market fluctuations and quick turnaround | Moderate, risk spreads over loan term |

| Cash Flow | One-time profit from resale | Regular income through interest and principal payments |

| Control Over Property | Limited, usually quick transfer | Retains lien and legal control until loan payoff |

| Target Investors | Flippers, short-term investors | Sellers seeking passive income, investors in note financing |

| Legal Complexity | Minimal | Higher, requires detailed contracts and compliance |

Which is better?

Micro flipping offers rapid property turnover by targeting undervalued homes for quick resale, generating fast returns with minimal capital investment. Seller financing provides flexibility by allowing buyers to purchase with financed terms directly from the seller, enhancing cash flow and expanding buyer pools. Choosing between them depends on risk tolerance, market conditions, and investment goals, with micro flipping favoring short-term profits and seller financing supporting long-term income.

Connection

Micro flipping involves quickly buying and selling properties for small profits, often using creative financing methods like seller financing to reduce upfront capital requirements. Seller financing allows buyers to purchase homes by making direct payments to the seller, which enables micro flippers to acquire properties without traditional bank loans. This synergy accelerates transaction processes and expands investment opportunities within the real estate market.

Key Terms

Owner Financing

Owner financing offers buyers flexible loan terms directly from sellers, bypassing traditional banks and simplifying the purchasing process. This method enhances cash flow for sellers and enables quicker property transactions compared to micro flipping, which relies on rapid renovations and resale for short-term profits. Explore deeper insights into owner financing strategies to leverage its full potential in real estate.

Assignment Contract

Seller financing involves the seller providing direct financing to the buyer, enabling property acquisition without traditional bank loans, often secured by a promissory note and deed of trust. Micro flipping centers on rapid property transactions using assignment contracts, allowing investors to assign their purchase rights to new buyers for quick profits without actual property ownership. Explore how assignment contracts streamline micro flipping strategies to enhance your real estate investments.

Due Diligence

Seller financing requires thorough due diligence on the buyer's creditworthiness, property condition, and legal compliance to reduce default risks and secure investment returns. Micro flipping demands meticulous market analysis, quick property evaluations, and accurate cost assessments to ensure profitable, fast-turnaround deals. Explore deeper strategies and key factors to master due diligence in both approaches.

Source and External Links

M&A Seller Financing: A Complete Guide - This guide provides an overview of seller financing, where the seller functions as a lender, offering terms like down payments and monthly installments for business sales.

Seller financing: Definition and how it's used in real estate - This article explains how seller financing works in real estate, involving private transactions between buyers and sellers, often using arrangements like holding mortgages or land contracts.

Seller Financing | Definition + Real Estate Examples - This resource defines seller financing as a method where the seller provides financing for part of the purchase price, receiving a promissory note from the buyer in return.

dowidth.com

dowidth.com