Real estate crowdfunding allows multiple investors to pool funds into property projects, offering diversified opportunities with lower entry costs compared to property flipping, which involves purchasing, renovating, and selling properties for profit. Crowdfunding platforms facilitate access to commercial and residential developments without the hands-on involvement required in flipping, which demands capital, renovation expertise, and market timing. Discover detailed insights on how these investment strategies differ and which suits your financial goals best.

Why it is important

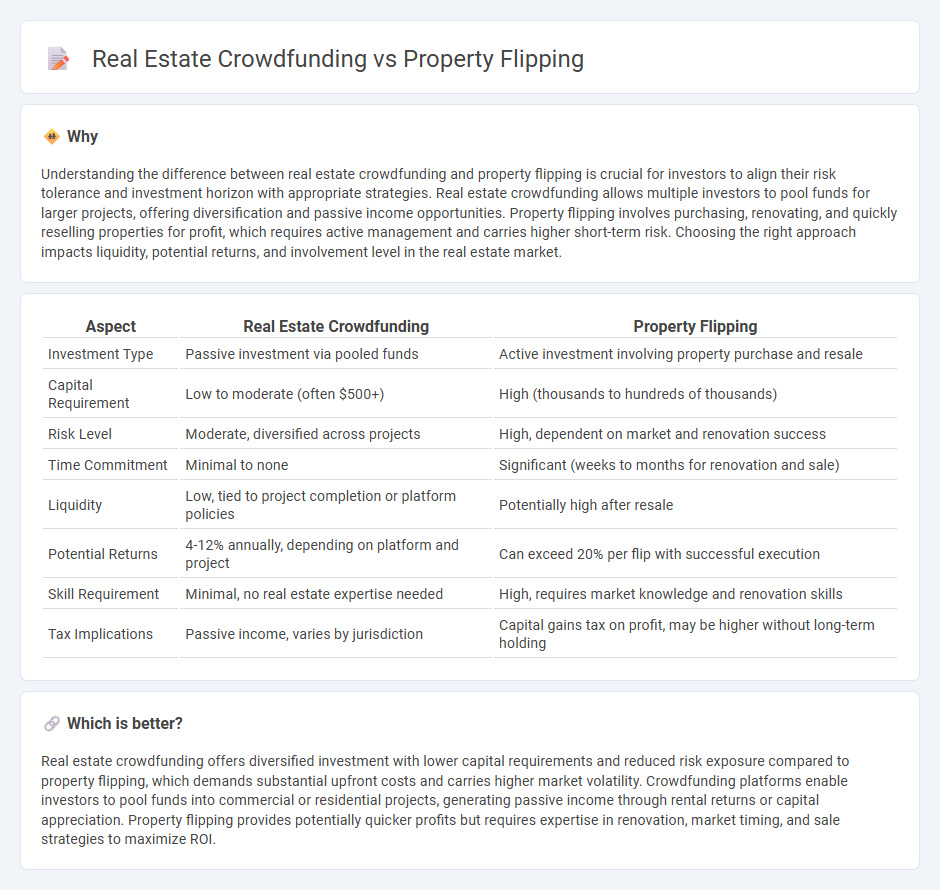

Understanding the difference between real estate crowdfunding and property flipping is crucial for investors to align their risk tolerance and investment horizon with appropriate strategies. Real estate crowdfunding allows multiple investors to pool funds for larger projects, offering diversification and passive income opportunities. Property flipping involves purchasing, renovating, and quickly reselling properties for profit, which requires active management and carries higher short-term risk. Choosing the right approach impacts liquidity, potential returns, and involvement level in the real estate market.

Comparison Table

| Aspect | Real Estate Crowdfunding | Property Flipping |

|---|---|---|

| Investment Type | Passive investment via pooled funds | Active investment involving property purchase and resale |

| Capital Requirement | Low to moderate (often $500+) | High (thousands to hundreds of thousands) |

| Risk Level | Moderate, diversified across projects | High, dependent on market and renovation success |

| Time Commitment | Minimal to none | Significant (weeks to months for renovation and sale) |

| Liquidity | Low, tied to project completion or platform policies | Potentially high after resale |

| Potential Returns | 4-12% annually, depending on platform and project | Can exceed 20% per flip with successful execution |

| Skill Requirement | Minimal, no real estate expertise needed | High, requires market knowledge and renovation skills |

| Tax Implications | Passive income, varies by jurisdiction | Capital gains tax on profit, may be higher without long-term holding |

Which is better?

Real estate crowdfunding offers diversified investment with lower capital requirements and reduced risk exposure compared to property flipping, which demands substantial upfront costs and carries higher market volatility. Crowdfunding platforms enable investors to pool funds into commercial or residential projects, generating passive income through rental returns or capital appreciation. Property flipping provides potentially quicker profits but requires expertise in renovation, market timing, and sale strategies to maximize ROI.

Connection

Real estate crowdfunding and property flipping are connected through their focus on maximizing returns in the property market by leveraging investment strategies. Crowdfunding allows multiple investors to pool capital to fund property purchases or renovations, which are then often flipped for profit. This synergy accelerates project funding and distributes financial risk, enhancing opportunities for investors and flippers in competitive real estate markets.

Key Terms

Property flipping:

Property flipping involves purchasing undervalued properties, renovating them quickly, and selling for a profit, often yielding high returns within a short timeframe. This strategy requires substantial market knowledge, capital for renovations, and an understanding of neighborhood trends to maximize profitability. Explore the benefits and risks of property flipping to determine if it suits your investment goals.

After-repair value (ARV)

After-repair value (ARV) is crucial in property flipping as it determines potential profit margin by estimating a renovated property's market worth. Real estate crowdfunding relies less on ARV and more on projected rental income and property appreciation to attract investors. Explore how ARV influences each investment strategy to make informed real estate decisions.

Holding costs

Property flipping involves significant holding costs such as mortgage payments, property taxes, insurance, utilities, and maintenance during the renovation period, which can quickly erode profit margins if the sale is delayed. Real estate crowdfunding typically minimizes holding costs for investors since the platform or developer manages expenses and investors hold indirect ownership without ongoing financial obligations. Explore the nuances of holding costs in these investment options to optimize your real estate strategy.

Source and External Links

Flipping - Wikipedia - The term "flipping" refers to the process of buying, rehabbing, and selling properties for profit, commonly used in real estate and finance.

Illegal Property Flipping - FBI.gov - This webpage discusses illegal property flipping schemes, where properties are resold at artificially inflated prices with minimal improvements, often involving straw buyers and false appraisals.

Flipping Houses: A How-To Guide For Beginners - Bankrate - This guide provides a beginner's overview of flipping houses, covering the process from finding properties to rehabbing and selling them for profit.

dowidth.com

dowidth.com