Micro flipping focuses on quick property acquisitions and sales to generate fast profits, while the BRRRR strategy involves buying undervalued properties, rehabbing them, renting for steady cash flow, refinancing to pull out equity, and repeating the process. Investors seeking short-term gains may prefer micro flipping, whereas those aiming for long-term wealth-building often utilize BRRRR for portfolio growth and passive income. Explore detailed comparisons and investment suitability to determine the best real estate strategy for your goals.

Why it is important

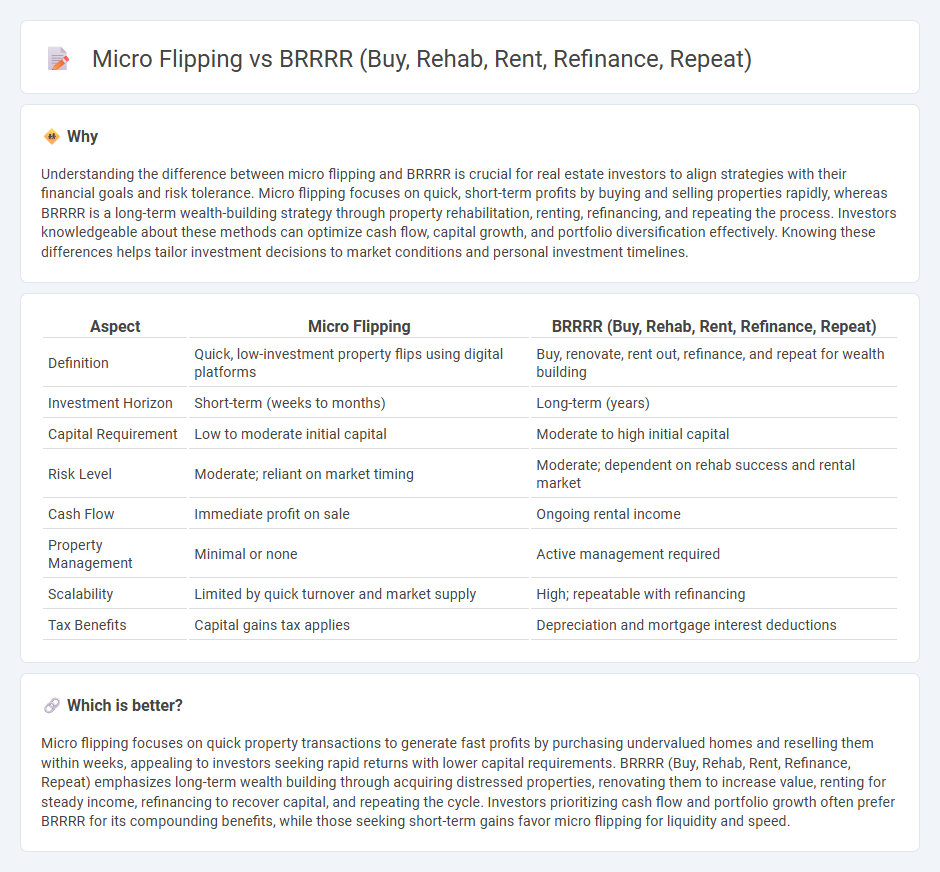

Understanding the difference between micro flipping and BRRRR is crucial for real estate investors to align strategies with their financial goals and risk tolerance. Micro flipping focuses on quick, short-term profits by buying and selling properties rapidly, whereas BRRRR is a long-term wealth-building strategy through property rehabilitation, renting, refinancing, and repeating the process. Investors knowledgeable about these methods can optimize cash flow, capital growth, and portfolio diversification effectively. Knowing these differences helps tailor investment decisions to market conditions and personal investment timelines.

Comparison Table

| Aspect | Micro Flipping | BRRRR (Buy, Rehab, Rent, Refinance, Repeat) |

|---|---|---|

| Definition | Quick, low-investment property flips using digital platforms | Buy, renovate, rent out, refinance, and repeat for wealth building |

| Investment Horizon | Short-term (weeks to months) | Long-term (years) |

| Capital Requirement | Low to moderate initial capital | Moderate to high initial capital |

| Risk Level | Moderate; reliant on market timing | Moderate; dependent on rehab success and rental market |

| Cash Flow | Immediate profit on sale | Ongoing rental income |

| Property Management | Minimal or none | Active management required |

| Scalability | Limited by quick turnover and market supply | High; repeatable with refinancing |

| Tax Benefits | Capital gains tax applies | Depreciation and mortgage interest deductions |

Which is better?

Micro flipping focuses on quick property transactions to generate fast profits by purchasing undervalued homes and reselling them within weeks, appealing to investors seeking rapid returns with lower capital requirements. BRRRR (Buy, Rehab, Rent, Refinance, Repeat) emphasizes long-term wealth building through acquiring distressed properties, renovating them to increase value, renting for steady income, refinancing to recover capital, and repeating the cycle. Investors prioritizing cash flow and portfolio growth often prefer BRRRR for its compounding benefits, while those seeking short-term gains favor micro flipping for liquidity and speed.

Connection

Micro flipping and the BRRRR strategy intersect through their focus on maximizing real estate investment returns via property improvements. Micro flipping involves quickly buying and selling properties with minor renovations for rapid profit, while BRRRR extends this concept by holding and refinancing the property to fund further acquisitions. Both techniques leverage rehabbing properties to increase value, optimizing cash flow and enabling scalable real estate portfolio growth.

Key Terms

**Equity**

BRRRR strategy builds equity through systematic property appreciation and refinancing after rehab and rental phases, enhancing long-term wealth. Micro flipping generates quicker equity by purchasing undervalued properties, making minimal improvements, then selling rapidly, focusing on short-term gains. Explore detailed comparisons of equity growth and cash flow dynamics between these two strategies to optimize your real estate investments.

**Holding Period**

BRRRR involves a longer holding period as investors buy, rehab, rent, and refinance properties before repeating the process, typically holding each asset for months or years to build equity and generate rental income. Micro flipping, by contrast, emphasizes rapid transactions with holding periods often lasting just days or weeks, aiming to quickly capitalize on short-term market opportunities and minimize carrying costs. Explore the detailed pros and cons of each strategy to determine which holding period aligns best with your investment goals.

**Transaction Volume**

BRRRR strategy typically involves fewer transactions over a longer period due to the extensive rehab and refinance process, resulting in lower transaction volume compared to micro flipping, which emphasizes high-frequency purchases and rapid resales for quick profits. Micro flipping capitalizes on quick market turnovers and minimal holding times, driving significantly higher transaction volume and faster capital cycling. Explore the detailed metrics and market impacts of both strategies to optimize your real estate investment approach.

Source and External Links

How the BRRRR Method Builds Passive Income Fast - This guide explains the BRRRR method, a real estate investment strategy that involves buying, rehabilitating, renting, refinancing, and repeating the process to rapidly expand a portfolio.

BRRRR Method: Buy, Rehab, Rent, Refinance, Repeat - The BRRRR method is an investment strategy that focuses on rehabbing houses, renting them, and using the equity to finance future investments, offering both pros and cons for real estate investors.

What is the BRRRR method (and how does it work)? - The BRRRR method is a real estate investment strategy involving buying, rehabilitating, renting, and refinancing properties to efficiently build wealth through repeated investments.

dowidth.com

dowidth.com