Sale leaseback offers companies immediate capital by selling property and leasing it back long-term, while build to suit involves constructing a custom facility tailored to specific operational needs. Corporations use sale leaseback to improve liquidity, whereas build to suit supports strategic growth with ownership benefits. Explore the advantages and applications of each real estate strategy to determine the best fit for your business.

Why it is important

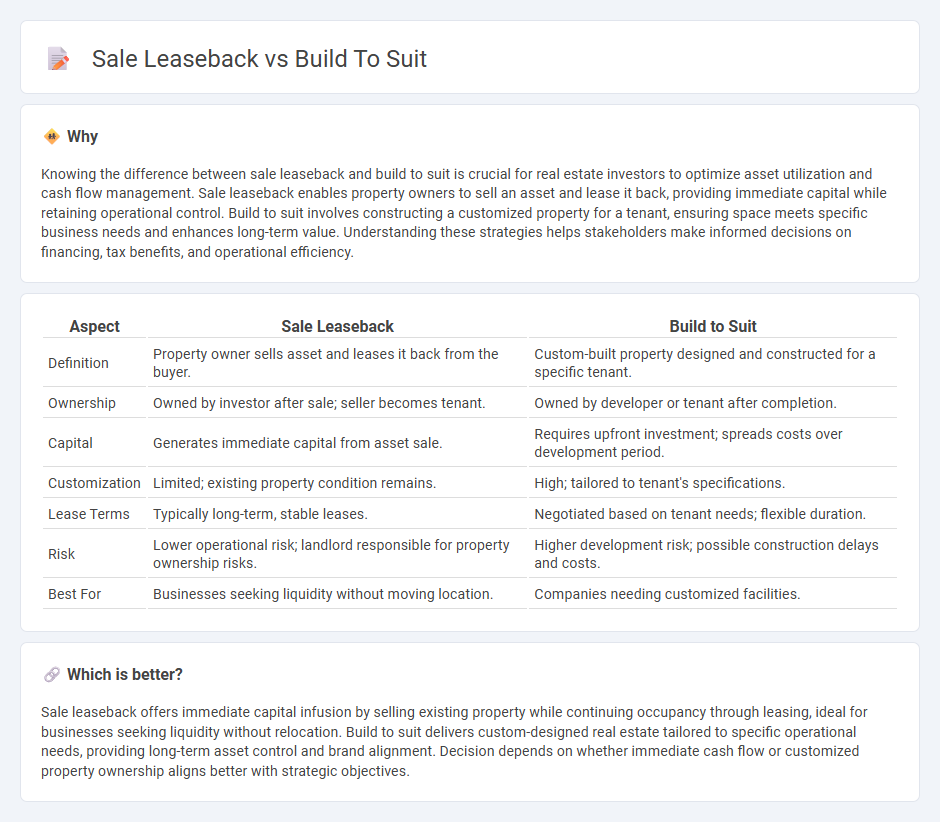

Knowing the difference between sale leaseback and build to suit is crucial for real estate investors to optimize asset utilization and cash flow management. Sale leaseback enables property owners to sell an asset and lease it back, providing immediate capital while retaining operational control. Build to suit involves constructing a customized property for a tenant, ensuring space meets specific business needs and enhances long-term value. Understanding these strategies helps stakeholders make informed decisions on financing, tax benefits, and operational efficiency.

Comparison Table

| Aspect | Sale Leaseback | Build to Suit |

|---|---|---|

| Definition | Property owner sells asset and leases it back from the buyer. | Custom-built property designed and constructed for a specific tenant. |

| Ownership | Owned by investor after sale; seller becomes tenant. | Owned by developer or tenant after completion. |

| Capital | Generates immediate capital from asset sale. | Requires upfront investment; spreads costs over development period. |

| Customization | Limited; existing property condition remains. | High; tailored to tenant's specifications. |

| Lease Terms | Typically long-term, stable leases. | Negotiated based on tenant needs; flexible duration. |

| Risk | Lower operational risk; landlord responsible for property ownership risks. | Higher development risk; possible construction delays and costs. |

| Best For | Businesses seeking liquidity without moving location. | Companies needing customized facilities. |

Which is better?

Sale leaseback offers immediate capital infusion by selling existing property while continuing occupancy through leasing, ideal for businesses seeking liquidity without relocation. Build to suit delivers custom-designed real estate tailored to specific operational needs, providing long-term asset control and brand alignment. Decision depends on whether immediate cash flow or customized property ownership aligns better with strategic objectives.

Connection

Sale leaseback and build-to-suit strategies are connected through their focus on customized real estate solutions that optimize financial and operational flexibility for businesses. Sale leaseback allows companies to sell their property and lease it back, freeing up capital while maintaining occupancy, whereas build-to-suit involves constructing a property tailored precisely to a tenant's specifications, often resulting in long-term lease agreements. Both approaches facilitate efficient asset management, enabling companies to align real estate with strategic business needs without significant upfront capital expenditure.

Key Terms

Customization

Build-to-suit properties offer extensive customization, allowing tenants to design spaces tailored to specific operational needs and efficiency. Sale-leaseback transactions typically involve existing properties with limited modification opportunities, as buyers prioritize immediate lease income over bespoke designs. Explore detailed comparisons to understand which option aligns best with your business goals.

Ownership Transfer

Build to suit involves the developer constructing a customized property for a specific tenant, with ownership typically transferring upon project completion or lease commencement. Sale leaseback is a financial transaction where an owner sells an existing property and immediately leases it back, retaining operational use without ownership. Explore more to understand which strategy aligns best with your real estate and financial goals.

Long-term Lease

Build-to-suit leases provide tenants with customized properties designed to meet specific operational needs, typically involving long-term lease agreements spanning 10 to 20 years. Sale leaseback transactions enable owners to monetize real estate assets by selling the property and simultaneously leasing it back, often securing long-term leases that preserve business continuity. Explore detailed comparisons to determine which strategy best aligns with your long-term leasing objectives.

Source and External Links

Understanding Build to Suit Development - This webpage explains what build-to-suit developments are, highlighting their cost-effectiveness and reduced leasing risk for developers.

WHAT IS A BUILD TO SUIT? - This resource describes build-to-suit as an approach where a new property is designed and constructed to meet the tenant's exact specifications.

Built to Suit in Commercial Real Estate - This commercial real estate glossary entry outlines how built-to-suit developments involve a developer constructing a property specifically for a single tenant's use.

dowidth.com

dowidth.com