Proptech solutions leverage technology to streamline property management, sales, and rentals, offering tools like AI-driven analytics, virtual tours, and blockchain for secure transactions. Real estate investment platforms focus on enabling fractional ownership and crowdsourcing investments, democratizing access to property markets with diversified portfolios and lower entry barriers. Explore how these innovations are transforming the real estate landscape and unlocking new opportunities for investors and users.

Why it is important

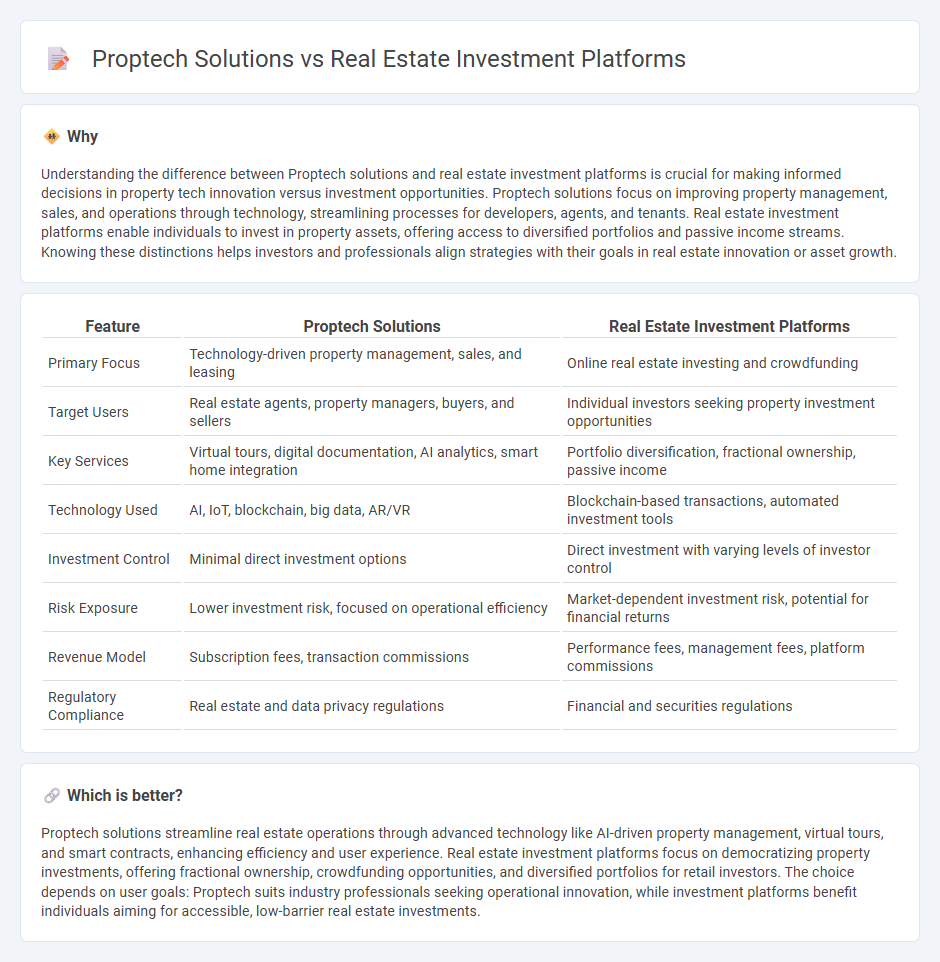

Understanding the difference between Proptech solutions and real estate investment platforms is crucial for making informed decisions in property tech innovation versus investment opportunities. Proptech solutions focus on improving property management, sales, and operations through technology, streamlining processes for developers, agents, and tenants. Real estate investment platforms enable individuals to invest in property assets, offering access to diversified portfolios and passive income streams. Knowing these distinctions helps investors and professionals align strategies with their goals in real estate innovation or asset growth.

Comparison Table

| Feature | Proptech Solutions | Real Estate Investment Platforms |

|---|---|---|

| Primary Focus | Technology-driven property management, sales, and leasing | Online real estate investing and crowdfunding |

| Target Users | Real estate agents, property managers, buyers, and sellers | Individual investors seeking property investment opportunities |

| Key Services | Virtual tours, digital documentation, AI analytics, smart home integration | Portfolio diversification, fractional ownership, passive income |

| Technology Used | AI, IoT, blockchain, big data, AR/VR | Blockchain-based transactions, automated investment tools |

| Investment Control | Minimal direct investment options | Direct investment with varying levels of investor control |

| Risk Exposure | Lower investment risk, focused on operational efficiency | Market-dependent investment risk, potential for financial returns |

| Revenue Model | Subscription fees, transaction commissions | Performance fees, management fees, platform commissions |

| Regulatory Compliance | Real estate and data privacy regulations | Financial and securities regulations |

Which is better?

Proptech solutions streamline real estate operations through advanced technology like AI-driven property management, virtual tours, and smart contracts, enhancing efficiency and user experience. Real estate investment platforms focus on democratizing property investments, offering fractional ownership, crowdfunding opportunities, and diversified portfolios for retail investors. The choice depends on user goals: Proptech suits industry professionals seeking operational innovation, while investment platforms benefit individuals aiming for accessible, low-barrier real estate investments.

Connection

Proptech solutions enhance real estate investment platforms by integrating advanced technologies like AI, blockchain, and big data analytics to streamline property transactions, improve asset management, and increase transparency for investors. These platforms leverage Proptech to provide real-time market insights, automate portfolio management, and facilitate fractional ownership, making real estate investment more accessible and efficient. The synergy between Proptech and investment platforms drives innovation, reduces risks, and maximizes returns within the real estate sector.

Key Terms

Crowdfunding

Real estate investment platforms leverage crowdfunding to enable diverse investors to pool capital for property acquisitions, democratizing access to lucrative projects. Proptech solutions incorporate advanced technologies like blockchain and AI to enhance transparency, security, and efficiency in crowdfunding processes. Discover how these innovations revolutionize real estate investment by exploring detailed insights.

Property management software

Property management software streamlines tasks such as tenant screening, lease tracking, and maintenance requests, offering real estate investors and managers unparalleled efficiency and transparency. Real estate investment platforms primarily facilitate capital pooling and investment opportunities, while Proptech solutions enhance operational management through automation and data analytics. Discover how leveraging advanced property management software can transform your real estate operations.

Tokenization

Real estate investment platforms leverage tokenization to create fractional ownership opportunities, enabling greater liquidity and accessibility for investors. Proptech solutions integrate blockchain technology to streamline property transactions, enhance transparency, and reduce settlement times through tokenized assets. Explore how tokenization revolutionizes real estate investing with cutting-edge Proptech innovations.

Source and External Links

Best Real Estate Investing Apps of June 2025 - Business Insider - CrowdStreet is a platform for experienced, accredited real estate investors offering pre-vetted commercial properties with a $25,000 minimum investment and a 3-5 year lock-up period, focusing on transparency and advanced market insight.

Crowdfunding real estate: What to know - Rocket Mortgage - This source highlights platforms like Fundrise and RealtyMogul for nonaccredited and accredited investors, offering real estate crowdfunding opportunities with low minimums for Fundrise and a broad portfolio on RealtyMogul, while CrowdStreet serves accredited investors with commercial projects and high minimums.

Arrived | Easily Invest in Real Estate - Arrived allows investors to start with as little as $100 to invest in pre-vetted rental properties, earning passive income from rent and property appreciation, handling management tasks to simplify real estate investing.

dowidth.com

dowidth.com