Single-family rentals offer tenants privacy, yard space, and neighborhood integration, attracting long-term renters seeking stability. Fourplexes provide multiple income streams within one property, allowing investors to diversify risk and maximize cash flow. Discover the advantages and challenges of each investment to determine the best fit for your real estate portfolio.

Why it is important

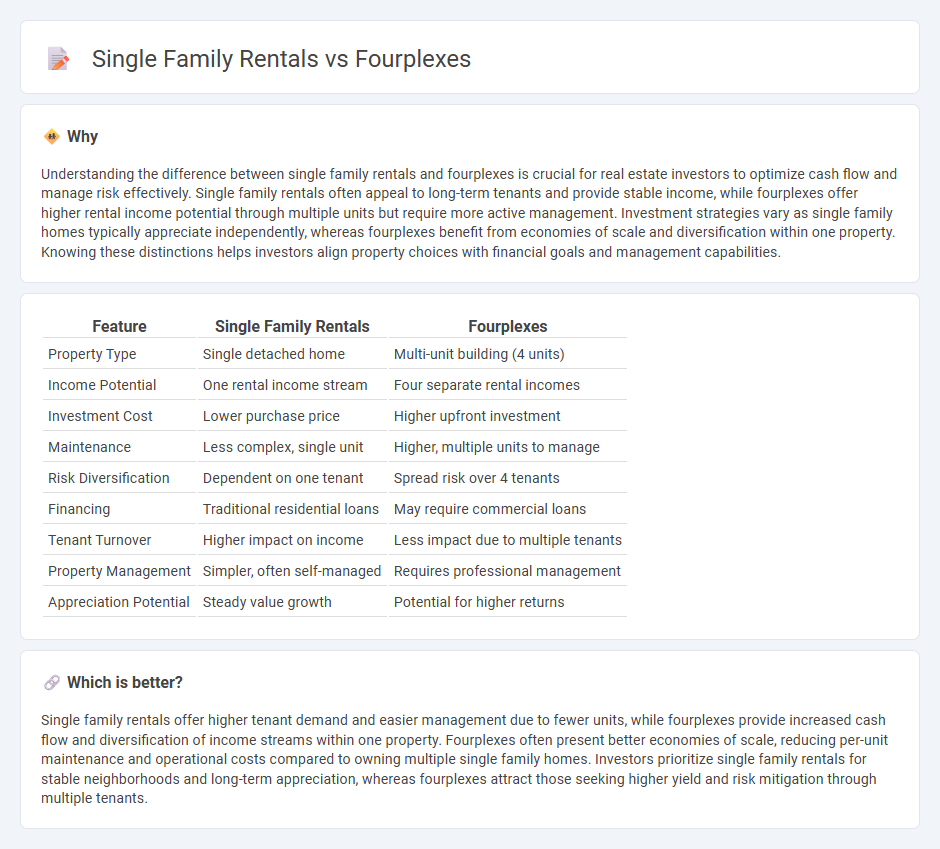

Understanding the difference between single family rentals and fourplexes is crucial for real estate investors to optimize cash flow and manage risk effectively. Single family rentals often appeal to long-term tenants and provide stable income, while fourplexes offer higher rental income potential through multiple units but require more active management. Investment strategies vary as single family homes typically appreciate independently, whereas fourplexes benefit from economies of scale and diversification within one property. Knowing these distinctions helps investors align property choices with financial goals and management capabilities.

Comparison Table

| Feature | Single Family Rentals | Fourplexes |

|---|---|---|

| Property Type | Single detached home | Multi-unit building (4 units) |

| Income Potential | One rental income stream | Four separate rental incomes |

| Investment Cost | Lower purchase price | Higher upfront investment |

| Maintenance | Less complex, single unit | Higher, multiple units to manage |

| Risk Diversification | Dependent on one tenant | Spread risk over 4 tenants |

| Financing | Traditional residential loans | May require commercial loans |

| Tenant Turnover | Higher impact on income | Less impact due to multiple tenants |

| Property Management | Simpler, often self-managed | Requires professional management |

| Appreciation Potential | Steady value growth | Potential for higher returns |

Which is better?

Single family rentals offer higher tenant demand and easier management due to fewer units, while fourplexes provide increased cash flow and diversification of income streams within one property. Fourplexes often present better economies of scale, reducing per-unit maintenance and operational costs compared to owning multiple single family homes. Investors prioritize single family rentals for stable neighborhoods and long-term appreciation, whereas fourplexes attract those seeking higher yield and risk mitigation through multiple tenants.

Connection

Single family rentals and fourplexes are both key segments in the residential real estate market, providing investors with rental income opportunities. Single family rentals offer individual homes that attract long-term tenants seeking privacy, while fourplexes consolidate multiple rental units within one property, maximizing cash flow and operational efficiency. Both asset types benefit from strong rental demand, property appreciation, and can diversify a real estate portfolio through varied tenant demographics and location strategies.

Key Terms

Cash Flow

Fourplexes typically generate higher cash flow due to multiple rental units contributing to total income, reducing the impact of vacancies compared to single-family rentals. Operating costs in fourplexes are often lower per unit, improving net cash flow efficiency. Explore detailed financial comparisons to maximize your real estate investment cash flow.

Property Management

Fourplex property management involves overseeing multiple rental units under one roof, demanding efficient coordination of tenant relations, maintenance, and rent collection to maximize cash flow. Single family rental management requires individualized attention per property but often entails less complexity in tenant turnover and maintenance scheduling. Explore more insights to determine which rental strategy aligns best with your property management goals.

Vacancy Rate

Fourplexes generally exhibit lower vacancy rates compared to single family rentals due to diversified income streams from multiple units, reducing the impact of any single vacancy. Single family rentals often face higher vacancy risk, as the absence of tenants results in complete loss of rental income for the property. Explore detailed vacancy rate trends and investment insights to optimize your rental portfolio strategy.

Source and External Links

Fourplex House Plans | Maximize Rental Income with Our Expertly ... - A fourplex is a single building divided into four separate living units, each with private entrances and full facilities, offering affordability, multiple income streams, and potential for living in one unit while renting others to cover housing costs.

Fourplexes: What to know before investing | Rocket Mortgage - A fourplex is a multifamily home with four separate units, typically arranged side-by-side or stacked, providing investors with relatively low entry costs and potential for high cash flow, making them a popular real estate investment choice.

Guide to Fourplexes: The Pros and Cons of Owning a Fourplex - 2025 - Advantages of owning a fourplex include immediate cash flow, streamlined property management, less vacancy risk, access to favorable residential financing, tax benefits, and it being a strong entry point into real estate investing.

dowidth.com

dowidth.com