Proptech startups leverage technology to streamline real estate transactions, offering innovative solutions such as digital property listings, virtual tours, and automated contract management. Title and escrow services focus on securing property ownership by verifying titles and managing funds during the closing process, ensuring legal protection and compliance. Explore how these sectors intersect and transform real estate transactions today.

Why it is important

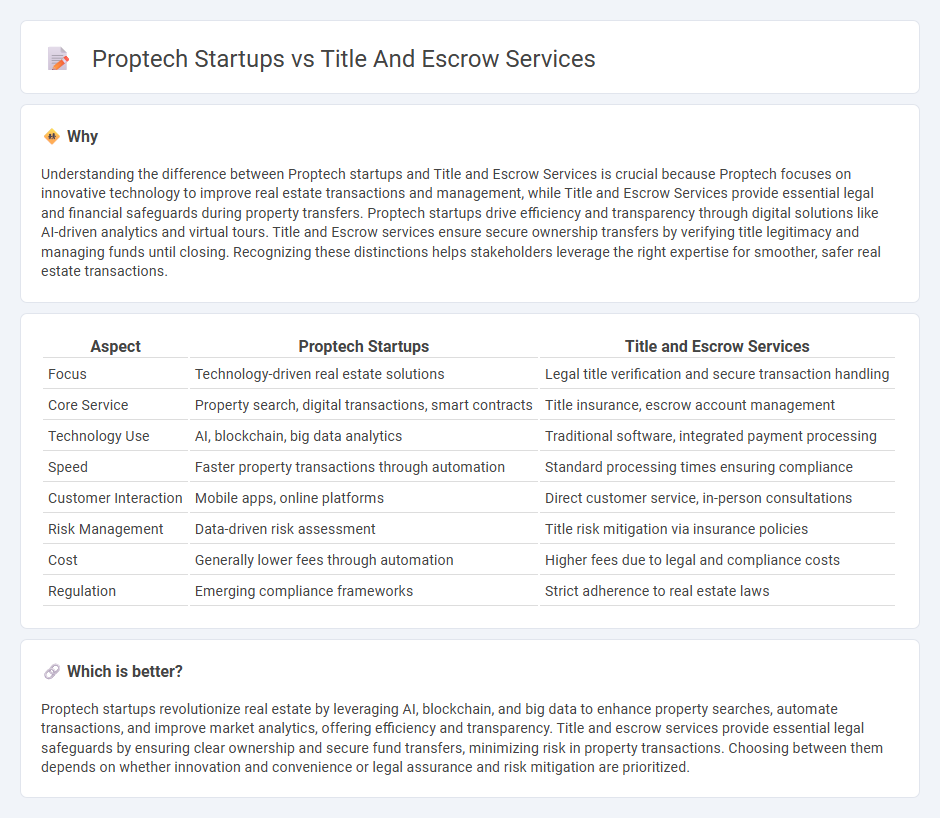

Understanding the difference between Proptech startups and Title and Escrow Services is crucial because Proptech focuses on innovative technology to improve real estate transactions and management, while Title and Escrow Services provide essential legal and financial safeguards during property transfers. Proptech startups drive efficiency and transparency through digital solutions like AI-driven analytics and virtual tours. Title and Escrow services ensure secure ownership transfers by verifying title legitimacy and managing funds until closing. Recognizing these distinctions helps stakeholders leverage the right expertise for smoother, safer real estate transactions.

Comparison Table

| Aspect | Proptech Startups | Title and Escrow Services |

|---|---|---|

| Focus | Technology-driven real estate solutions | Legal title verification and secure transaction handling |

| Core Service | Property search, digital transactions, smart contracts | Title insurance, escrow account management |

| Technology Use | AI, blockchain, big data analytics | Traditional software, integrated payment processing |

| Speed | Faster property transactions through automation | Standard processing times ensuring compliance |

| Customer Interaction | Mobile apps, online platforms | Direct customer service, in-person consultations |

| Risk Management | Data-driven risk assessment | Title risk mitigation via insurance policies |

| Cost | Generally lower fees through automation | Higher fees due to legal and compliance costs |

| Regulation | Emerging compliance frameworks | Strict adherence to real estate laws |

Which is better?

Proptech startups revolutionize real estate by leveraging AI, blockchain, and big data to enhance property searches, automate transactions, and improve market analytics, offering efficiency and transparency. Title and escrow services provide essential legal safeguards by ensuring clear ownership and secure fund transfers, minimizing risk in property transactions. Choosing between them depends on whether innovation and convenience or legal assurance and risk mitigation are prioritized.

Connection

Proptech startups integrate advanced technologies such as blockchain, artificial intelligence, and cloud computing to streamline Title and Escrow Services, enhancing transaction transparency and security. These innovations reduce paperwork, accelerate title searches, and automate escrow processes, minimizing risks and errors in property transactions. By leveraging Proptech solutions, Title and Escrow providers improve efficiency, cost-effectiveness, and customer satisfaction in real estate closings.

Key Terms

**Title and Escrow Services:**

Title and escrow services ensure secure property transactions by verifying ownership, managing funds, and facilitating clear title transfers, minimizing risks for buyers and sellers. These services rely on established legal frameworks and industry expertise to deliver trusted, compliant closing processes. Discover how traditional title and escrow services maintain property deal integrity in evolving real estate markets.

Title Insurance

Title and escrow services provide essential protection by verifying property ownership and securing transactions, minimizing risks such as fraud or liens. Proptech startups are innovating by integrating blockchain technology and AI to streamline title insurance processes, enhancing speed, transparency, and cost efficiency. Explore how emerging technologies are transforming title insurance and safeguarding real estate investments.

Escrow Account

Escrow accounts serve as a secure financial arrangement pivotal in real estate transactions, ensuring funds are safeguarded until contract conditions are met. Traditional title and escrow services provide trusted, regulated custodianship of funds, offering critical risk mitigation and legal compliance. Discover how proptech startups innovate escrow account management to enhance efficiency and transparency in property deals.

Source and External Links

Florida Title & Escrow Professionals - A full-service title company in Florida offering purchase and sale transactions, refinance, REO and short sale closings, title examinations, insurance issuance, escrow, and document services with flexible closing times including nights and weekends.

Weston Title & Escrow - Trusted South Florida title and escrow company serving Broward, Miami-Dade, and Palm Beach counties since 1994, providing personalized real estate closings, title insurance, title searches, and escrow services by attorney-owners.

Florida Title and Escrow - A Florida title and escrow company with over 24 years in the market, known for fast turnaround, professional service, and protecting clients against wire fraud scams while handling real estate closings statewide.

dowidth.com

dowidth.com