Real estate crowdfunding allows multiple investors to pool funds online to finance property projects, providing access to diversified portfolios with lower capital requirements. Wholesaling real estate involves securing contracts on properties and selling those contracts to buyers for a profit, often requiring less upfront investment but active market knowledge and negotiation skills. Explore the nuances between these strategies to determine which aligns best with your investment goals.

Why it is important

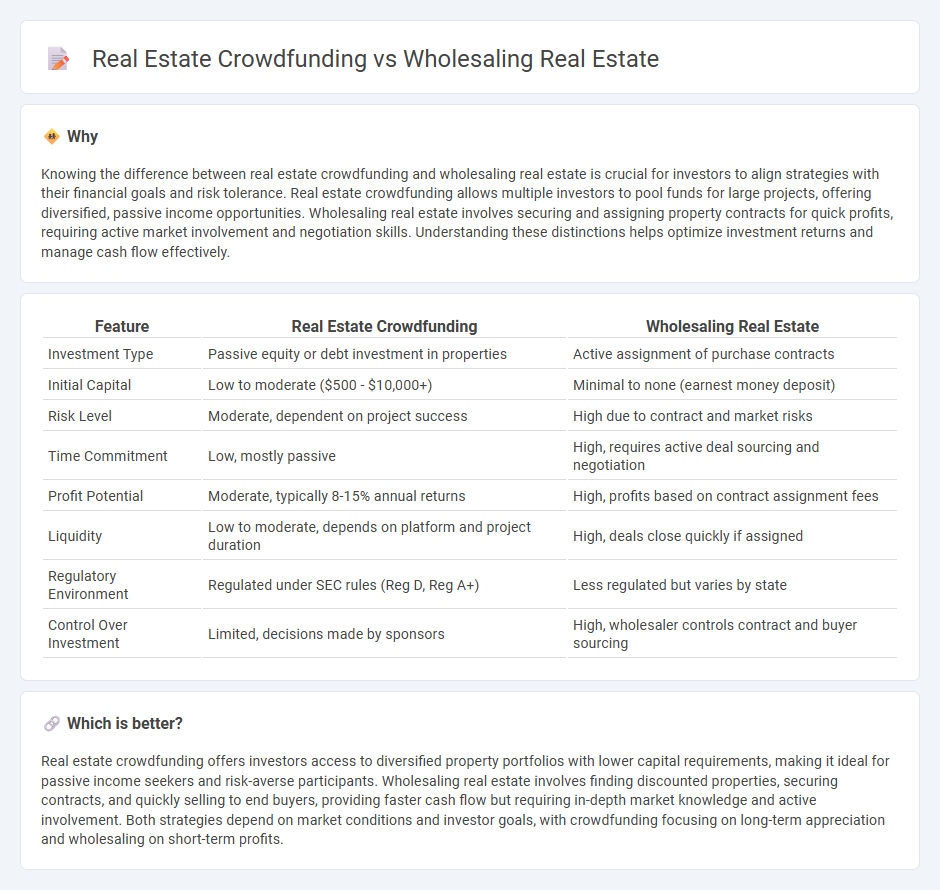

Knowing the difference between real estate crowdfunding and wholesaling real estate is crucial for investors to align strategies with their financial goals and risk tolerance. Real estate crowdfunding allows multiple investors to pool funds for large projects, offering diversified, passive income opportunities. Wholesaling real estate involves securing and assigning property contracts for quick profits, requiring active market involvement and negotiation skills. Understanding these distinctions helps optimize investment returns and manage cash flow effectively.

Comparison Table

| Feature | Real Estate Crowdfunding | Wholesaling Real Estate |

|---|---|---|

| Investment Type | Passive equity or debt investment in properties | Active assignment of purchase contracts |

| Initial Capital | Low to moderate ($500 - $10,000+) | Minimal to none (earnest money deposit) |

| Risk Level | Moderate, dependent on project success | High due to contract and market risks |

| Time Commitment | Low, mostly passive | High, requires active deal sourcing and negotiation |

| Profit Potential | Moderate, typically 8-15% annual returns | High, profits based on contract assignment fees |

| Liquidity | Low to moderate, depends on platform and project duration | High, deals close quickly if assigned |

| Regulatory Environment | Regulated under SEC rules (Reg D, Reg A+) | Less regulated but varies by state |

| Control Over Investment | Limited, decisions made by sponsors | High, wholesaler controls contract and buyer sourcing |

Which is better?

Real estate crowdfunding offers investors access to diversified property portfolios with lower capital requirements, making it ideal for passive income seekers and risk-averse participants. Wholesaling real estate involves finding discounted properties, securing contracts, and quickly selling to end buyers, providing faster cash flow but requiring in-depth market knowledge and active involvement. Both strategies depend on market conditions and investor goals, with crowdfunding focusing on long-term appreciation and wholesaling on short-term profits.

Connection

Real estate crowdfunding and wholesaling real estate are connected through their ability to provide alternative investment opportunities without the need for substantial capital. Crowdfunding pools funds from multiple investors to finance properties, while wholesaling involves contracting properties at a lower price to assign the deal to a buyer, often using quick turnaround strategies. Both methods leverage network connections and market knowledge to optimize returns within the real estate sector.

Key Terms

Wholesaling real estate:

Wholesaling real estate involves finding undervalued properties, securing contracts at below-market prices, and assigning these contracts to investors for a profit, often without needing to purchase the property outright. This strategy requires strong negotiation skills, a network of buyers, and quick deal execution to capitalize on market opportunities. Explore the differences and benefits of wholesaling real estate to boost your investment portfolio.

Assignment contract

Wholesaling real estate involves securing a property under contract with the intent to assign that contract to another buyer, generating profit through the assignment fee, while real estate crowdfunding pools funds from multiple investors to finance property projects without direct ownership or contract assignment. The assignment contract in wholesaling is crucial as it legally transfers purchase rights to a new buyer, differing significantly from the equity or debt agreements in crowdfunding. Explore the distinct legal frameworks and profit mechanisms behind these strategies to better understand their investment potential.

Earnest money

Wholesaling real estate involves securing a property contract using earnest money, typically a small deposit to demonstrate good faith and secure the rights to assign the contract. In real estate crowdfunding, investors contribute capital to fund projects collectively, often without dealing directly with earnest money, as the platform manages financial commitments and risk mitigation. Discover how earnest money functions within each model and its impact on investment security by exploring detailed comparisons.

Source and External Links

Wholesale real estate: A beginner's guide - This guide explains how real estate wholesaling allows individuals to profit from property deals without purchasing the property themselves.

Wholesale Real Estate: Full Guide & Profit Calculator - This comprehensive guide covers the basics of wholesale real estate and provides tools for calculating profits in this investment strategy.

How to Start Wholesaling Real Estate in 7 Steps - This article outlines a step-by-step approach to starting a career in wholesaling real estate, including securing properties under contract and assigning them to buyers.

dowidth.com

dowidth.com