Opportunity Zones provide tax incentives for long-term investments in designated low-income communities, encouraging economic growth and real estate development. Low-Income Housing Tax Credit (LIHTC) is a federal program offering tax credits to developers who build or rehabilitate affordable rental housing for low-income households. Explore the key differences and benefits of Opportunity Zones and LIHTC to maximize your real estate investment strategy.

Why it is important

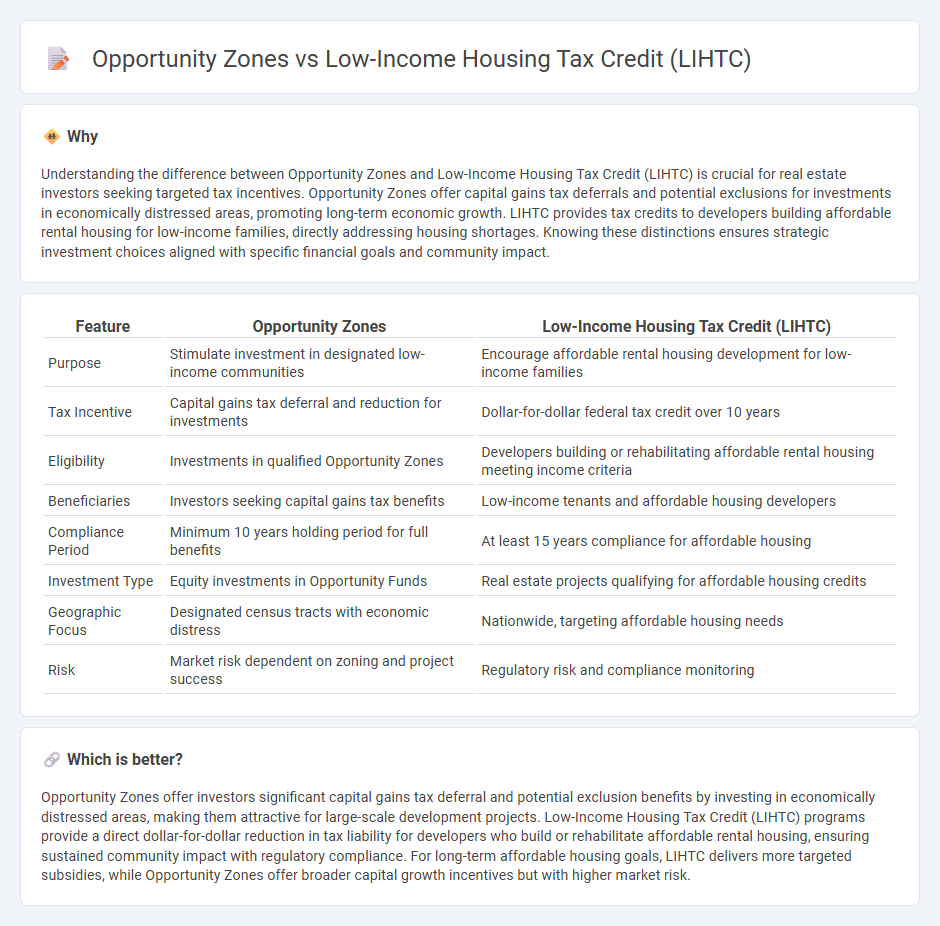

Understanding the difference between Opportunity Zones and Low-Income Housing Tax Credit (LIHTC) is crucial for real estate investors seeking targeted tax incentives. Opportunity Zones offer capital gains tax deferrals and potential exclusions for investments in economically distressed areas, promoting long-term economic growth. LIHTC provides tax credits to developers building affordable rental housing for low-income families, directly addressing housing shortages. Knowing these distinctions ensures strategic investment choices aligned with specific financial goals and community impact.

Comparison Table

| Feature | Opportunity Zones | Low-Income Housing Tax Credit (LIHTC) |

|---|---|---|

| Purpose | Stimulate investment in designated low-income communities | Encourage affordable rental housing development for low-income families |

| Tax Incentive | Capital gains tax deferral and reduction for investments | Dollar-for-dollar federal tax credit over 10 years |

| Eligibility | Investments in qualified Opportunity Zones | Developers building or rehabilitating affordable rental housing meeting income criteria |

| Beneficiaries | Investors seeking capital gains tax benefits | Low-income tenants and affordable housing developers |

| Compliance Period | Minimum 10 years holding period for full benefits | At least 15 years compliance for affordable housing |

| Investment Type | Equity investments in Opportunity Funds | Real estate projects qualifying for affordable housing credits |

| Geographic Focus | Designated census tracts with economic distress | Nationwide, targeting affordable housing needs |

| Risk | Market risk dependent on zoning and project success | Regulatory risk and compliance monitoring |

Which is better?

Opportunity Zones offer investors significant capital gains tax deferral and potential exclusion benefits by investing in economically distressed areas, making them attractive for large-scale development projects. Low-Income Housing Tax Credit (LIHTC) programs provide a direct dollar-for-dollar reduction in tax liability for developers who build or rehabilitate affordable rental housing, ensuring sustained community impact with regulatory compliance. For long-term affordable housing goals, LIHTC delivers more targeted subsidies, while Opportunity Zones offer broader capital growth incentives but with higher market risk.

Connection

Opportunity Zones and the Low-Income Housing Tax Credit (LIHTC) intersect by incentivizing real estate investments in economically distressed communities to promote affordable housing development. Opportunity Zones offer capital gains tax deferrals for investments in designated areas, which can be combined with LIHTC benefits to attract private capital for constructing or rehabilitating affordable rental housing. This synergy enhances financial feasibility and encourages sustainable urban revitalization by aligning federal tax incentives with community development goals.

Key Terms

Tax Credits

Low-Income Housing Tax Credit (LIHTC) program provides a dollar-for-dollar reduction in federal tax liability for investors funding affordable rental housing development. Opportunity Zones offer tax incentives primarily through deferral and potential exclusion of capital gains when reinvesting in designated economically distressed communities. Discover more about how these tax credits can maximize your investment impact.

Qualified Census Tracts

The Low-Income Housing Tax Credit (LIHTC) program targets affordable housing developments in Qualified Census Tracts (QCTs) to incentivize investments in low-income communities by offering tax credits based on project costs and low-income units. Opportunity Zones, designated by the Tax Cuts and Jobs Act, encourage long-term investments in economically distressed QCTs through deferral and exclusion of capital gains taxes on qualified investments in these zones. Explore further to understand the distinct tax benefits and eligibility criteria for projects within Qualified Census Tracts under LIHTC and Opportunity Zone programs.

Capital Gains Deferral

The Low-Income Housing Tax Credit (LIHTC) provides a dollar-for-dollar reduction in tax liability for developers who invest in affordable housing projects, but it does not directly address capital gains deferral. Opportunity Zones, designated economically-distressed areas, offer investors the ability to defer and potentially reduce capital gains taxes by reinvesting gains into Qualified Opportunity Funds. Explore the distinct tax benefits and strategies of LIHTC and Opportunity Zones to optimize your real estate investment portfolio.

Source and External Links

RAD and Low-Income Tax Credits - The Low-Income Housing Tax Credit (LIHTC) program provides financial incentives through tax breaks for investors to support affordable rental housing development.

About the LIHTC - The LIHTC offers a dollar-for-dollar reduction in federal tax liability to investors who finance affordable rental housing developments.

What is the Low-Income Housing Tax Credit and how does it work? - The LIHTC subsidizes the acquisition, construction, and rehabilitation of affordable rental housing by providing tax credits based on the project's qualified basis and credit percentage.

dowidth.com

dowidth.com